- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Should Burlington Stores' (BURL) Expansion and Sales Gains Prompt a Closer Look From Investors?

Reviewed by Sasha Jovanovic

- In the past week, Burlington Stores announced continued progress on its off-price strategy, highlighted by a 5% comparable-sales gain and stronger margins in the second quarter alongside a major multi-year store expansion plan targeting 500 new locations by 2028.

- These initiatives indicate that Burlington’s operational enhancements are translating into tangible sales and margin improvements, fueling optimism around the company’s transformation and expansion efforts.

- To understand the implications of Burlington’s expansion ambitions and sales momentum, we’ll assess how these updates shape its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Burlington Stores Investment Narrative Recap

To own shares in Burlington Stores, an investor needs conviction in the off-price retail model’s ability to capture increased demand for value and the success of Burlington’s aggressive store rollout plan. The recent announcement of a 5% comparable-sales gain and stronger margins reinforces the importance of robust store productivity as the key short-term catalyst, while also intensifying the risk tied to scaling up physical locations should demand or traffic decelerate. This news meaningfully supports the catalyst but doesn’t eliminate concerns around execution risk if expansion outpaces market conditions.

Among the recent updates, Burlington’s multi-year plan to open 500 additional stores, a major scaling effort and the most relevant announcement to this news, sits at the core of both the company’s growth ambitions and its primary risk. With fresh evidence of improving sales and margins in the second quarter, the expansion narrative gains support, but the success of this rollout still depends on sustained consumer interest and careful management of store-level profitability.

By contrast, investors should be aware that rapid physical expansion could increase exposure to...

Read the full narrative on Burlington Stores (it's free!)

Burlington Stores' outlook suggests revenues will reach $14.3 billion and earnings will rise to $993.7 million by 2028. This scenario assumes a 9.1% annual revenue growth rate and a $447.3 million increase in earnings from the current $546.4 million.

Uncover how Burlington Stores' forecasts yield a $351.75 fair value, a 26% upside to its current price.

Exploring Other Perspectives

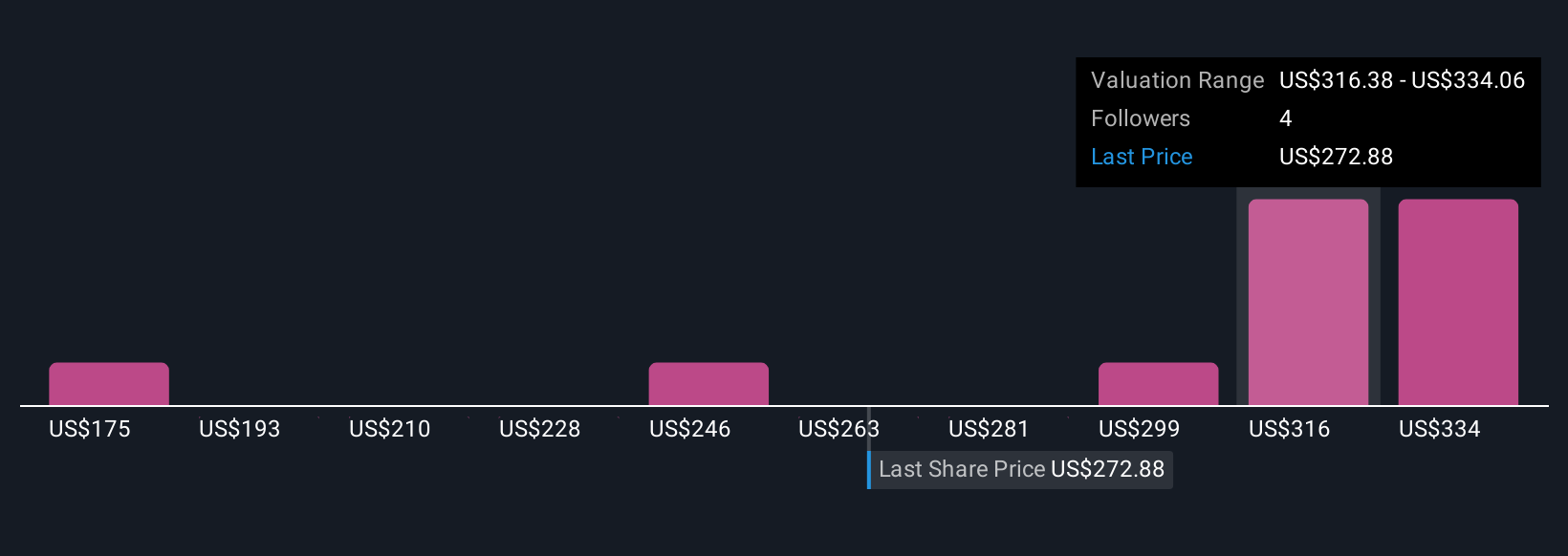

Simply Wall St Community members have posted five fair value estimates for Burlington ranging from US$174.88 to US$351.75 per share, reflecting wide variation in outlook. This diversity is worth weighing alongside the risk that accelerating store openings could pressure Burlington’s margins should demand falter, highlighting the need to consider several viewpoints when assessing potential and pitfalls.

Explore 5 other fair value estimates on Burlington Stores - why the stock might be worth as much as 26% more than the current price!

Build Your Own Burlington Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Burlington Stores research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Burlington Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Burlington Stores' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States and Puerto Rico.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives