- United States

- /

- Specialty Stores

- /

- NYSE:FND

Floor & Decor (FND): Evaluating Valuation After Strong Results, CEO Transition, and Updated Guidance

Reviewed by Simply Wall St

Floor & Decor Holdings (NYSE:FND) attracted attention with its latest quarterly earnings release, showcasing higher sales and net income compared to last year. The announcement was accompanied by a planned CEO transition and updated guidance for the next fiscal year.

See our latest analysis for Floor & Decor Holdings.

Despite Floor & Decor’s solid revenue growth and plans for leadership continuity, the past year’s total shareholder return sits at -41.9%. Short-term momentum continues to fade, with a 30-day share price return of -16.4% reflecting shifting investor sentiment amid recent executive transitions and cautious guidance.

If you’re weighing new opportunities on the back of these latest retail moves, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets, but after a string of disappointing returns, the question now is whether Floor & Decor is undervalued or if the market has already accounted for all future growth prospects.

Most Popular Narrative: 27.8% Undervalued

Floor & Decor's most widely followed narrative assigns a fair value significantly above the current share price, reflecting a gap driven by long-term growth projections. This sets the stage for debate on whether analysts are too bullish or if the market is simply too pessimistic right now.

“Expanding store footprint, pro customer focus, and targeted design services position the company for ongoing sales and margin growth as market demand rebounds. Strong supply chain agility, omnichannel initiatives, and demographic tailwinds support long-term revenue growth and competitive advantages despite economic uncertainty.”

What happens if this specialty retailer's growth engine accelerates rapidly? The narrative hints at a bold transformation. Pro customers, omnichannel strategies, and potential future profit margins could reset how the market values this stock. Dig beyond the headlines to unlock the quantitative assumptions turning heads among analysts.

Result: Fair Value of $81.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak housing activity and intensified price competition could challenge the company's growth outlook. This may also potentially undermine the optimistic narrative.

Find out about the key risks to this Floor & Decor Holdings narrative.

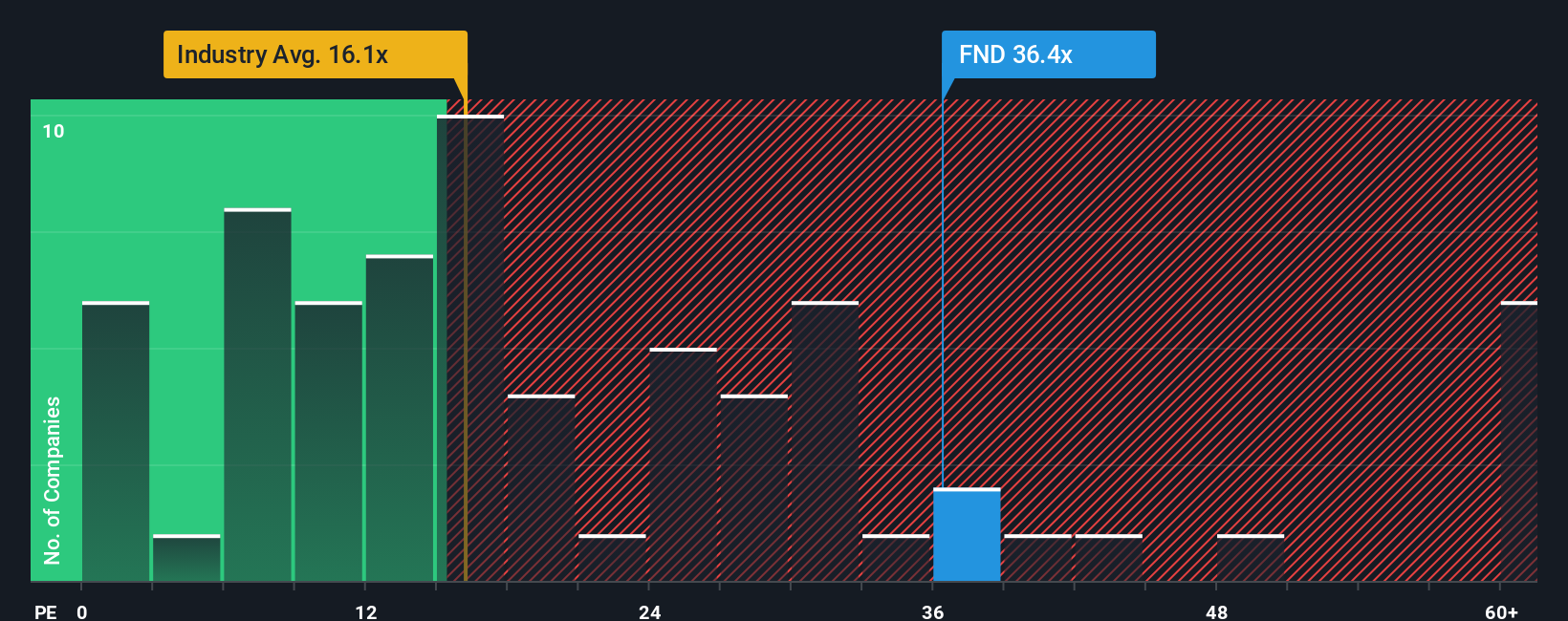

Another View: Comparing Price Ratios

Looking through another lens, Floor & Decor trades at a price-to-earnings ratio of 29.3x. This is notably higher than both the US Specialty Retail industry average of 16.4x and the peer average of 13.3x. Even the fair ratio stands at 17.4x, suggesting a significant premium. Such a gap raises questions about whether investors are taking on added valuation risk or betting on a turnaround.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Floor & Decor Holdings Narrative

If you see the story playing out differently, there’s nothing stopping you from running the numbers and mapping out your own take. Do it your way, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for more investment ideas?

If you’re ready to unlock fresh opportunities, use the Simply Wall Street Screener to target high-potential companies that fit your personal investing goals today.

- Tap into future breakthroughs and technology shifts by evaluating companies leading the way in quantum computing with these 28 quantum computing stocks.

- Maximize your income potential and spot businesses with strong yields by taking a closer look at these 17 dividend stocks with yields > 3% offering more than 3%.

- Get ahead of the next market wave by tracking innovation in the healthcare field, using these 32 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives