- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Could Abercrombie & Fitch (ANF) Sustain Its Brand Revival With Improving Fundamentals and Influencer Collaborations?

Reviewed by Sasha Jovanovic

- In recent news, Abercrombie & Fitch has been recognized for its operational turnaround, showing significant growth in free cash flow and record earnings, while also gaining positive attention for innovative product launches and influencer collaborations such as Kathleen Post’s fall collection and strong reviews for their denim line.

- This shift highlights how the company’s updated brand image and disciplined financial management are strengthening its appeal to both consumers and long-term investors.

- We'll examine how Abercrombie & Fitch's recent operational and brand transformation shapes the outlook for future fundamentals and valuation.

Find companies with promising cash flow potential yet trading below their fair value.

Abercrombie & Fitch Investment Narrative Recap

To be a shareholder in Abercrombie & Fitch, you need confidence in the company’s ability to sustain brand revitalization and margin improvements through targeted product innovation, digital engagement, and partnerships, while effectively handling cost pressures from tariffs and a competitive retail environment. The recent positive press surrounding influencer collaborations and strong denim reviews contributes positively to near-term consumer interest, but does not materially shift the largest short-term catalyst, which remains robust digital expansion. Tariff headwinds, especially the projected US$90 million impact in 2025, still present the primary risk to margins.

Among the new developments, Abercrombie’s expanded fashion partnership with the NFL, especially as Official Fashion Partner and in launching exclusive team collaborations, stands out as directly relevant to its growth catalysts. These partnerships reinforce the brand’s youth appeal and broaden its presence in sports fan apparel, key factors as the company relies on fresh customer acquisition channels and higher engagement to drive future fundamentals and valuation.

On the flip side, while excitement builds around the latest product drops and partnerships, investors should watch for signs that tariff costs are starting to erode profitability…

Read the full narrative on Abercrombie & Fitch (it's free!)

Abercrombie & Fitch is projected to reach $5.8 billion in revenue and $489.4 million in earnings by 2028. This outlook requires a 4.3% annual revenue growth rate and reflects a $51.6 million decrease in earnings from the current level of $541.0 million.

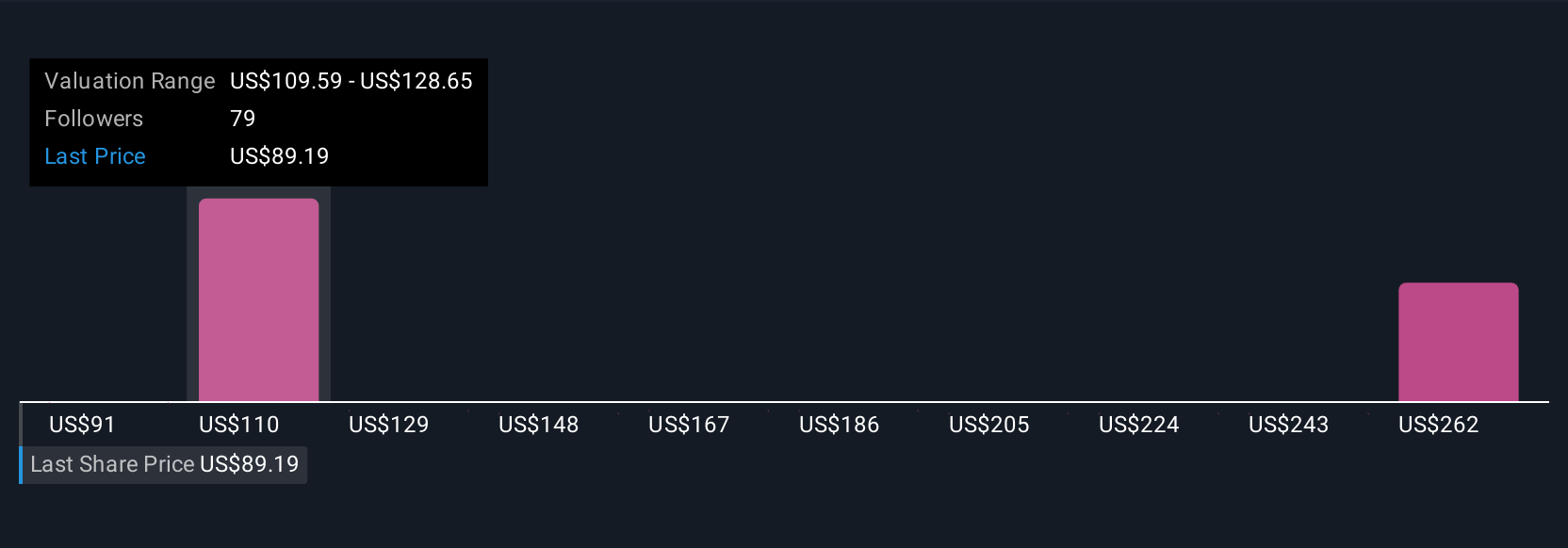

Uncover how Abercrombie & Fitch's forecasts yield a $110.56 fair value, a 50% upside to its current price.

Exploring Other Perspectives

Fourteen individual fair value estimates from the Simply Wall St Community range from US$83.08 to US$157.03 per share, with opinions spanning both ends. As digital engagement remains critical to defending operating margins, consider how your outlook on the company’s resilience compares to this diversity of views.

Explore 14 other fair value estimates on Abercrombie & Fitch - why the stock might be worth just $83.08!

Build Your Own Abercrombie & Fitch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Abercrombie & Fitch research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Abercrombie & Fitch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Abercrombie & Fitch's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives