- United States

- /

- Specialty Stores

- /

- NYSE:DKS

The Bull Case For DICK'S Sporting Goods (DKS) Could Change Following Archery Price Fixing Lawsuit Consolidation

Reviewed by Sasha Jovanovic

- Earlier this month, a federal judicial panel consolidated nearly 20 antitrust class action lawsuits accusing Dick’s Sporting Goods and several others of price fixing archery products, transferring the multidistrict litigation to Colorado for the first time in over 15 years.

- This consolidation brings significant legal and reputational challenges for Dick’s Sporting Goods, as the case involves alleged industry-wide efforts to inflate archery product prices dating back to 2014.

- Now, we'll explore how potential legal and reputational risks from this antitrust lawsuit could impact Dick's Sporting Goods' investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

DICK'S Sporting Goods Investment Narrative Recap

To own shares of DICK'S Sporting Goods, you need to believe in the company's ability to sustain revenue and profit growth through expanding its omnichannel strategy, maintaining margin discipline, and integrating new ventures like the Foot Locker acquisition. The recent antitrust lawsuit over alleged price-fixing in archery products does create legal and reputational risks, but it is not currently material to the key short-term catalysts of consumer demand and execution on store expansion and digital initiatives.

One of the most interesting company updates recently has been the raised guidance for comparable sales growth in 2025, now expected between 2.0 and 3.5 percent. This revision suggests DICK'S remains confident in its operational momentum despite the litigation headlines, keeping the company's sales performance and consumer trends in focus for the near term.

In contrast, investors should not overlook the ongoing risks tied to heavy investments in physical stores if traffic fails to meet expectations...

Read the full narrative on DICK'S Sporting Goods (it's free!)

DICK'S Sporting Goods is projected to deliver $15.0 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes a 2.9% annual revenue growth rate and a $0.1 billion increase in earnings from the current $1.2 billion.

Uncover how DICK'S Sporting Goods' forecasts yield a $240.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

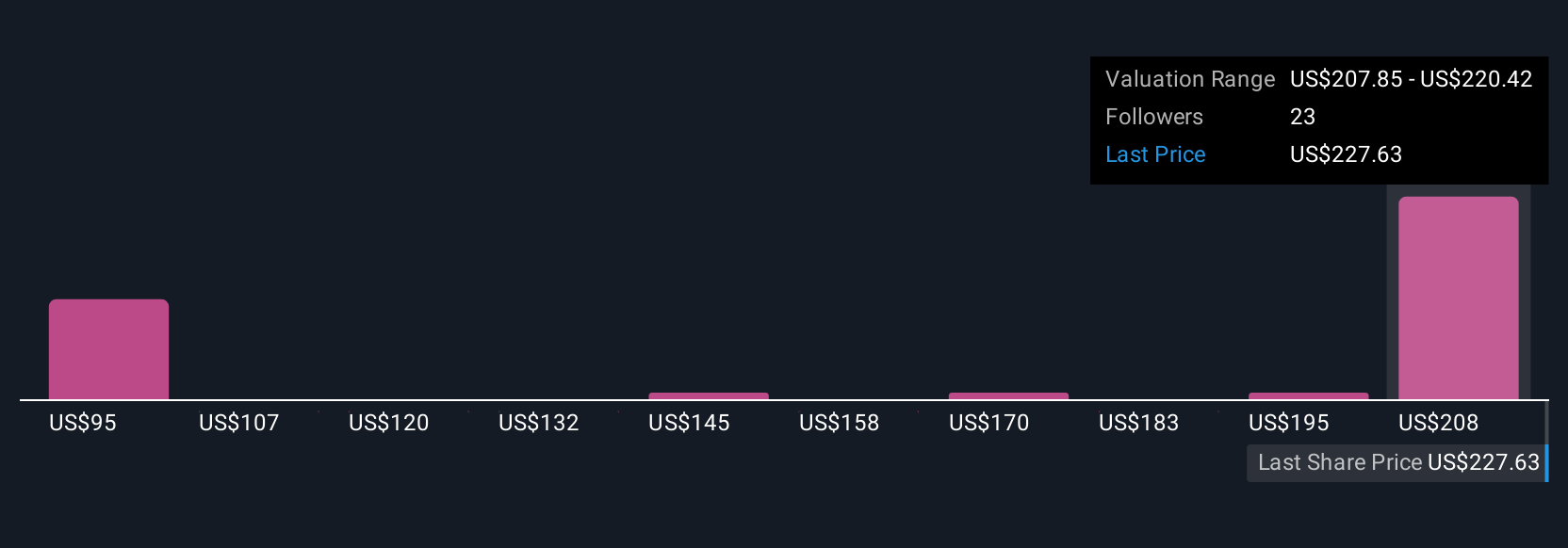

Six Simply Wall St Community fair value estimates for DICK'S Sporting Goods range from US$153.36 to US$538.01 per share. With the recent legal action now in play, some market participants are questioning whether previously anticipated margin improvements will fully materialize; you can compare these differing perspectives below.

Explore 6 other fair value estimates on DICK'S Sporting Goods - why the stock might be worth 33% less than the current price!

Build Your Own DICK'S Sporting Goods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DICK'S Sporting Goods research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DICK'S Sporting Goods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DICK'S Sporting Goods' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives