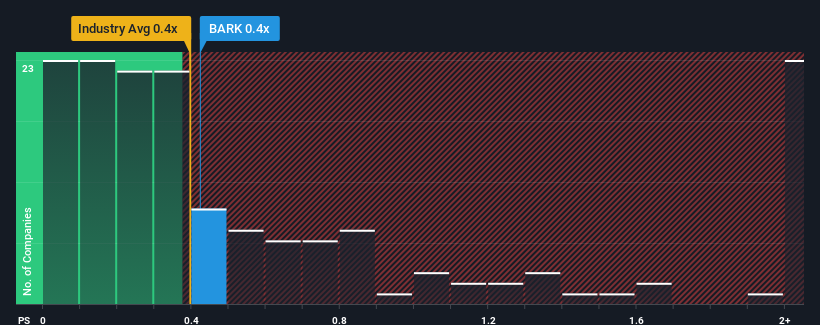

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Specialty Retail industry in the United States, you could be forgiven for feeling indifferent about BARK, Inc.'s (NYSE:BARK) P/S ratio, which comes in at about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for BARK

What Does BARK's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, BARK has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BARK.How Is BARK's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like BARK's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 112% overall rise in revenue, in spite of its uninspiring short-term performance. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 8.6% per annum over the next three years. That's shaping up to be similar to the 6.7% each year growth forecast for the broader industry.

With this in mind, it makes sense that BARK's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On BARK's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at BARK's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with BARK, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BARK might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BARK

BARK

A dog-centric company, provides products, services, and content for dogs.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives