- United States

- /

- Specialty Stores

- /

- NYSE:BKE

Is Buckle Fairly Priced After Shares Climb 21%?

Reviewed by Bailey Pemberton

- Wondering if Buckle is a hidden gem or just fairly priced? You are not alone; the stock’s valuation has plenty of investors curious right now.

- Buckle’s shares have climbed 21.2% over the last year and 3.2% in the last week, hinting at persistent growth potential and shifting market sentiment.

- Recent headlines highlight Buckle’s continued focus on operational efficiency and evolving retail strategies, with new store openings and digital sales initiatives making waves in the industry. These moves are catching the attention of both investors and competitors, fueling speculation around the company’s long-term prospects.

- Currently, Buckle scores 4 out of 6 on our valuation checks, suggesting the company is undervalued in several key areas. Next, we will break down those valuation approaches in detail, and at the end of the article, we will share what we think is an even smarter way to judge Buckle’s true worth.

Approach 1: Buckle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach helps investors understand whether the current share price reflects the underlying business fundamentals.

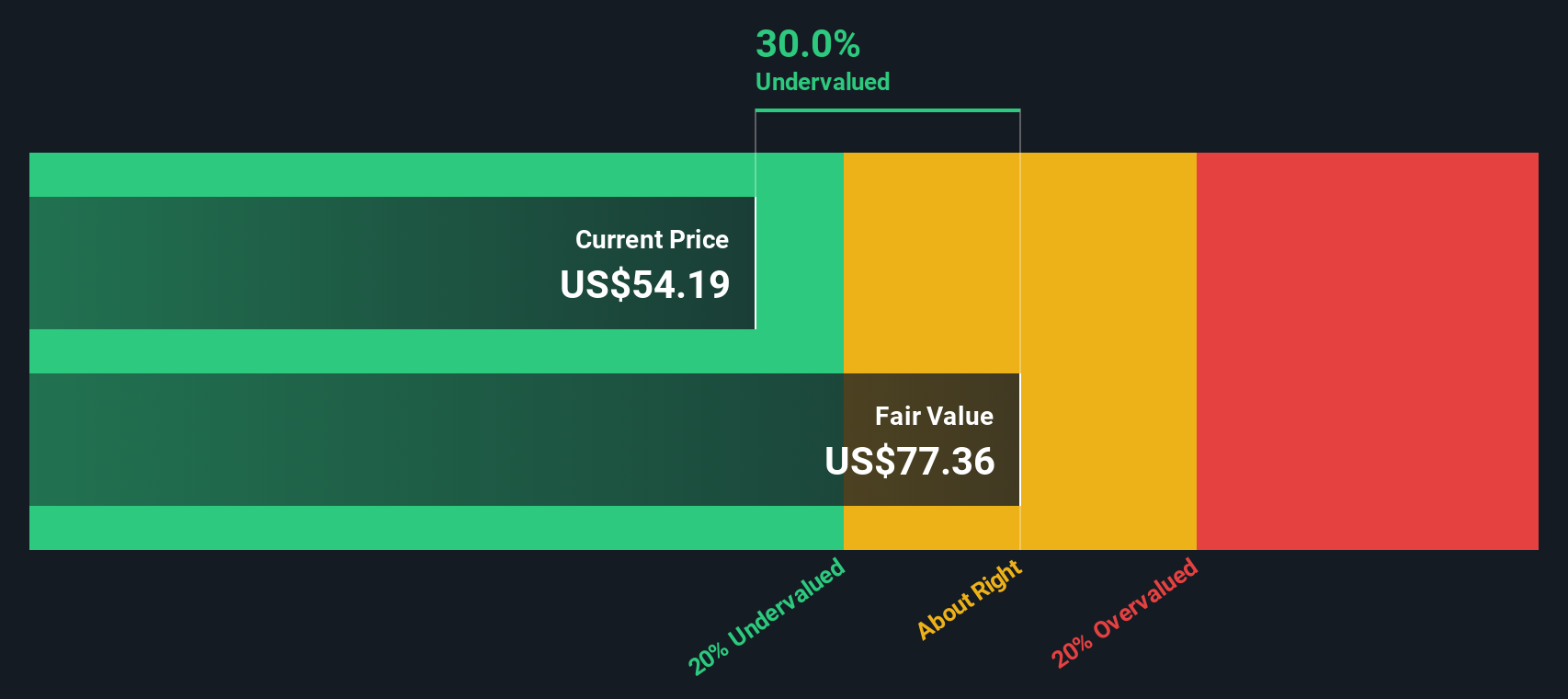

For Buckle, the latest twelve months Free Cash Flow stands at $214.7 million. Analysts estimate Buckle’s annual Free Cash Flow will continue to rise, with projections reaching $317.2 million in 2035. While analysts typically provide up to five years of forecasts, these longer-term figures are extrapolated based on current trends and historical averages.

According to the DCF model, which uses a two-stage Free Cash Flow to Equity approach, the fair value per share for Buckle is calculated at $88.86. Compared to its current market price, this suggests the stock is trading at a 35.5% discount to its intrinsic value, indicating the shares are potentially significantly undervalued.

This result provides a clear message: based on cash flow forecasts and a well-established valuation method, Buckle appears to be trading below what the business is worth today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Buckle is undervalued by 35.5%. Track this in your watchlist or portfolio, or discover 924 more undervalued stocks based on cash flows.

Approach 2: Buckle Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Buckle because it directly compares the company’s share price to its earnings. This ratio helps investors gauge whether a stock is expensive relative to the profits it generates, which is especially helpful for companies with stable and growing earnings streams.

When using the PE ratio, growth expectations and risks play a significant role in determining what is considered “normal” or “fair.” Rapid earnings growth or low risk typically warrant higher PE ratios, while slower growth or elevated risk should lead to lower PEs. This context is important when tracking Buckle’s valuation against competitors and the broader market.

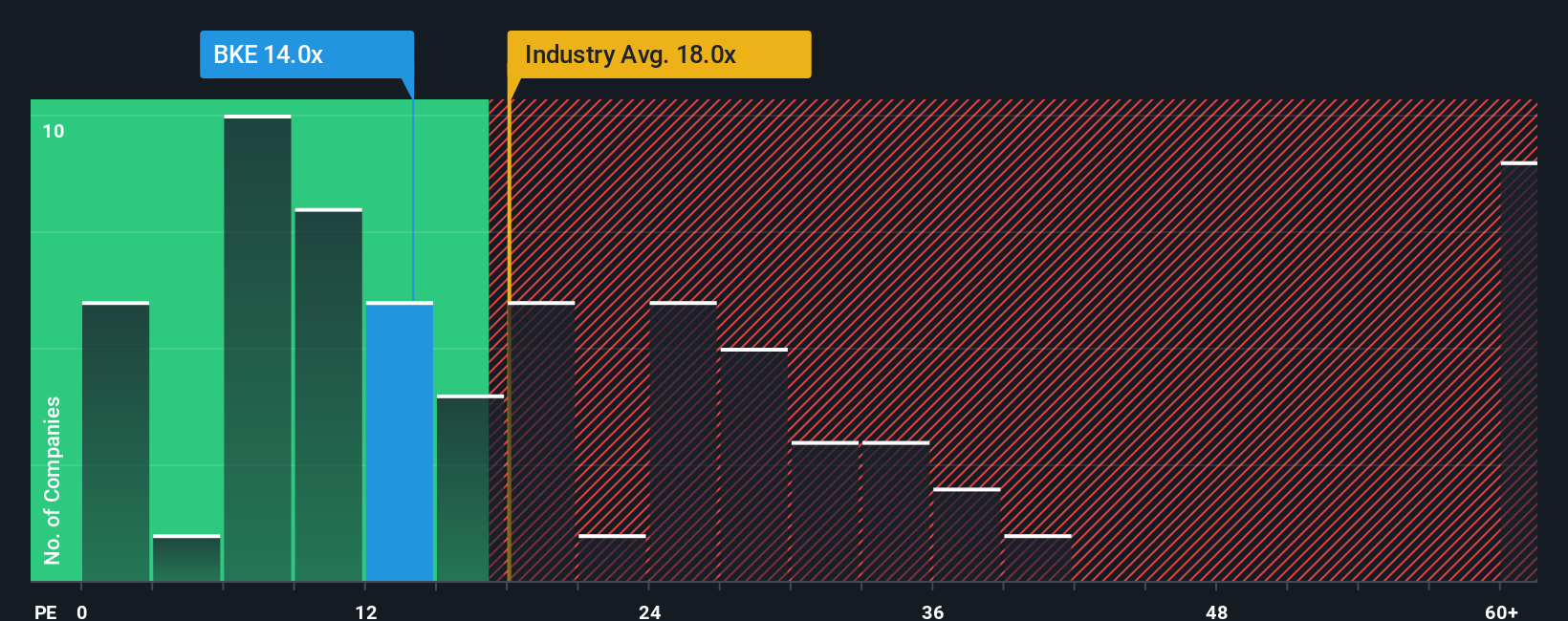

Buckle’s current PE ratio is 14x. For comparison, the average PE among industry peers is 20x, and the broader specialty retail industry averages about 18x. This positions Buckle below both its sector and peer benchmarks, which may indicate deep value or possibly overlooked strengths.

Simply Wall St’s “Fair Ratio” refines this analysis further. Unlike basic industry averages or peer comparisons, the Fair Ratio integrates a company’s unique earnings growth outlook, risks, profit margins, industry dynamics, and market cap. It offers a more tailored and realistic comparison for investors.

Buckle’s Fair Ratio lands at 13.2x. With the current PE at 14x, the difference is minimal, suggesting the stock is valued about where it should be based on its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Buckle Narrative

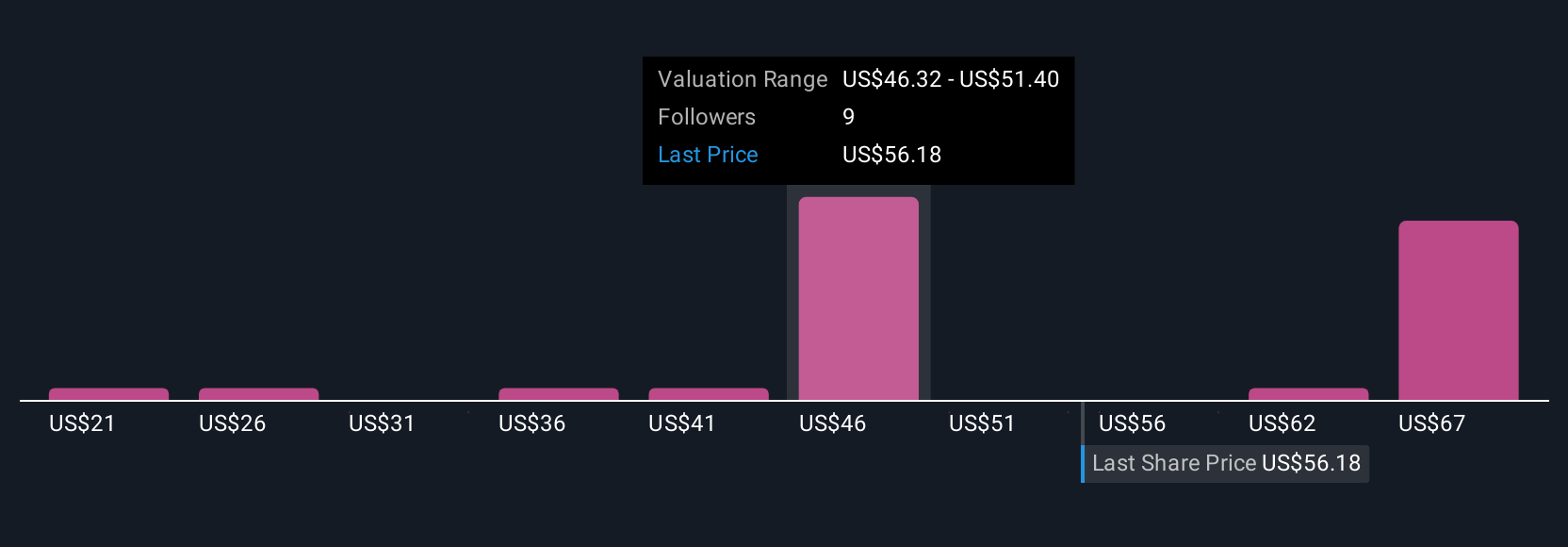

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple investment story that connects your perspective on Buckle, such as its future revenue growth, earnings, and profit margins, with a financial forecast and a fair value, making the numbers meaningful and actionable.

On Simply Wall St’s Community page, millions of investors use Narratives to articulate their outlook in plain terms, set their own expectations, and see an up-to-date fair value based on those assumptions. Narratives make it easy to compare your view with others, and since the results update automatically as new news or earnings are released, you are never left behind as the story evolves.

For example, one investor may believe Buckle’s steady specialty apparel sales, digital investments, and strong balance sheet justify a fair value of $54 per share. Another, more skeptical investor may see risks like slow e-commerce growth and rising costs, favoring a lower outlook. By modeling your own Buckle Narrative, you can instantly see whether the market price offers an attractive opportunity to buy or a signal to reconsider, based on your actual expectations and not just the consensus.

Do you think there's more to the story for Buckle? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Buckle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKE

Buckle

Operates as a retailer of casual apparel, footwear, and accessories for men, women, and kids under the Buckle and Buckle Youth brands in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success