- United States

- /

- Specialty Stores

- /

- NYSE:GAP

Gap (GPS) Valuation Check After Fresh Analyst Upgrades and Growing Investor Optimism

Reviewed by Simply Wall St

Gap (GAP) just caught a wave of upgrades from Wells Fargo, Telsey Advisory, and Baird, as investors warm to its tariff strategy, brand rebuild, and marketing push heading into 2026.

See our latest analysis for Gap.

Those upgrades line up with what the tape is already telling us, with Gap’s 90 day share price return of 22.6 percent and 1 year total shareholder return of 20.4 percent pointing to momentum that has been building rather than fading as its tariff and brand reset story gains traction at a recent share price of 28.02 dollars.

If this turnaround has you thinking more broadly about where consumer names can surprise next, it could be worth scanning fast growing stocks with high insider ownership for other under the radar compounders with aligned insiders.

Yet with Gap trading just below fresh analyst targets after a 160 percent three year run, the real debate now is whether investors still have upside left or whether the market has already priced in the turnaround.

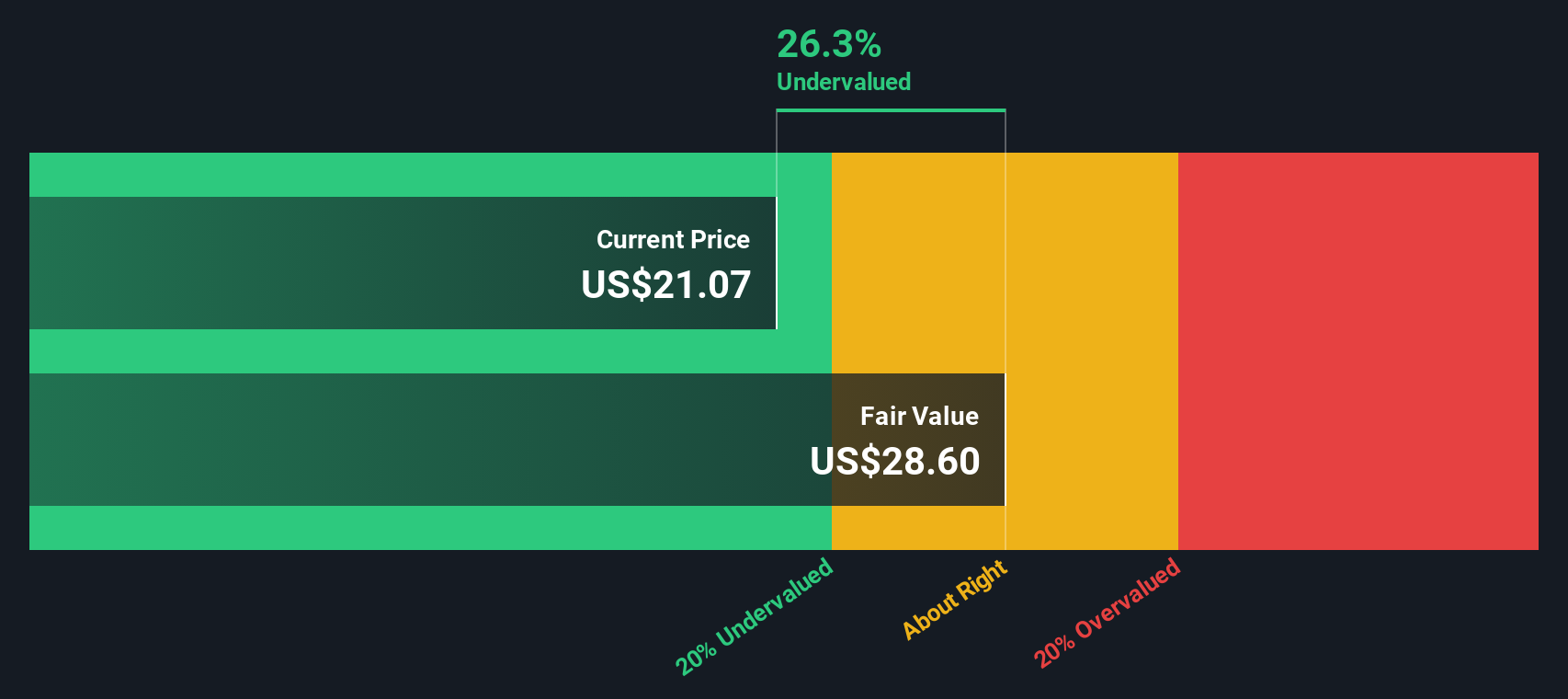

Most Popular Narrative Narrative: 2.2% Undervalued

The most followed valuation view pegs Gap’s fair value slightly above the 28.02 dollar close, framing today’s price as a modest discount with execution still under scrutiny.

Continued improvement in cost structure (portfolio rationalization, store optimization, SG&A leverage, disciplined inventory management) and rigorous operational discipline are freeing up capital for growth investments and have supported expanded operating margins despite external pressures like tariffs. Further margin improvement is expected as tariff impact is mitigated.

Want to see how steady, single digit growth assumptions, firmer margins, and a richer future earnings multiple all add up to this valuation call? The full narrative unpacks the math behind that gap.

Result: Fair Value of $28.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could unravel if tariff pressures reintensify or Athleta’s reset fails to gain traction, forcing deeper promotions and weighing on margins.

Find out about the key risks to this Gap narrative.

Another Angle on Value

Our DCF model is more cautious, putting fair value at 27.33 dollars, slightly below today’s 28.02 dollar price and implying Gap may be a touch overvalued. If cash flows already look priced in, where does the next leg of upside realistically come from?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gap for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gap Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in just minutes using Do it your way.

A great starting point for your Gap research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Gap might fit your strategy today, but smart investors keep a bench of fresh ideas ready so they never freeze when opportunity knocks.

- Capture potential multi baggers early by scanning these 3632 penny stocks with strong financials where strong fundamentals meet compelling growth stories before the crowd catches on.

- Ride powerful secular trends by targeting companies at the forefront of automation and data intelligence using these 24 AI penny stocks to sharpen your next move.

- Identify value focused opportunities by checking these 910 undervalued stocks based on cash flows that still trade below their cash flow potential while the broader market looks the other way.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GAP

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion