- United States

- /

- Specialty Stores

- /

- NYSE:CANG

Investors who have held Cango (NYSE:CANG) over the last five years have watched its earnings decline along with their investment

This week we saw the Cango Inc. (NYSE:CANG) share price climb by 13%. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 64% in that half decade.

On a more encouraging note the company has added US$22m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Check out our latest analysis for Cango

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Cango became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 0.7% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

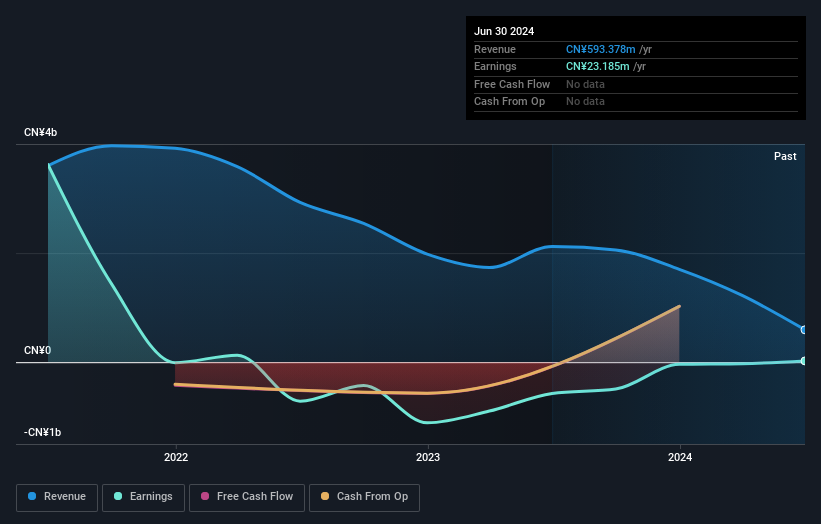

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Cango's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Cango's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Cango's TSR of was a loss of 2.1% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Cango shareholders have received a total shareholder return of 53% over the last year. There's no doubt those recent returns are much better than the TSR loss of 0.4% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Cango (1 is significant!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CANG

Cango

Operates an automotive transaction service platform that connects dealers, original equipment manufacturers, financial institutions, car buyers, insurance brokers, and companies in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.