- United States

- /

- Specialty Stores

- /

- NYSE:GME

Does GameStop’s Latest Price Drop Signal a Shift for 2025 Investors?

Reviewed by Bailey Pemberton

- Wondering if GameStop's current stock price could be an opportunity in disguise? Let's examine what the numbers and latest sentiment suggest about its value and future potential.

- Shares have been on a wild ride lately, jumping 5.9% in the last week but still down 8.1% over the past month and nearly 30% year-to-date.

- GameStop has once again captured headlines due to renewed attention from retail trading communities, as well as ongoing discussions around its evolving business model and changes in leadership. The buzz has amplified volatility and kept investors watching closely for potential developments.

- In our valuation checks, GameStop scores 2 out of 6 for being undervalued, which might be surprising given the current attention. Before drawing conclusions, let’s break down how different valuation approaches assess GameStop and consider what could be a better way to identify opportunities at the end of this article.

GameStop scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: GameStop Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those values back to today using an appropriate rate. This approach aims to determine how much GameStop is worth based on how much cash it can generate in the years ahead.

For GameStop, the latest reported Free Cash Flow (FCF) stands at $474.5 Million. Analysts estimate that FCF could grow at a rate of nearly 29% in the near term, with the DCF model projecting FCF to reach $1.38 Billion a decade from now. While forecasts are generally considered most reliable for the next few years, projections beyond five years are extrapolated based on broader industry trends.

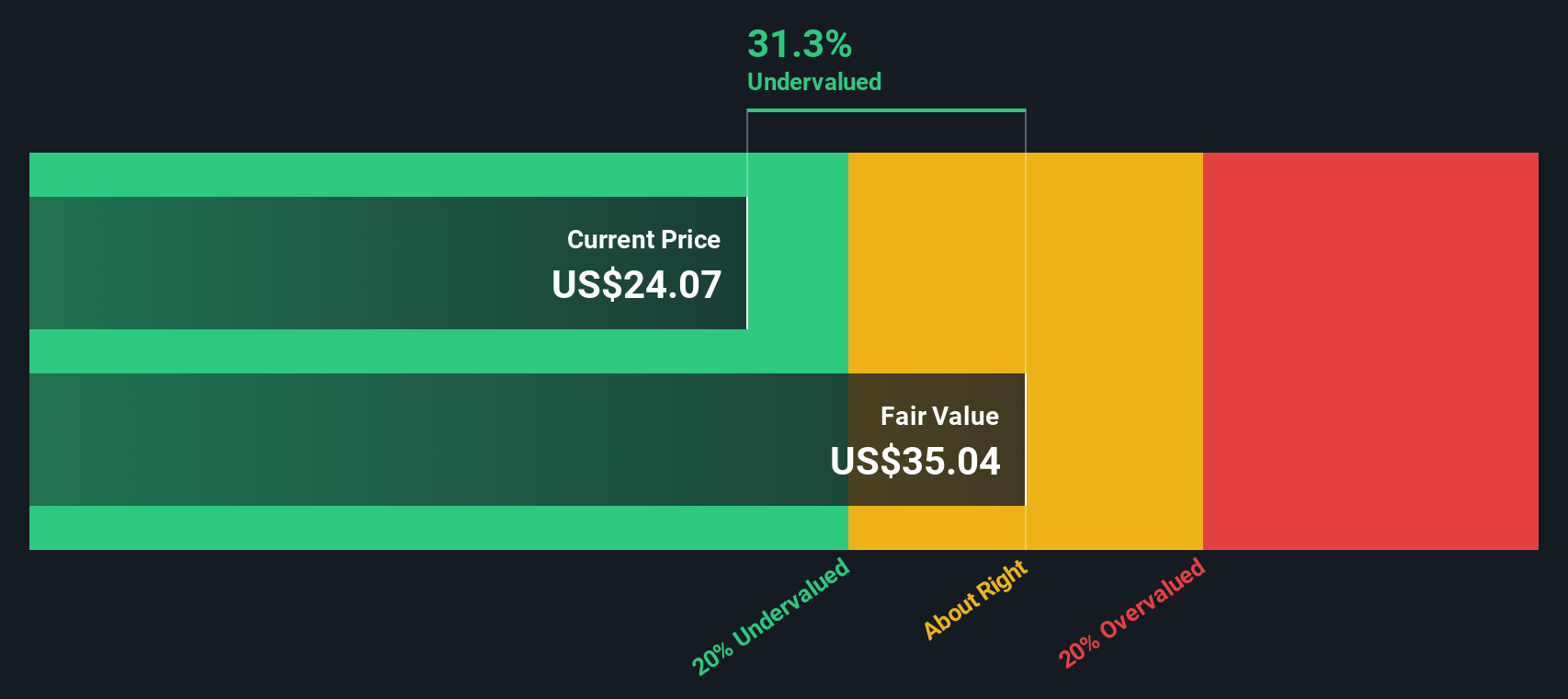

Using the DCF method, Simply Wall St’s analysis places GameStop’s intrinsic value at $34.59 per share. This figure is about 37.5% above the latest market price, indicating the stock is undervalued according to the model’s cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests GameStop is undervalued by 37.5%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: GameStop Price vs Earnings (PE Ratio Analysis)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing companies that are profitable, like GameStop. This multiple shows how much investors are willing to pay today for each dollar of earnings. Generally, a higher PE ratio can suggest growth expectations, while a lower one may reflect either underappreciation or increased risk. What counts as a “fair” PE ratio depends on the company’s future prospects and business risks.

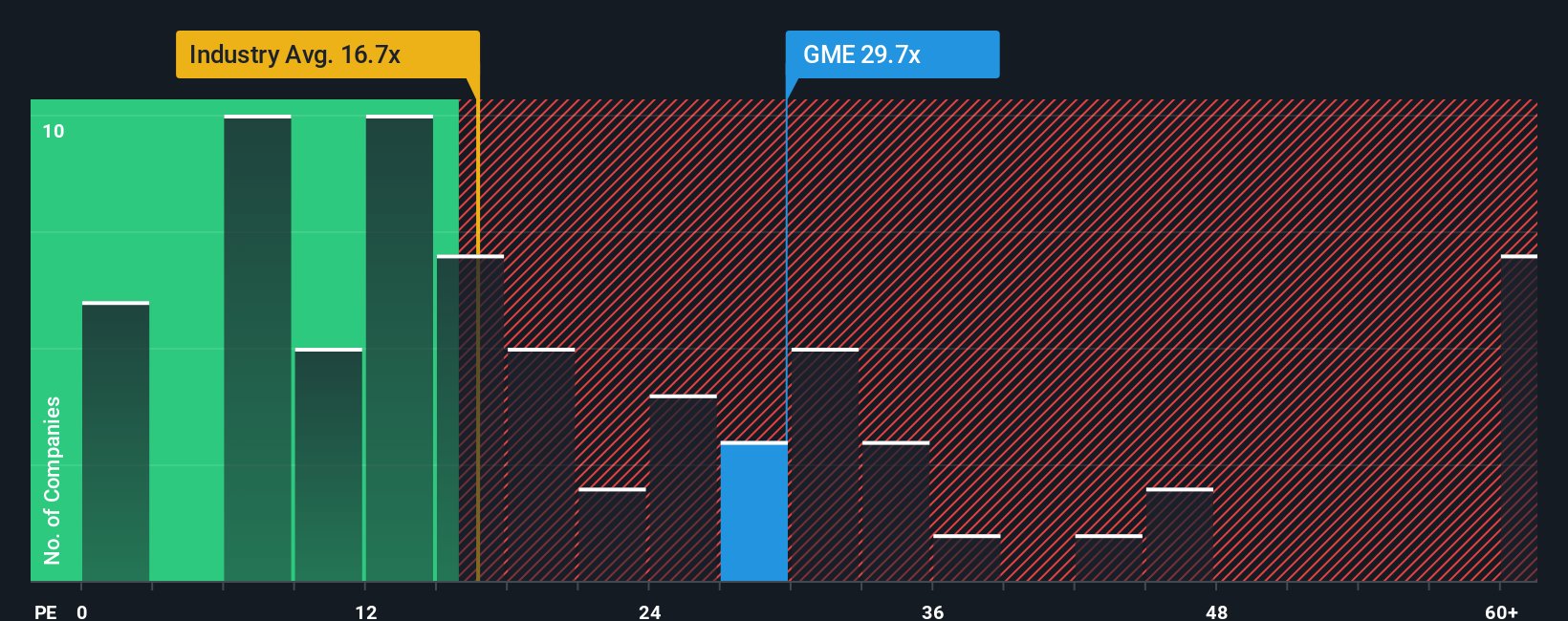

GameStop’s current PE ratio is 26.7x, which is above both the specialty retail industry average of 18.0x and the peer average of 19.7x. At first glance, this might imply that GameStop is priced at a premium compared to its industry and direct competitors. However, these benchmarks do not always tell the full story, especially if the company’s outlook differs from peers.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Instead of simply comparing with industry averages, the Fair Ratio defines what GameStop’s valuation should be by factoring in its earnings growth, profit margins, market cap, and risks unique to the business. This holistic approach aims to provide a more accurate view of what investors should pay.

Comparing the Fair Ratio with GameStop’s current PE, the difference is less than 0.10x, indicating that the share price is in line with market expectations for its future earnings potential and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your GameStop Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple, yet powerful method to anchor your investment decisions in both the story you believe about a company, such as its strategy, risks, and future potential, and in tangible numbers like fair value, future revenue, and profit margins. By creating and sharing a Narrative on Simply Wall St's Community page, investors are able to link their view of GameStop’s journey directly to a financial forecast and see what the company is truly worth according to their own assumptions.

Narratives make decision-making easier by clearly showing whether the Fair Value you calculate is above or below the current price, helping you quickly spot potential buy or sell opportunities. In addition, these Narratives dynamically update when events like earnings reports or news break, keeping your thesis relevant as circumstances change. For example, one investor's Narrative might see GameStop’s fair value at $120, based on bullish crypto and cost-cutting strategies, while another’s Narrative might be much more cautious, with a fair value of $11.91, focused on persistent challenges and slow digital growth. No matter your perspective, Narratives allow you to forecast, share, and refine your investment thinking, making stock analysis approachable and actionable for everyone.

For GameStop, we’ll make it really easy for you with previews of two leading GameStop Narratives:

Fair Value: $120.00

Trading at approximately 81.97% below the narrative fair value

Revenue Growth Rate: 0%

- GameStop is seen as a compelling investment due to a strong Q1 2025 profit rebound, zero long-term debt, and a significant cash position ($6.4 billion). The company also has transformative leadership by Ryan Cohen and an active, loyal retail shareholder base employing the Direct Registration System (DRS).

- The company has strategically accumulated 4,710 Bitcoin (valued at over $500 million), which boosts financial flexibility, and has aggressively cut costs and exited unprofitable markets, improving profit margins and operational efficiency.

- Retail investors and insiders are demonstrating long-term confidence, as indicated by recent insider buying and ongoing support from online communities. This is fueling potential resilience and upside against market volatility and external skepticism.

Fair Value: $11.91

Trading at approximately 81.63% above the narrative fair value

Revenue Growth Rate: 0%

- GameStop faces major headwinds due to declining brick-and-mortar sales, tough digital competition, and continued revenue drops. This is despite recent cost-cutting and a temporary net profit.

- The company’s ventures into cryptocurrency and BNPL (Buy Now, Pay Later) partnerships show willingness to adapt but introduce new volatility and do not guarantee fundamental business improvements.

- Meme stock dynamics and speculative trading drive share price to levels disconnected from company fundamentals. This highlights risks for long-term investors in the face of unpredictable market sentiment and external hype.

Do you think there's more to the story for GameStop? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GME

GameStop

A specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success