- United States

- /

- Specialty Stores

- /

- OTCPK:EXPR.Q

These 4 Measures Indicate That Express (NYSE:EXPR) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Express, Inc. (NYSE:EXPR) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Express

How Much Debt Does Express Carry?

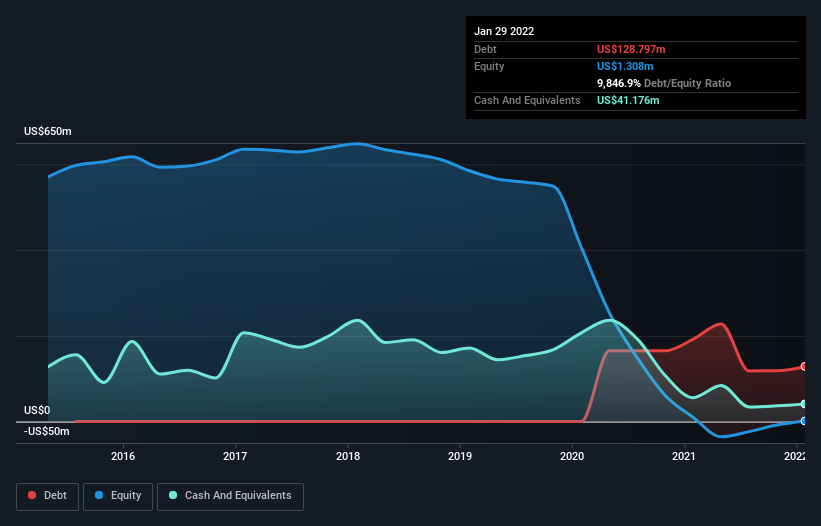

You can click the graphic below for the historical numbers, but it shows that Express had US$128.8m of debt in January 2022, down from US$192.0m, one year before. On the flip side, it has US$41.2m in cash leading to net debt of about US$87.6m.

How Strong Is Express' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Express had liabilities of US$586.7m due within 12 months and liabilities of US$671.5m due beyond that. Offsetting these obligations, it had cash of US$41.2m as well as receivables valued at US$65.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.15b.

The deficiency here weighs heavily on the US$212.6m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Express would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Given net debt is only 1.3 times EBITDA, it is initially surprising to see that Express's EBIT has low interest coverage of 0.06 times. So one way or the other, it's clear the debt levels are not trivial. We also note that Express improved its EBIT from a last year's loss to a positive US$919k. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Express's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Express actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

To be frank both Express's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Express stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for Express (1 shouldn't be ignored) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Express might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:EXPR.Q

Express

Operates as a fashion retail company that offers apparel and accessories in the United States and Puerto Rico.

Slightly overvalued very low.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.