- United States

- /

- Specialty Stores

- /

- NYSE:FND

Assessing Floor & Decor (FND) Valuation Following New Store Expansion Across Key States

Reviewed by Simply Wall St

Floor & Decor Holdings (FND) is busy expanding its reach again, with new warehouse stores opening across Washington, South Carolina, and Idaho. The company continues investing in growth and seeks to broaden its national footprint.

See our latest analysis for Floor & Decor Holdings.

All this store-opening momentum comes at a time when the stock has struggled for traction. Even with the company’s steady expansion, the 1-year total shareholder return sits at -49.24%, and shares are currently trading at $60.52, which is well off earlier highs. The stock’s performance this year has been under pressure, but these latest moves suggest management remains focused on growth, hinting the market could re-assess the long-term outlook as new locations ramp up.

If you’re interested in what else is gaining ground beyond home improvement, now’s a smart moment to uncover opportunities with fast growing stocks with high insider ownership.

At current prices and after sharp declines, is the market underestimating Floor & Decor’s growth prospects? Alternatively, is the potential from these new openings already factored in, leaving investors little room for upside?

Most Popular Narrative: 23.3% Undervalued

According to the most widely followed valuation narrative, Floor & Decor’s fair value estimate clearly tops the last close of $60.52, hinting at meaningful upside still on the table. This perspective draws from consensus analyst figures and current market sentiment, creating an intriguing divergence compared to the company’s recent stock performance.

Floor & Decor's ongoing aggressive store expansion strategy, opening 20 new warehouse-format stores this year and at least 20 planned for next year, with the infrastructure to accelerate openings further as housing market conditions improve, positions the company to capture outsized revenue growth and future operating leverage as end-market demand returns.

Want to know what ambitious assumptions drive this valuation? Analysts are betting on an earnings acceleration that only a handful of retailers could justify. Discover the calculation that puts Floor & Decor in the spotlight. Are the numbers too bold, or is the upside just getting started?

Result: Fair Value of $78.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently weak existing home sales and elevated mortgage rates could limit demand recovery, which may challenge the optimistic growth assumptions underlying this valuation narrative.

Find out about the key risks to this Floor & Decor Holdings narrative.

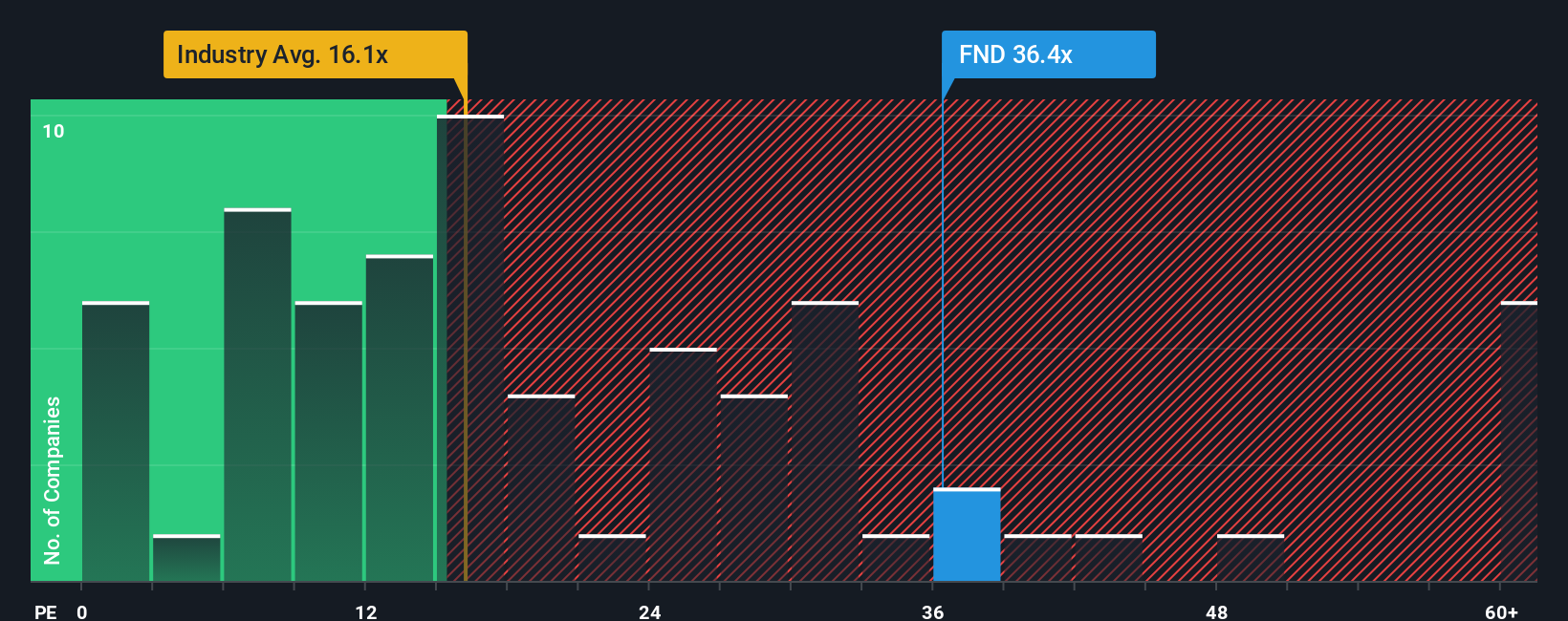

Another View: Signs of Expensive Valuation

Looking at valuation from a different angle, Floor & Decor trades at a price-to-earnings ratio of 30.1x. This stands notably above both its industry average of 18.2x and its peers at 13.1x, and is also well above the fair ratio of 17.5x that the market may one day revert to. This suggests investors are paying a significant premium for future growth, which raises concerns about valuation risk if high expectations are not met. Could this premium narrow if growth disappoints, or is there enough staying power for the stock to justify its price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Floor & Decor Holdings Narrative

If you believe there’s another angle to the Floor & Decor story, dig into the numbers yourself and put together your own view in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for More Compelling Investment Ideas?

Don't wait and wonder what you've missed. Seize the moment by tapping into smart stock ideas built by the Simply Wall Street Screener to stay ahead of the market.

- Enhance your portfolio with steady income streams when you tap into these 15 dividend stocks with yields > 3% with attractive yields above 3%.

- Capitalize on untapped growth by targeting these 923 undervalued stocks based on cash flows that may be poised to rebound based on strong cash flow fundamentals.

- Get ahead of the innovation curve and spot tomorrow’s disruptors through these 26 AI penny stocks that are driving advancements in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives