- United States

- /

- Specialty Stores

- /

- NYSE:FND

Do Floor & Decor’s (FND) New Store Openings Reveal a Bold Bet on Brick-and-Mortar Expansion?

Reviewed by Sasha Jovanovic

- Floor & Decor Holdings recently opened new warehouse store and design center locations in Washington, Idaho, and New York, each staffed by dozens of associates and offering a wide selection of in-stock hard-surface flooring and design services.

- With over 250 warehouse-format stores now operating across 38 states, these consecutive launches highlight the company’s ongoing focus on rapid brick-and-mortar expansion into key regional markets.

- We'll explore how the recent wave of store openings may bolster Floor & Decor's investment outlook through expanded market reach.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Floor & Decor Holdings Investment Narrative Recap

To be a Floor & Decor Holdings shareholder, you need to believe that the company’s consistent brick-and-mortar expansion can eventually translate into stronger transaction growth and market share, despite challenging housing market conditions and subdued consumer activity. These latest store openings in Washington, Idaho, and New York reinforce management’s confidence in scaling its geographic presence, but if underlying demand remains soft, the incremental expense burden may challenge short-term profitability; the sustained success of these new units is the major catalyst, while overextension remains a clear risk. At this stage, the immediate impact on core growth drivers appears modest, as top-line momentum is still heavily dependent on a housing recovery and translating expansion into comparable store sales growth. Among recent announcements, the launch of the PRO Services and PRO Premier Rewards Program at several grand openings stands out for its relevance. This program is aimed specifically at building deeper relationships with professional contractors, a customer segment that now represents about half of sales and continues to grow faster than average for the company. Strengthening this base is closely tied to the company's ability to drive same-store sales and defend margin in a competitive retail environment. But while the store rollout continues, investors should not lose sight of the risk that...

Read the full narrative on Floor & Decor Holdings (it's free!)

Floor & Decor Holdings' narrative projects $6.0 billion revenue and $296.9 million earnings by 2028. This requires 9.0% yearly revenue growth and a $85.7 million increase in earnings from $211.2 million today.

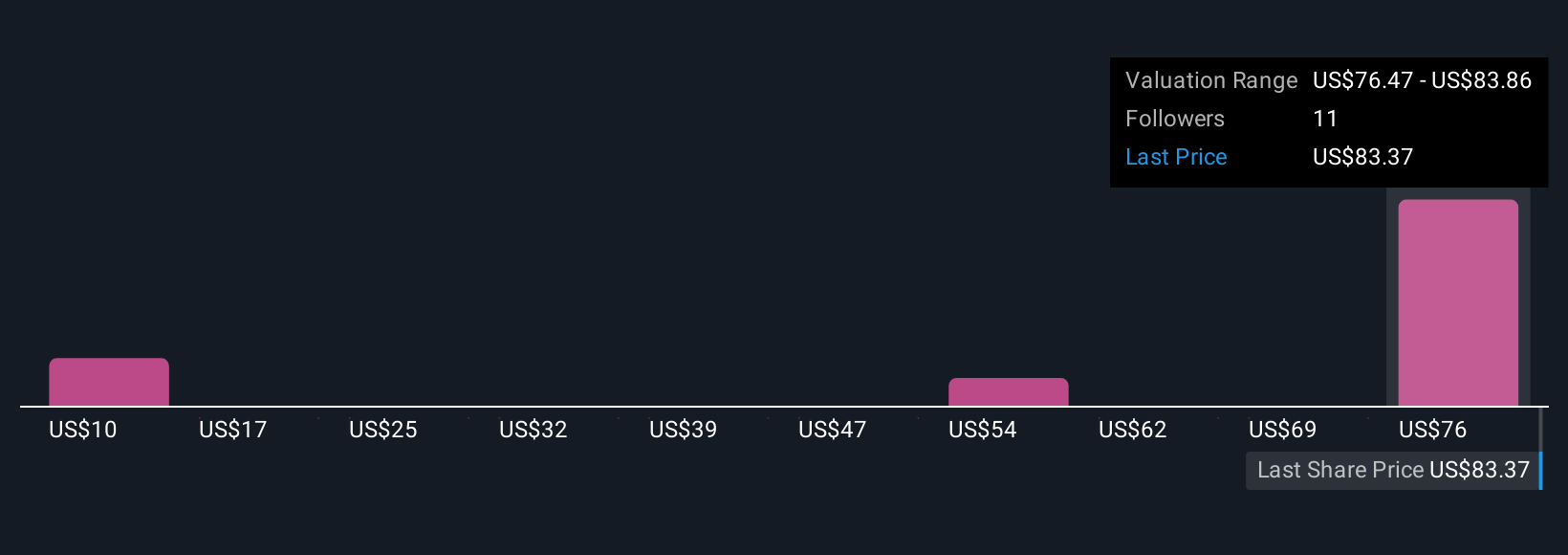

Uncover how Floor & Decor Holdings' forecasts yield a $78.91 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$24.59 to US$78.91 per share, illustrating significant disagreement among investors. With aggressive expansion continuing while housing activity remains slow, be aware of how recent store openings could affect long-term profitability and margins.

Explore 5 other fair value estimates on Floor & Decor Holdings - why the stock might be worth less than half the current price!

Build Your Own Floor & Decor Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Floor & Decor Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Floor & Decor Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Floor & Decor Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives