Alibaba’s $2.17B ESOP Move and AI Push Might Change the Case for Investing in BABA

Reviewed by Sasha Jovanovic

- Earlier this month, Alibaba Group Holding filed a shelf registration to offer 12,500,000 American Depositary Shares worth US$2.17 billion, linked to its Employee Stock Ownership Plan (ESOP).

- An interesting aspect is that this capital move coincides with Alibaba’s rapid advances in artificial intelligence, international mapping expansion, and collaboration with XPeng on autonomous mobility initiatives.

- Next, we'll examine how Alibaba's AI leadership, highlighted by its Qwen3-Max outperforming key rivals, could influence its investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alibaba Group Holding Investment Narrative Recap

To be an Alibaba shareholder today, you need conviction in the company’s ability to ride rapid AI and cloud adoption while converting heavy investment into sustainable profit growth. The recently filed US$2.17 billion shelf registration linked to its ESOP is large, but does not meaningfully affect the immediate catalysts or amplify the major risk: ongoing margin pressure as Alibaba pushes for quick commerce scale and AI leadership just as competition and spending remain high.

Alibaba’s Qwen3-Max AI model recently surpassing major global rivals stands out, as it directly relates to a key business driver, capturing more enterprise AI and cloud revenue. This progress is significant in the context of mounting investment across its core and new segments, which further intensifies focus on the potential payback from these areas amid near-term profitability challenges and heightened competitive threats.

Yet, on the other side, investors should note...

Read the full narrative on Alibaba Group Holding (it's free!)

Alibaba Group Holding's narrative projects CN¥1,260.3 billion in revenue and CN¥171.1 billion in earnings by 2028. This requires 8.0% yearly revenue growth and a CN¥22.8 billion earnings increase from CN¥148.3 billion today.

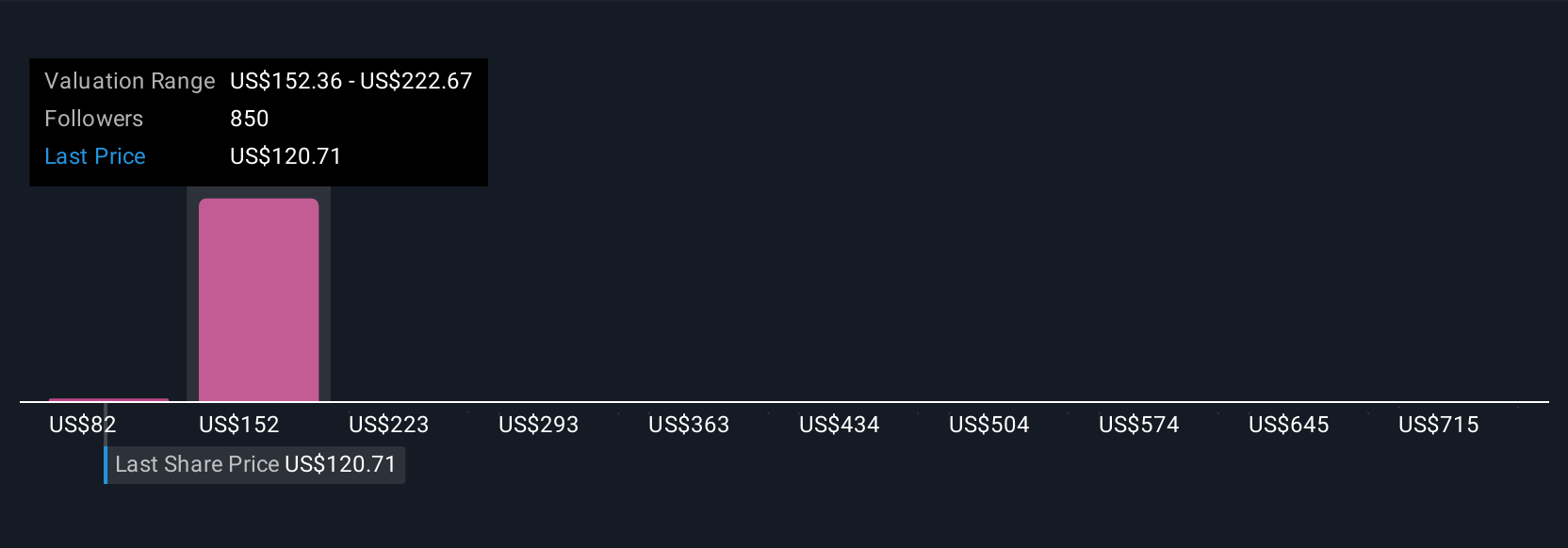

Uncover how Alibaba Group Holding's forecasts yield a $196.82 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Seventy individual fair value estimates from the Simply Wall St Community span from US$107.09 to US$261.74 per share. While opinions differ, the quest for returns amid Alibaba’s margin pressure remains a major talking point worth exploring alongside these diverse views.

Explore 70 other fair value estimates on Alibaba Group Holding - why the stock might be worth 36% less than the current price!

Build Your Own Alibaba Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alibaba Group Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Alibaba Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alibaba Group Holding's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BABA

Alibaba Group Holding

Through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives