- United States

- /

- Specialty Stores

- /

- NYSE:BOOT

With Boot Barn Holdings, Inc. (NYSE:BOOT) It Looks Like You'll Get What You Pay For

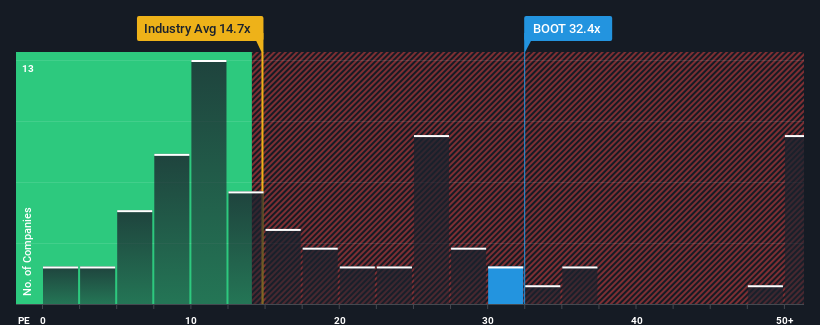

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider Boot Barn Holdings, Inc. (NYSE:BOOT) as a stock to avoid entirely with its 32.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Boot Barn Holdings has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Boot Barn Holdings

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Boot Barn Holdings' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.8%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 44% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 16% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's understandable that Boot Barn Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Boot Barn Holdings' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Boot Barn Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Boot Barn Holdings with six simple checks on some of these key factors.

You might be able to find a better investment than Boot Barn Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Boot Barn Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BOOT

Boot Barn Holdings

Operates specialty retail stores in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives