- United States

- /

- Specialty Stores

- /

- NYSE:BBWI

Is Bath & Body Works Now Attractive After a 20% Share Price Drop?

Reviewed by Bailey Pemberton

- Thinking of adding Bath & Body Works to your portfolio or wondering if now is the right time? Let’s explore whether the stock is truly a bargain or just appears to be one.

- The share price has taken a hit recently, sliding 3.9% in the past week and falling more than 20% this past month. This has attracted investors’ attention to both the opportunities and risks involved.

- Much of this volatility is being driven by industry-wide challenges and shifting consumer trends, as well as updates on strategic initiatives from Bath & Body Works. Headlines have highlighted the company’s efforts to revamp its product lineup and strengthen its direct-to-consumer channels, generating both optimism and uncertainty among market watchers.

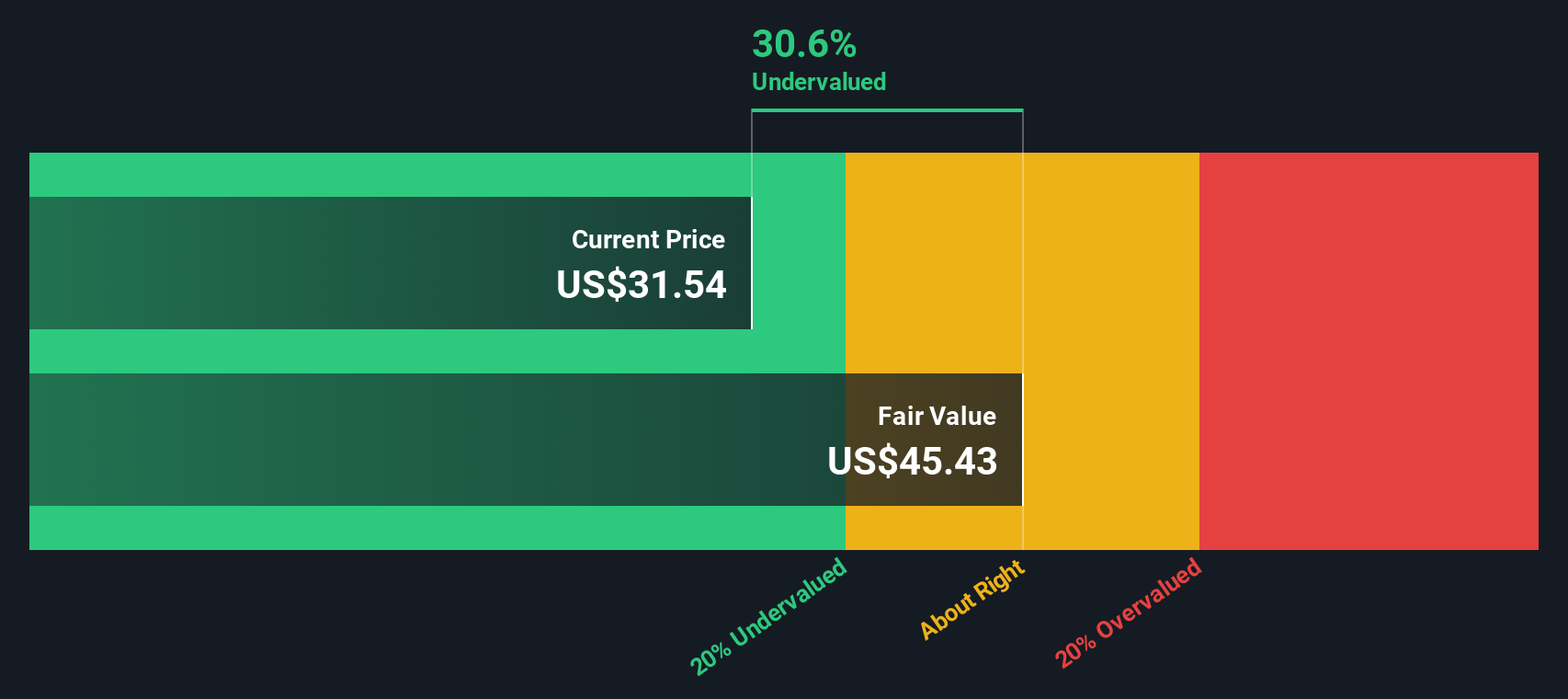

- On our valuation checks, Bath & Body Works scores a 5/6 for being undervalued, which is impressive by industry standards. We will review the key valuation methods behind this score, and discuss a smarter way to assess a company’s true worth by the end of the article.

Find out why Bath & Body Works's -28.9% return over the last year is lagging behind its peers.

Approach 1: Bath & Body Works Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method used to estimate a company's intrinsic value by forecasting its future cash flows and discounting them back to today's value. It helps investors understand what a business is truly worth, based on realistic cash generation over time.

For Bath & Body Works, the DCF analysis starts with the company’s current free cash flow, which stands at $740.9 Million. Analysts have projected annual cash flows through 2027, with free cash flow expected to reach roughly $753.9 Million in that year. Beyond this point, cash flows are extrapolated using conservative growth rates. This culminates in a projection of approximately $902.8 Million by 2035.

Applying these forecasts, the estimated intrinsic value per Bath & Body Works share is $42.53. When compared with the current market price, this represents a discount of 50.4%. In other words, the market is currently pricing the stock well below what the DCF model suggests it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bath & Body Works is undervalued by 50.4%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Bath & Body Works Price vs Earnings (PE Ratio)

For profitable companies like Bath & Body Works, the Price-to-Earnings (PE) ratio is a widely used valuation multiple. It is favored because it directly ties the company’s share price to its reported earnings, offering straightforward insight into how the market values each dollar of profit. A lower PE can indicate a bargain, while a higher one may signal high investor expectations.

Growth prospects and perceived risks play a significant role in what constitutes a "normal" PE ratio. Companies with faster expected earnings growth or lower risk typically deserve a higher PE. Those facing uncertainties or slower growth often trade at lower multiples.

Currently, Bath & Body Works’ PE ratio stands at 6.0x. This is significantly below both the specialty retail industry average of 16.6x and the peer average of 25.4x. On the surface, this suggests the stock could be undervalued. However, rather than, or in addition to, comparing to these broad benchmarks, we use Simply Wall St’s proprietary "Fair Ratio." This custom benchmark combines not just industry comparisons but also factors like Bath & Body Works’ growth trends, profit margins, market cap, and unique risk profile to provide a more tailored assessment.

For Bath & Body Works, the Fair Ratio is calculated at 16.0x. With the actual PE (6.0x) falling well below this fair value, it suggests the market is offering the stock at a notable discount to its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bath & Body Works Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story or perspective about a company’s future. It is the logic and assumptions you believe drive its growth, profits, and value, brought together into a clear financial forecast and a fair value estimate.

Unlike traditional metrics or models, Narratives link what you believe about Bath & Body Works, including its strategy, risks, and future prospects, directly to numbers like projected revenue, margins, and valuation. This approach makes your investment decisions both personal and actionable.

On Simply Wall St's Community page, millions of investors use Narratives as an easy and accessible tool to capture their views and see them instantly reflected in share price estimates. Narratives update in real time as new company news or results come out, helping you to adjust your view and spot when the current price is diverging from your fair value. This can be a key indicator for considering your investment actions.

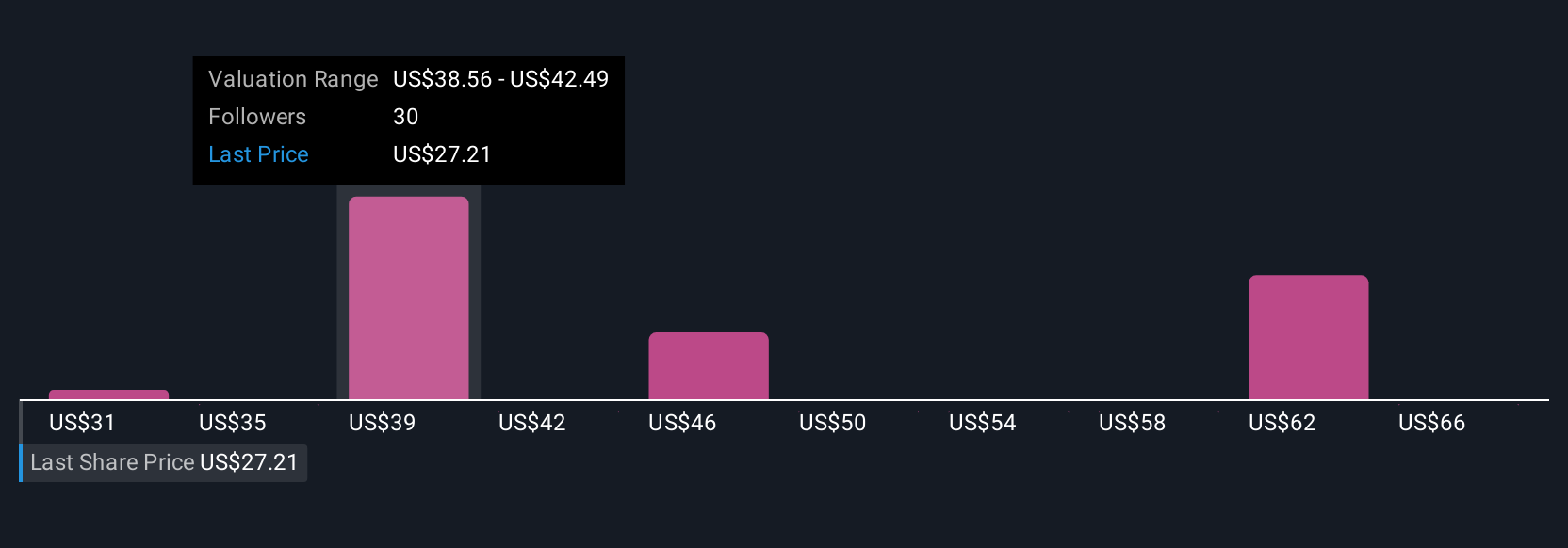

For example, one Narrative sees Bath & Body Works worth $64.56 a share based on aggressive growth in men's products and successful international expansion. Another projects a fair value closer to $37.77, focused on slow sales growth and ongoing margin pressure. Your story and numbers shape your investment call.

Do you think there's more to the story for Bath & Body Works? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bath & Body Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBWI

Bath & Body Works

Operates as a specialty retailer of home fragrance, personal and body care, soaps, and sanitizer products.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives