- United States

- /

- Specialty Stores

- /

- NYSE:BURL

Burlington Stores (BURL): Is Wall Street’s Upbeat Growth Outlook Reflected in Today’s Valuation?

Reviewed by Simply Wall St

Burlington Stores (BURL) is drawing attention ahead of its upcoming quarterly report, with Wall Street analysts projecting year-over-year growth in both earnings and revenues, as well as a higher store count compared to last year.

See our latest analysis for Burlington Stores.

Momentum has been picking up for Burlington Stores this year, with a 1-month share price return of 10.3% and the stock jumping 5% in just the last day. While the 1-year total shareholder return is a modest 1.7%, long-term investors have seen a substantial 51% gain over three years. This hints at underlying strength despite recent volatility.

If strong retail comebacks and shifting market momentum have you looking for your next idea, broaden your search and discover fast growing stocks with high insider ownership

With the stock trading below analyst price targets and annual growth in both revenue and net income, the question remains: is there value yet to be unlocked here, or has the market already factored in future gains?

Most Popular Narrative: 14.3% Undervalued

Burlington Stores closed at $296.51, while the most popular narrative sets fair value at $345.94. This gap is driving renewed attention from investors seeking upside value against recent price strength. Let’s look at what’s moving sentiment in this narrative.

Ongoing investments in automation (such as the new West Coast distribution center) and enhanced inventory management through reserve buying and supply chain initiatives allow Burlington to improve merchandise margins and achieve operating leverage, supporting long-term earnings growth.

Want to see what is powering this retail stock higher? The valuation’s backbone is a bold projection for surging profits and rising margins, with one expert assumption turning traditional retail norms upside down. Find out what expectations are fueling this price target. These numbers might surprise you.

Result: Fair Value of $345.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the potential for persistent tariff pressures or slower consumer spending. Either of these factors could challenge Burlington’s earnings momentum.

Find out about the key risks to this Burlington Stores narrative.

Another View: Is the Market Price Too High?

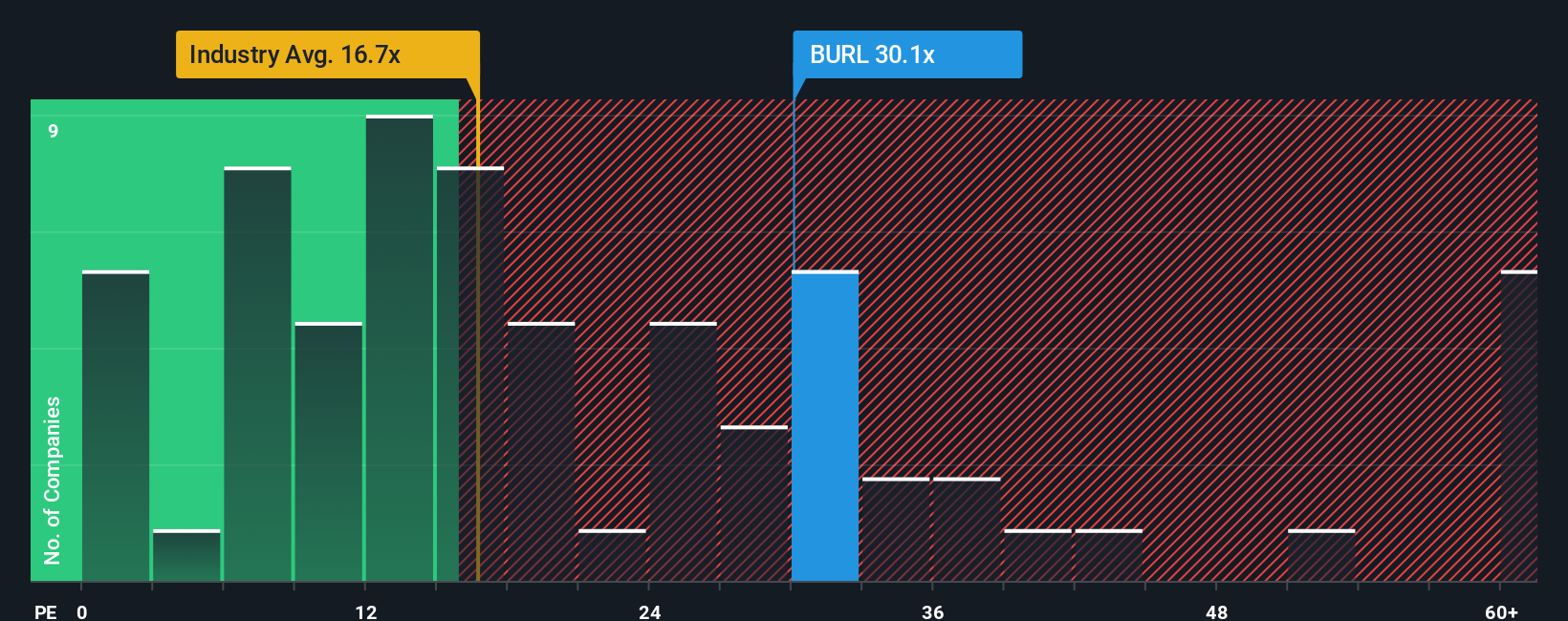

Looking at valuation through the lens of price-to-earnings, Burlington trades at 33.8x earnings, which is much higher than the US Specialty Retail industry average of 18.2x and also well above its fair ratio of 23.2x. This premium suggests investors expect outsize growth, but it creates risk if performance stalls. How long can this stock stand out before expectations recalibrate?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Burlington Stores Narrative

If you want to dig even deeper or put another spin on the data, you can easily build your own case for Burlington Stores in just minutes. Do it your way

A great starting point for your Burlington Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great opportunities rarely stick around for long. Give yourself an edge by exploring unique stocks that could be tomorrow’s breakthrough stories and outperform your expectations.

- Tap into the digital revolution and see which companies stand out among these 26 AI penny stocks, featuring cutting-edge advances in artificial intelligence.

- Maximize your income potential by checking out these 15 dividend stocks with yields > 3%, where attractive yields combine with strong fundamentals.

- Uncover potential bargains with these 917 undervalued stocks based on cash flows and position yourself ahead of other investors looking for hidden value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burlington Stores might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BURL

Burlington Stores

Operates as a retailer of branded merchandise in the United States and Puerto Rico.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives