- United States

- /

- Specialty Stores

- /

- NYSE:BBW

Improved Earnings Required Before Build-A-Bear Workshop, Inc. (NYSE:BBW) Stock's 26% Jump Looks Justified

Build-A-Bear Workshop, Inc. (NYSE:BBW) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 108% in the last year.

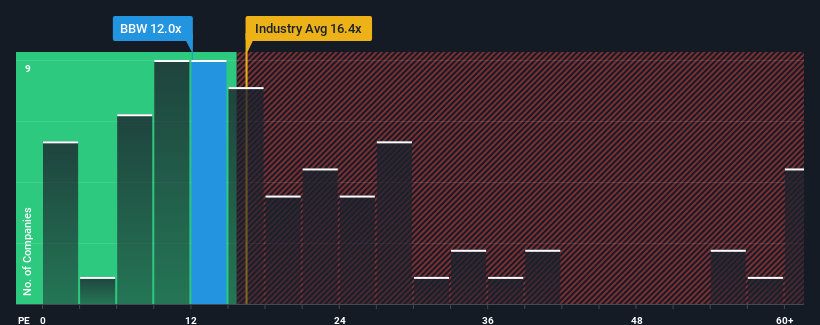

Although its price has surged higher, Build-A-Bear Workshop's price-to-earnings (or "P/E") ratio of 12x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Build-A-Bear Workshop certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Build-A-Bear Workshop

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Build-A-Bear Workshop's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 7.2% gain to the company's bottom line. Pleasingly, EPS has also lifted 81% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 6.3% each year during the coming three years according to the three analysts following the company. That's shaping up to be materially lower than the 11% per year growth forecast for the broader market.

In light of this, it's understandable that Build-A-Bear Workshop's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Build-A-Bear Workshop's P/E?

Despite Build-A-Bear Workshop's shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Build-A-Bear Workshop's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Build-A-Bear Workshop you should be aware of.

You might be able to find a better investment than Build-A-Bear Workshop. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Build-A-Bear Workshop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BBW

Build-A-Bear Workshop

Operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026