Could Etsy’s (ETSY) New UK Shipping Integration Signal a Shift in Its Cross-Border Strategy?

Reviewed by Sasha Jovanovic

- Etsy recently launched its “Gifts That Say I Get You” personalized holiday campaign, introduced curated gift guides, and announced a collaboration enabling UK sellers to use Royal Mail’s postal delivery duties paid (PDDP) service for simpler shipping to US buyers ahead of the festive season.

- This marks Etsy as the first marketplace to integrate Royal Mail’s PDDP service directly, making cross-border transactions more seamless for British small businesses and potentially strengthening Etsy’s international seller network.

- We'll explore how Etsy's pioneering shipping partnership with Royal Mail could influence long-term buyer engagement and marketplace growth.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Etsy Investment Narrative Recap

To be an Etsy shareholder today, you have to believe in the platform's ability to drive renewed growth in gross merchandise sales (GMS) and reverse declines in buyer activity, even as competition intensifies and marketing costs rise. The newly announced partnership with Royal Mail for postal delivery duties paid (PDDP) service stands out: while it makes US-UK cross-border sales easier, the immediate impact on total GMS or buyer engagement may not be material, given Etsy’s much larger domestic business and ongoing buyer trends. Among recent company news, the upcoming leadership change with Kruti Patel Goyal slated to step in as CEO in early 2026 is especially relevant, given her experience driving growth at Depop and her likely focus on operational execution that could affect both risk and growth drivers for Etsy. In contrast, investors should also be alert to signals the persistent decline in active buyers could continue to weigh on revenue growth and platform momentum if not addressed...

Read the full narrative on Etsy (it's free!)

Etsy's narrative projects $3.2 billion in revenue and $377.3 million in earnings by 2028. This requires 3.5% yearly revenue growth and a $213.3 million increase in earnings from the current $164.0 million.

Uncover how Etsy's forecasts yield a $69.23 fair value, a 30% upside to its current price.

Exploring Other Perspectives

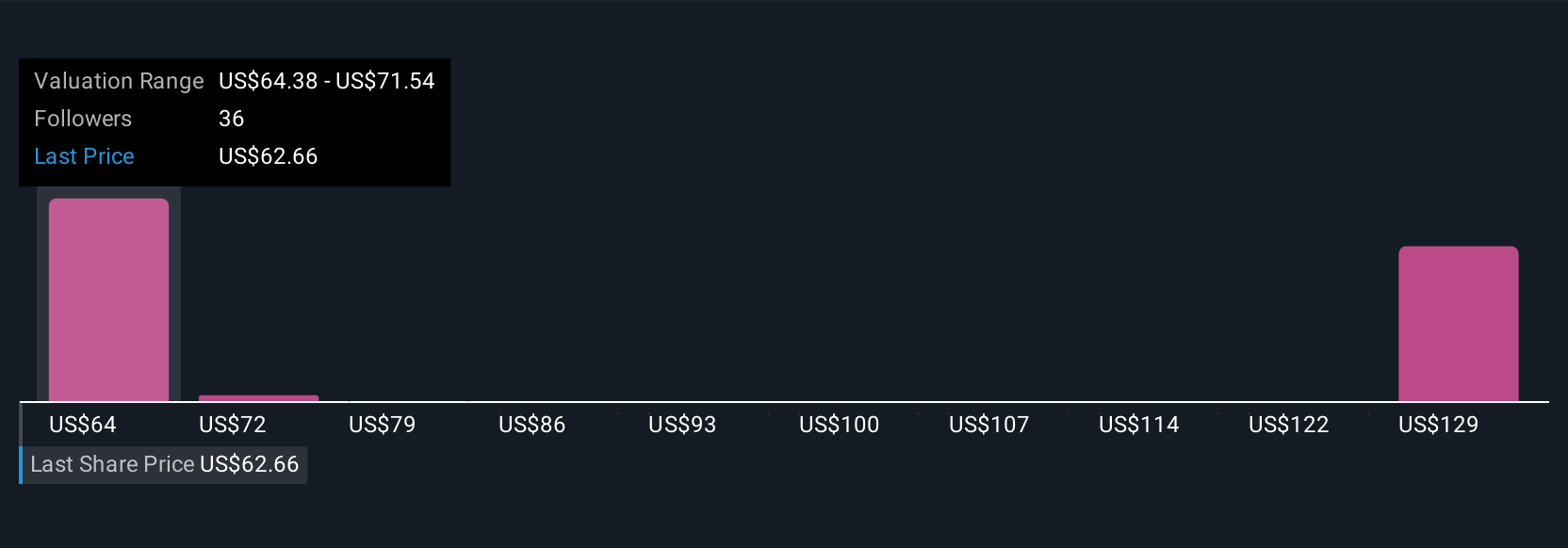

Five Simply Wall St Community participants estimate Etsy's fair value between US$67 and US$111 per share, offering a broad spectrum of opinions. While community outlooks span diverse price targets, the persistent challenge for Etsy remains whether it can boost platform engagement faster than costs rise.

Explore 5 other fair value estimates on Etsy - why the stock might be worth just $67.15!

Build Your Own Etsy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Etsy research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Etsy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Etsy's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Etsy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ETSY

Etsy

Operates two-sided online marketplaces that connect buyers and sellers worldwide.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives