- United States

- /

- Specialty Stores

- /

- NYSE:GME

GameStop (GME): Reassessing Valuation as Retail Traders Fuel a Speculative Surge

Reviewed by Simply Wall St

GameStop (GME) shares have surged in recent sessions as retail traders flock back into the stock, supported by a wave of bullish call options and renewed social media enthusiasm. The trading action stands out, given there have been no material updates from the company.

See our latest analysis for GameStop.

With GameStop’s 1-year total shareholder return up more than 14% and a remarkable 800% total return over five years, it’s clear the stock’s story remains driven by sudden surges in speculative interest. This week’s active options trading highlights how quickly momentum can turn, even as the share price is down 24% year-to-date. This shows both the allure and volatility that persist for long-term holders and short-term traders alike.

If today’s burst of activity has you rethinking what’s possible in this market, now might be the moment to discover fast growing stocks with high insider ownership

With GameStop’s fundamentals largely steady, the recent rally begs the key question: is the current price still leaving room for upside, or has the market already factored in all future growth and potential turnaround?

Most Popular Narrative: 80.6% Undervalued

GameStop’s latest closing price of $23.30 is dramatically below the $120 fair value proposed in the narrative by prime_is_back. This creates a bold contrast between market skepticism and bullish conviction. The difference highlights a debate among investors about the company’s transformation and future profit potential.

GameStop’s Q1 2025 financials, along with a strong shareholder community, demonstrated its takes-money-to-buy-whiskey strategy in action. This shows its status as a compelling investment, as retail investors have maintained for years while contending with a challenging media environment, bots, social media manipulation, and hedge funds. Gamestop reported a notable adjusted EPS of $0.17, beating estimates by 325%, and achieved a $44.8 million net profit, reversing last year’s $32 million loss. With $6.4 billion in cash and no long-term debt, GameStop has significant financial flexibility. Its strategic holding of 4,710 Bitcoin, valued at $516.6 million, positions the company to benefit if Bitcoin’s value increases (near $112,000).

Curious what combination of future profitability, cash reserves, and digital assets drives this lofty fair value? There is an unexpected twist related to the steep discount rate and the unconventional profit assumptions supporting this view. What fundamental shift is the community anticipating? Only the full narrative reveals the controversial reasoning behind such a large difference from the current price.

Result: Fair Value of $120 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or a sustained downturn in the gaming retail sector could quickly undermine this bullish thesis and disrupt investor confidence.

Find out about the key risks to this GameStop narrative.

Another View: The Market’s Multiple Tells a Different Story

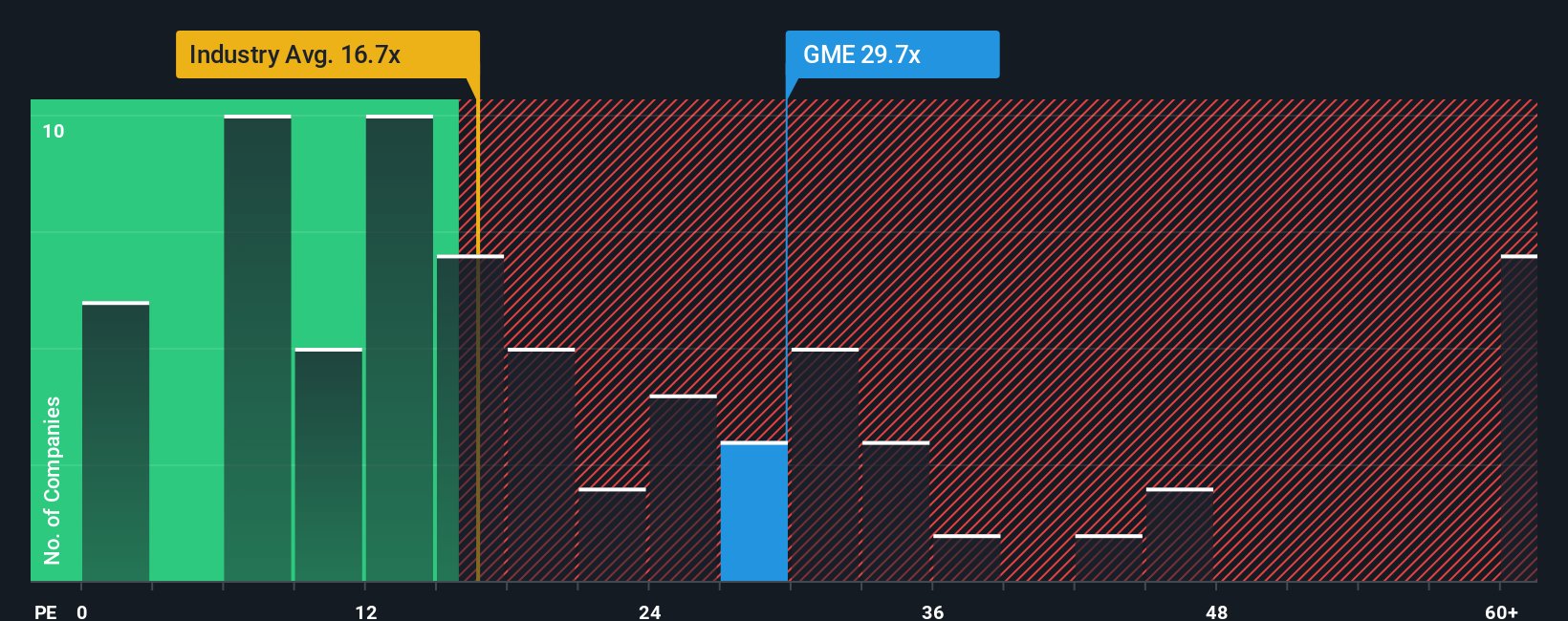

Looking through a different lens, GameStop’s share price trades at 28.8 times its earnings, which stands well above the US Specialty Retail industry average of 16.9 and its peer group’s 18.6. Such a premium signals investor optimism but also magnifies valuation risk if expectations are not met. Could this high multiple be justified if performance wobbles, or is the stock simply priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GameStop Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can share your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Looking for More Investment Ideas?

There’s a universe of great stocks out there waiting for smart investors like you. Don’t sit on the sidelines and wonder what you might be missing.

- Power up your income potential by reviewing these 17 dividend stocks with yields > 3% yielding over 3% and see which companies make steady payouts look easy.

- Catch the next wave in healthcare innovation by checking these 33 healthcare AI stocks and find businesses that are reshaping medicine with artificial intelligence.

- Secure your front-row seat to the blockchain boom by exploring these 80 cryptocurrency and blockchain stocks and spot those positioned to benefit from the digital asset revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives