- United States

- /

- Specialty Stores

- /

- NYSE:BBBY

Bed Bath & Beyond (BBBY): Losses Worsen at 59.6% Annual Rate, Challenging Value Narrative

Reviewed by Simply Wall St

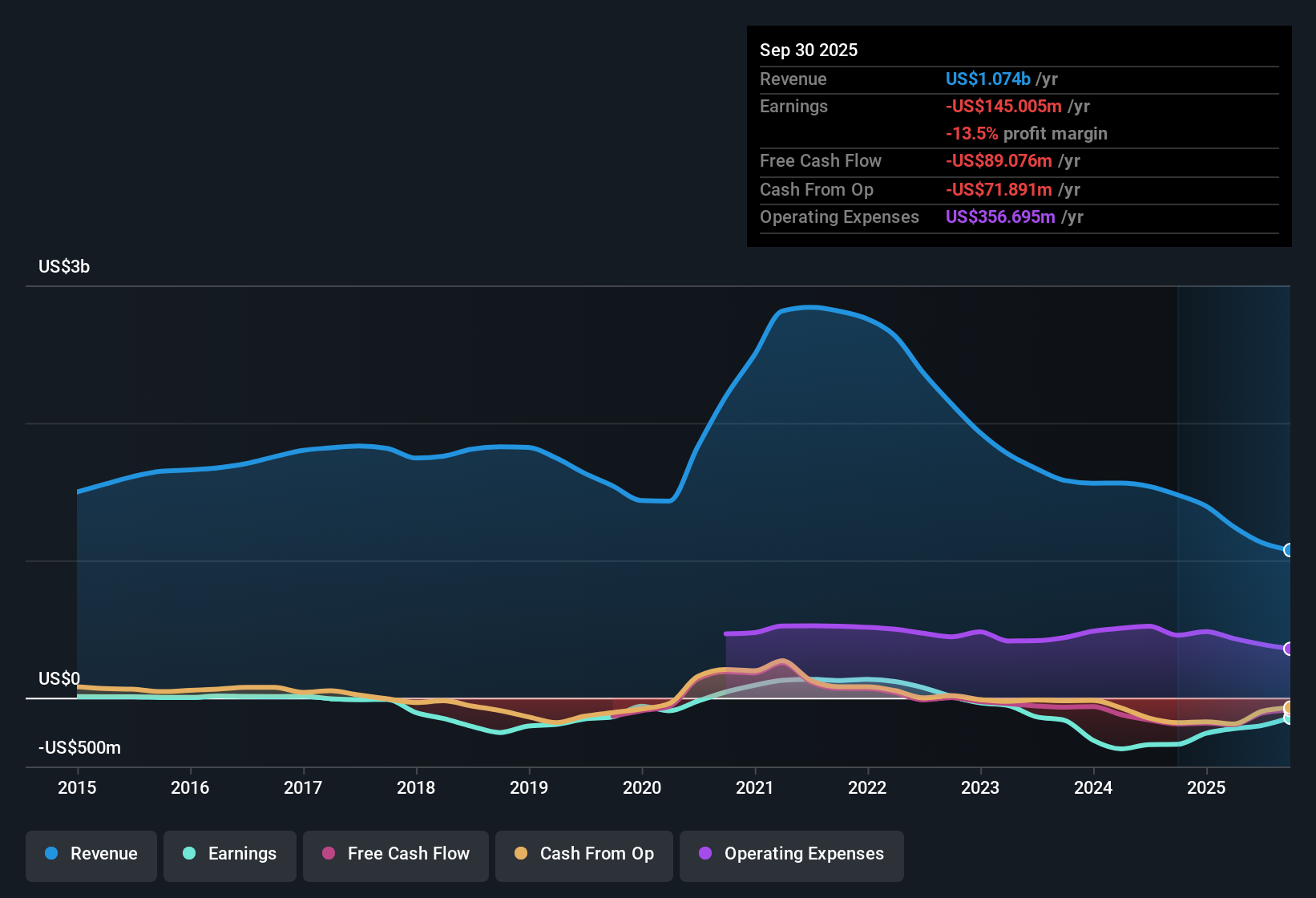

Bed Bath & Beyond (BBBY) remains deeply in the red, with losses accelerating by an average of 59.6% per year over the past five years. While revenue is forecast to grow 7.5% annually, this trails the broader US market's expected 10.1% per year and profits are not expected for at least the next three years. Despite the company trading at a price-to-sales multiple of 0.5x versus a sector average of 0.7x, persistent unprofitability and recent share dilution keep investor sentiment cautious.

See our full analysis for Bed Bath & Beyond.Next, we’ll put these headline numbers in context by comparing them against the most widely discussed narratives for Bed Bath & Beyond, highlighting where the story lines up with expectations and where it does not.

See what the community is saying about Bed Bath & Beyond

Margin Stays Deep in Negative Territory

- Profit margins remain under pressure, with no evidence from filings of an improvement in the company’s negative margins over the past year.

- Analysts' consensus view expects operational efficiencies and omni-channel investments to eventually boost margin profiles.

- However, a persistent lack of positive margin progression despite strategies such as luxury product expansion challenges the outlook for stabilization.

- While tech investments are positioned as future value catalysts, ongoing annual losses of 59.6% cast doubt on near-term shifts to profitability.

Share Dilution Compounds Investor Risks

- The number of shares outstanding is forecast to rise 7.0% annually for the next three years, intensifying dilution concerns that have already weakened investor confidence.

- Analysts' consensus view argues that equity raises may fund strategic pivots and unlock value from technology and licensing.

- Yet a volatile share price and lack of progress on profitability highlight why many see dilution as eroding rather than enabling future value.

- The company’s heavy reliance on non-core, higher-risk assets amplifies the importance of efficient capital use in any recovery scenario.

Valuation Gap Masks Deeper Challenges

- The price-to-sales multiple stands at 0.5x, a discount to the sector average of 0.7x and well below typical valuations for peers even as shares last traded at $8.39.

- Analysts' consensus view highlights that this apparent value is offset by ongoing unprofitability and muted revenue growth.

- This means the discount may simply reflect the market’s anticipation of more persistent or worsening loss trends rather than an overlooked bargain.

- Analyst price targets, capped at 11.5 based on current fundamentals, suggest any upside depends on both a turnaround in profit margins and improvements in core revenue, neither of which have emerged in recent filings.

- Curious how these headwinds and opportunities shape expert thinking? See the full take from analysts and investors in our consensus narrative. 📊 Read the full Bed Bath & Beyond Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bed Bath & Beyond on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might have missed? Share your outlook in just a few minutes and shape the conversation: Do it your way

A great starting point for your Bed Bath & Beyond research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Bed Bath & Beyond faces persistent losses, negative profit margins, and ongoing share dilution, with little evidence of financial improvement or earnings stability in sight.

If you value consistent financial strength and want to avoid these issues, check out solid balance sheet and fundamentals stocks screener (1979 results) for companies with healthier balance sheets and greater resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bed Bath & Beyond might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBBY

Bed Bath & Beyond

Operates as an e-commerce affinity marketing company in the United States and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives