- United States

- /

- Specialty Stores

- /

- NYSE:DKS

Is DICK'S Sporting Goods' (DKS) Celebrity-Driven Holiday Campaign a Sign of Evolving Brand Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, DICK'S Sporting Goods launched its 2025 holiday campaign, "Greatest Wrapper in the Game," featuring college basketball and rap star Flau'jae Johnson, alongside a holiday gift guide, Black Friday deals, and exclusive product promotions across its digital and store platforms.

- The collaboration with Flau'jae Johnson and rollout of limited-edition wrapping paper not only merges sports and entertainment culture, but also leverages innovative engagement efforts to attract holiday shoppers and expand the brand's appeal.

- Let's examine how DICK'S holiday campaign and celebrity partnership could influence its investment narrative, especially ahead of peak retail season.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

DICK'S Sporting Goods Investment Narrative Recap

To be a shareholder of DICK'S Sporting Goods, you need to believe in its ability to drive sustained growth through both its omni-channel strategy and expanded brand partnerships, especially as consumer interest in health and sports persists. The recent holiday campaign featuring Flau'jae Johnson brings fresh marketing energy just ahead of peak season, but unless it translates to increased store or online traffic, its effect on short-term earnings or near-term risks, such as post-acquisition exposure to in-store traffic volatility, may not be material.

Among recent announcements, DICK'S revealed new Black Friday deals and DICK'S Deal Days alongside a holiday gift guide, enhancing convenience with free shipping, same-day delivery, and a best price guarantee. These efforts tie directly into the company’s main short-term catalyst: capturing incremental holiday spending through both digital and in-person sales channels, which could help offset risks tied to higher fixed store costs and online competition.

By contrast, investors need to be especially mindful of what could happen if in-store traffic unexpectedly weakens after these heavy real estate investments and...

Read the full narrative on DICK'S Sporting Goods (it's free!)

DICK'S Sporting Goods' outlook anticipates $15.0 billion in revenue and $1.3 billion in earnings by 2028. This scenario assumes a 2.9% yearly revenue growth and a $0.1 billion increase in earnings from the current $1.2 billion.

Uncover how DICK'S Sporting Goods' forecasts yield a $240.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

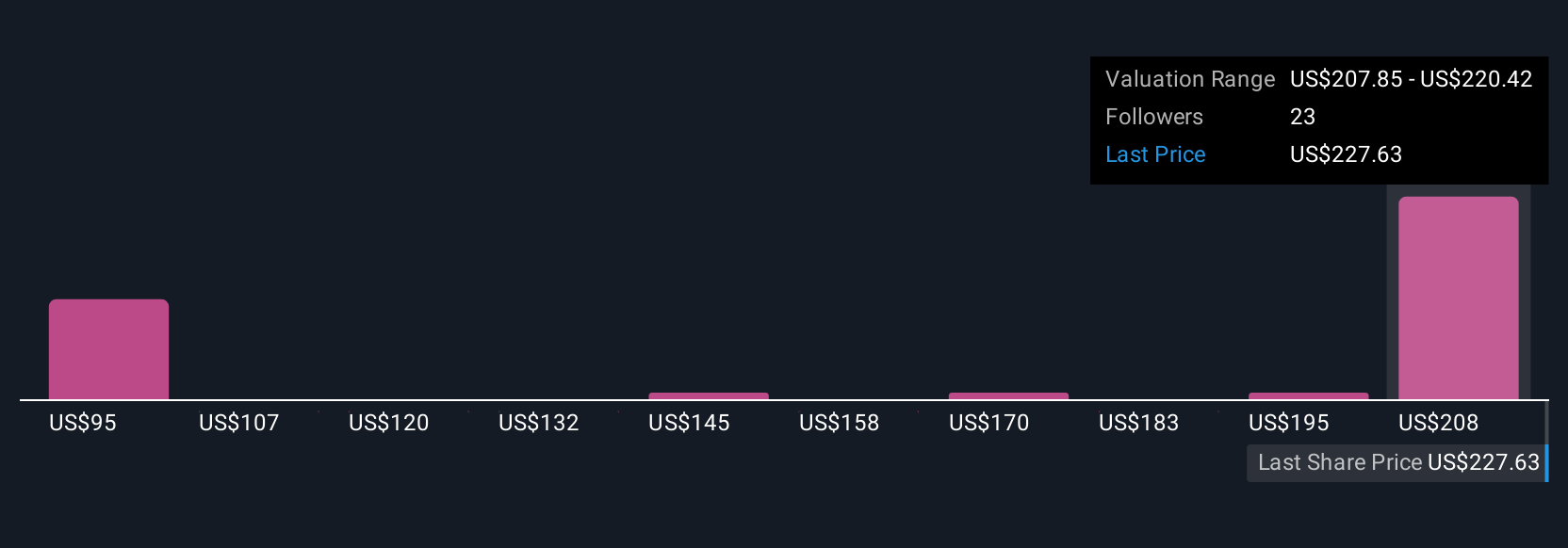

Simply Wall St Community members offered six fair value estimates for DICK'S Sporting Goods stock, ranging from US$153.36 to US$544.68. Despite this wide spectrum, ongoing investment in omnichannel experiences and digital convenience remains a central factor shaping where the company might move next, so consider several points of view before deciding.

Explore 6 other fair value estimates on DICK'S Sporting Goods - why the stock might be worth over 2x more than the current price!

Build Your Own DICK'S Sporting Goods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DICK'S Sporting Goods research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DICK'S Sporting Goods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DICK'S Sporting Goods' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKS

DICK'S Sporting Goods

Operates as an omni-channel sporting goods retailer primarily in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives