- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Is Abercrombie & Fitch (ANF) Recalibrating Its Supply Chain for Sustained Growth?

Reviewed by Sasha Jovanovic

- Abercrombie & Fitch recently announced plans to open a new distribution center in Columbus, Ohio, in partnership with logistics firm Bleckmann, set for completion in summer 2026, aiming to enhance operational efficiency and fulfill growing customer demand in North America.

- This expansion follows strong second-quarter earnings that exceeded analyst expectations, highlighting the company's commitment to long-term growth strategies and infrastructure investment.

- We'll explore how the new distribution center initiative could influence Abercrombie & Fitch's investment outlook and supply chain efficiency.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Abercrombie & Fitch Investment Narrative Recap

To be a shareholder in Abercrombie & Fitch, you need confidence in its ability to deliver sustained revenue growth by revitalizing brands, driving digital acceleration, and managing operational efficiency, even as the apparel sector remains competitive and exposed to evolving consumer trends. The recent Columbus, Ohio distribution center announcement represents a long-term investment in supply chain capacity but does not materially alter the immediate risk: ongoing margin pressure from tariffs and brand-specific sales declines, especially at the Abercrombie label.

Among recent announcements, Abercrombie & Fitch's raised 2025 sales and profit outlook stands out as most relevant. This positive guidance, following a strong second quarter, reinforces management’s focus on disciplined growth and operational improvements, both of which tie directly to the company's efforts to address near-term earnings volatility and restore investor confidence around its major catalysts.

However, despite management’s optimism, investors should keep a close eye on the risk of incrementally rising tariffs, which could compress margins if mitigation measures fall short...

Read the full narrative on Abercrombie & Fitch (it's free!)

Abercrombie & Fitch is projected to reach $5.8 billion in revenue and $489.4 million in earnings by 2028. This outlook involves a 4.3% annual revenue growth rate but a decrease in earnings of $51.6 million from the current $541.0 million.

Uncover how Abercrombie & Fitch's forecasts yield a $110.56 fair value, a 51% upside to its current price.

Exploring Other Perspectives

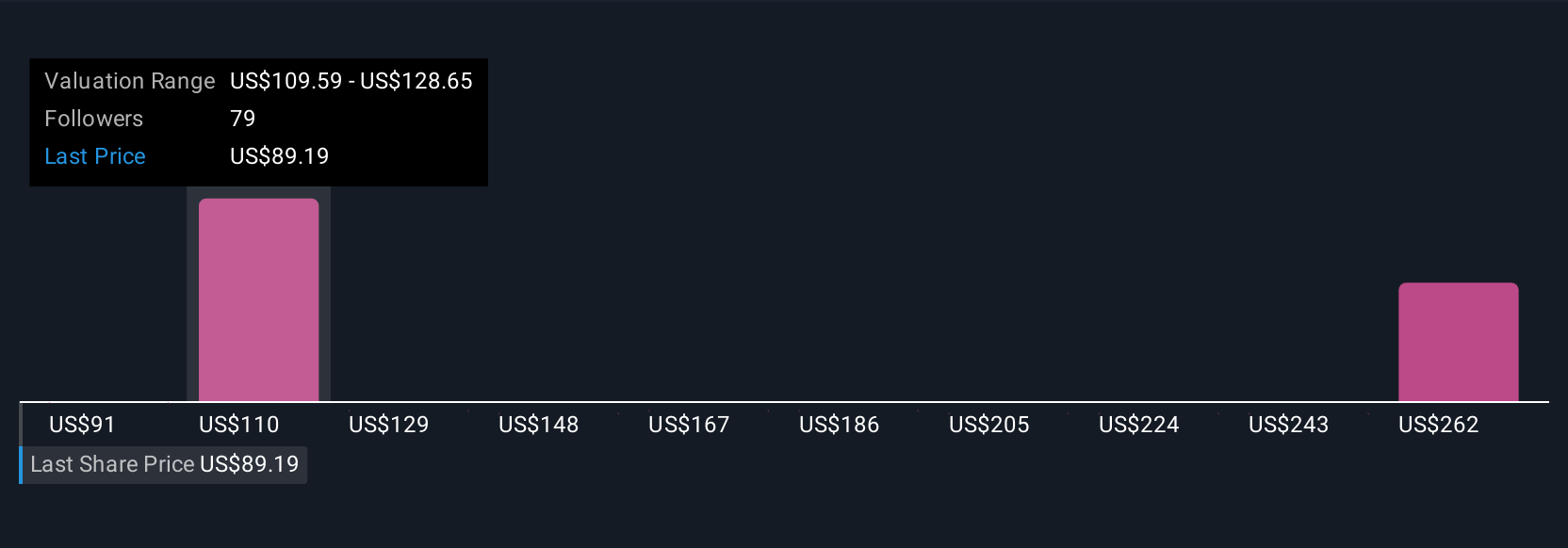

Simply Wall St Community members provided 14 fair value estimates for Abercrombie & Fitch ranging from US$83.08 to US$157.03 per share. While opinions vary widely, recent analyst consensus spotlights the risk of margin pressure from tariffs as a key challenge influencing future share performance, reminding you to consider multiple viewpoints before deciding where value lies.

Explore 14 other fair value estimates on Abercrombie & Fitch - why the stock might be worth just $83.08!

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion