- United States

- /

- Specialty Stores

- /

- NYSE:BBW

Discover 3 Undiscovered Gems in the US Market

Reviewed by Simply Wall St

In a market environment marked by recent declines in major indices such as the Dow Jones Industrial Average and the S&P 500, investors are keeping a close eye on upcoming earnings reports and economic indicators that could impact small-cap companies. Despite the broader market's volatility, this presents an opportunity to explore lesser-known stocks that may offer unique value propositions amidst current economic conditions. Identifying potential gems involves looking for companies with strong fundamentals, innovative products or services, and resilience in challenging times.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Pure Cycle (PCYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pure Cycle Corporation operates in the United States, offering water and wastewater services, with a market capitalization of $267.54 million.

Operations: Revenue is primarily generated from land development ($15.26 million) and water and wastewater resource development ($10.33 million), with a smaller contribution from single-family rentals ($0.50 million).

Pure Cycle, a small player in the water utilities sector, has shown resilience with its earnings growing 12.9% over the past year, outpacing industry growth of 12.5%. Despite a modest increase in its debt-to-equity ratio from 0% to 4.8% over five years, Pure Cycle maintains more cash than total debt and is free cash flow positive. The recent fiscal year results highlighted net income rising to US$13.11 million from US$11.61 million previously, while basic earnings per share improved to US$0.54 from US$0.48 last year, suggesting solid operational performance amidst revenue fluctuations.

- Delve into the full analysis health report here for a deeper understanding of Pure Cycle.

Review our historical performance report to gain insights into Pure Cycle's's past performance.

Build-A-Bear Workshop (BBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Build-A-Bear Workshop, Inc. is a multi-channel retailer specializing in plush animals and related products with operations in the United States, Canada, the United Kingdom, Ireland, and other international locations, and has a market capitalization of approximately $626.94 million.

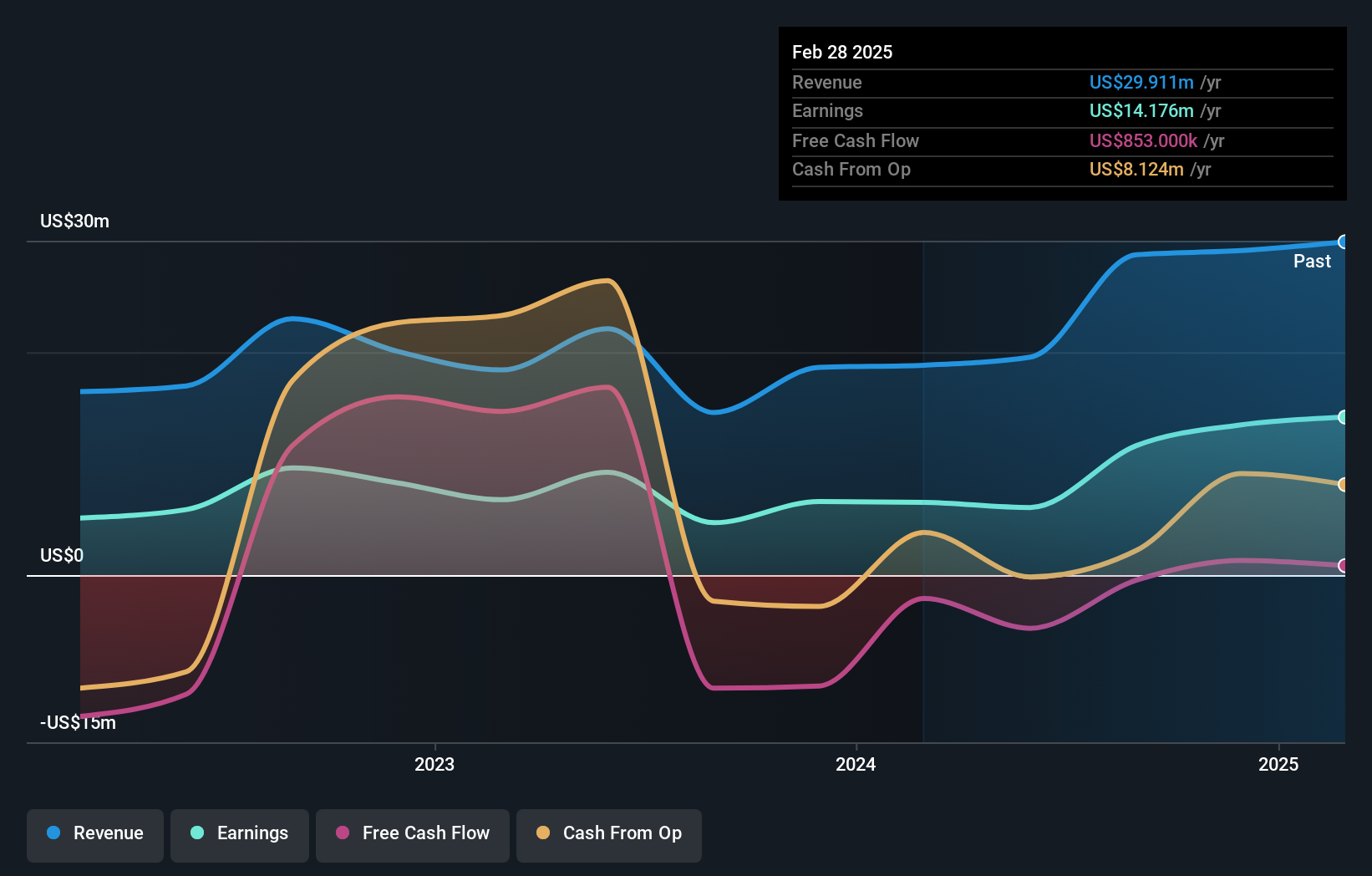

Operations: Build-A-Bear Workshop generates revenue primarily through its Direct-To-Consumer segment, which accounts for $483.23 million, followed by Commercial at $34.36 million and International Franchising at $4.93 million.

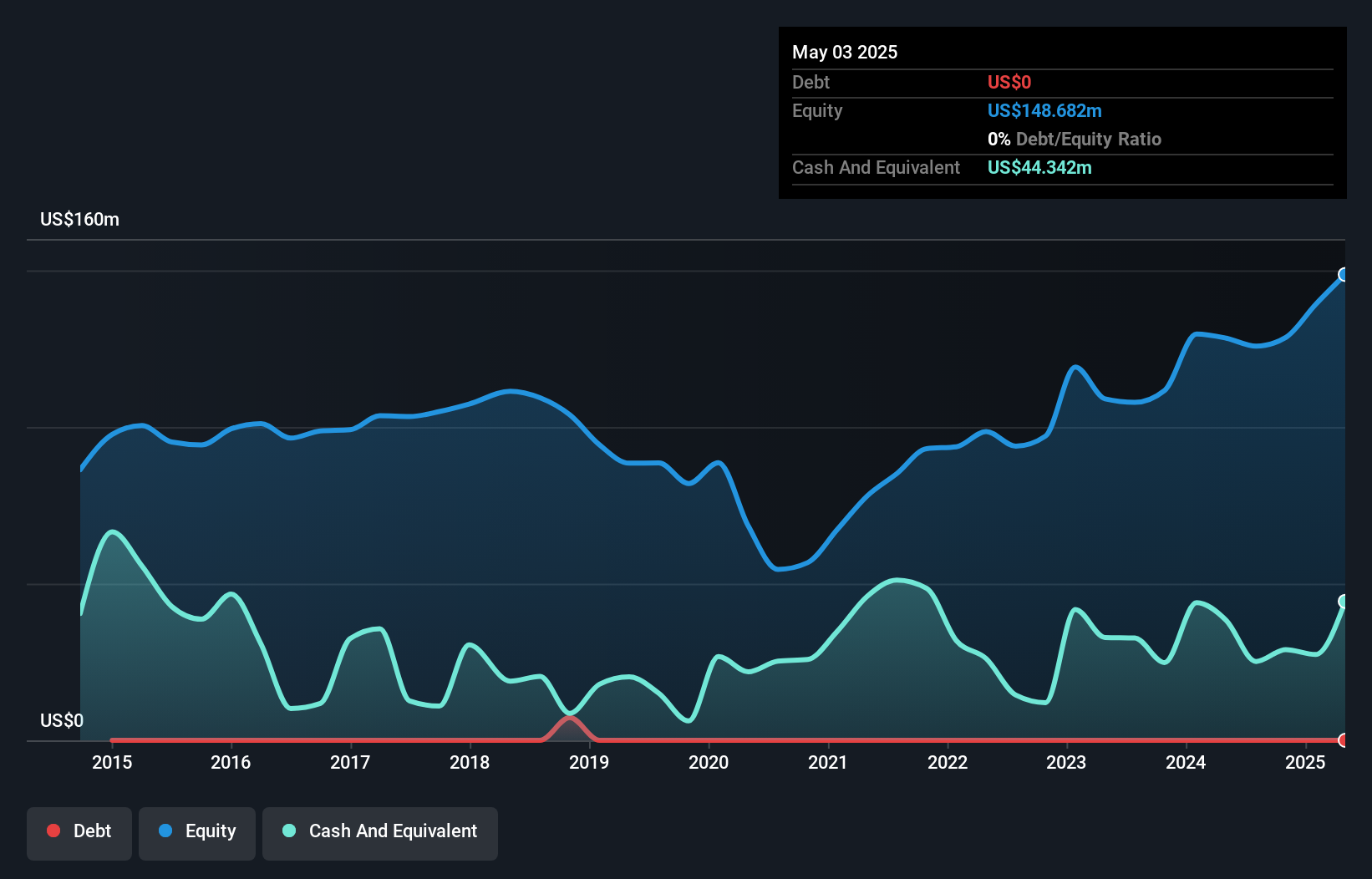

Build-A-Bear Workshop, a nimble player in the specialty retail space, has shown resilience with an 18.3% earnings growth over the past year, outpacing its industry peers. The company is debt-free and trades at 13% below its estimated fair value, offering a compelling valuation. Recent strategic moves include expanding eCommerce under new leadership and increasing physical stores to at least 60 locations this year. Although facing challenges like rising costs and digital competition affecting margins from 11.3% to an expected 10.6%, Build-A-Bear's proactive approach in diversifying revenue streams positions it well for future growth opportunities.

Global Ship Lease (GSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Ship Lease, Inc. specializes in owning and chartering containerships under fixed-rate charters to global container shipping companies, with a market capitalization of approximately $1.23 billion.

Operations: GSL generates revenue primarily from its transportation-shipping segment, amounting to $747.04 million. The company's financial performance is influenced by its fixed-rate charter agreements with global shipping companies.

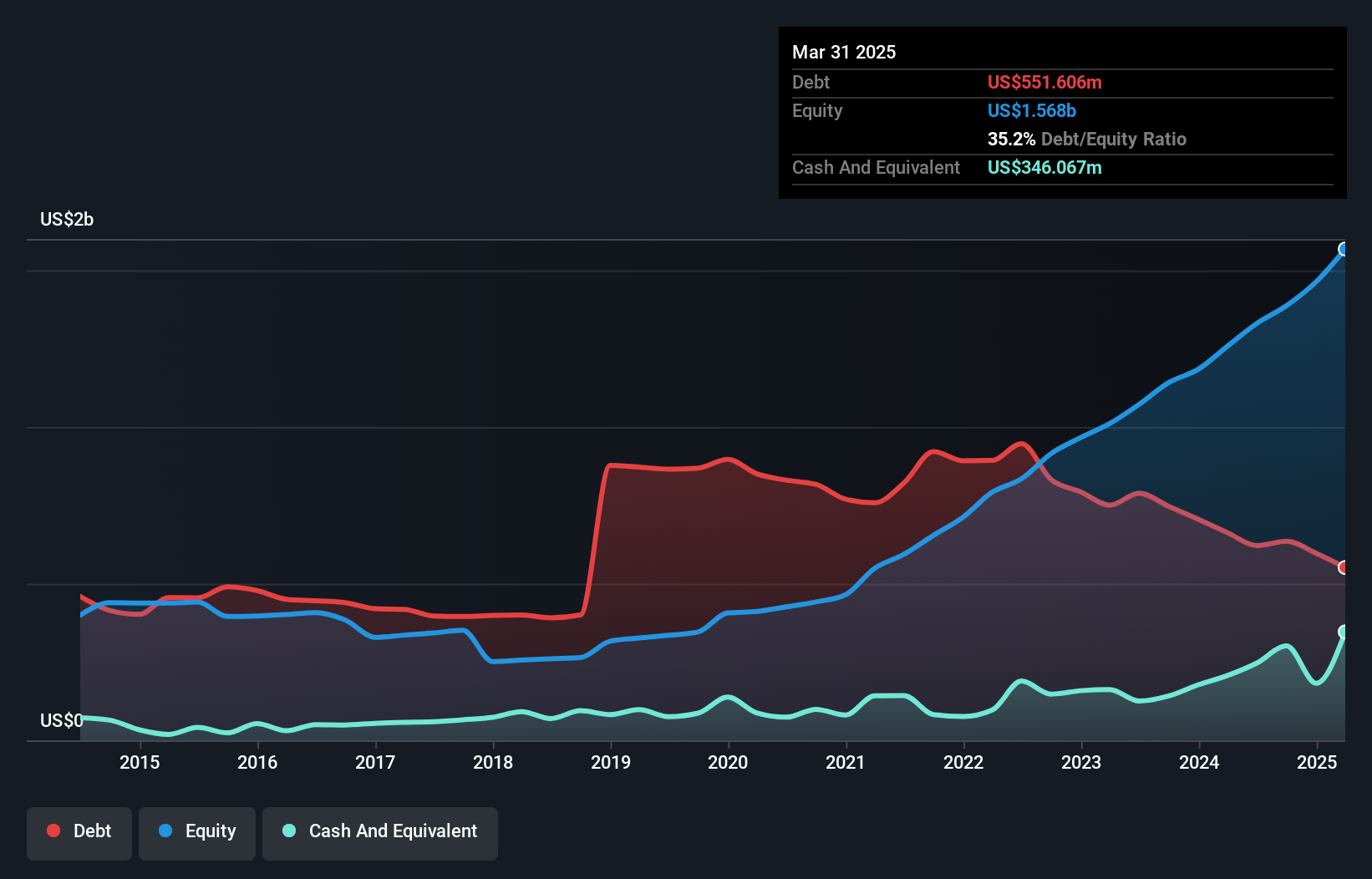

Global Ship Lease, operating in the containership sector, has shown robust performance with earnings growing by 24.6% over the past year, outpacing the shipping industry's -1.1%. The company trades at 65.9% below its estimated fair value and has reduced its debt to equity ratio from 184.9% to 42.2% over five years, indicating strong financial management. GSL's interest payments are well covered by EBIT at a ratio of 25x, reflecting solid operational efficiency despite industry challenges like trade uncertainties and regulatory pressures on decarbonization efforts impacting future revenue projections negatively by an expected annual decline of 5.3%.

Next Steps

- Navigate through the entire inventory of 294 US Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Build-A-Bear Workshop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBW

Build-A-Bear Workshop

Operates as a multi-channel retailer of plush animals and related products in the United States, Canada, the United Kingdom, Ireland, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives