- United States

- /

- Specialty Stores

- /

- NYSE:ANF

Abercrombie & Fitch (ANF) Margin Decline Reinforces Concerns Over Profit Durability

Reviewed by Simply Wall St

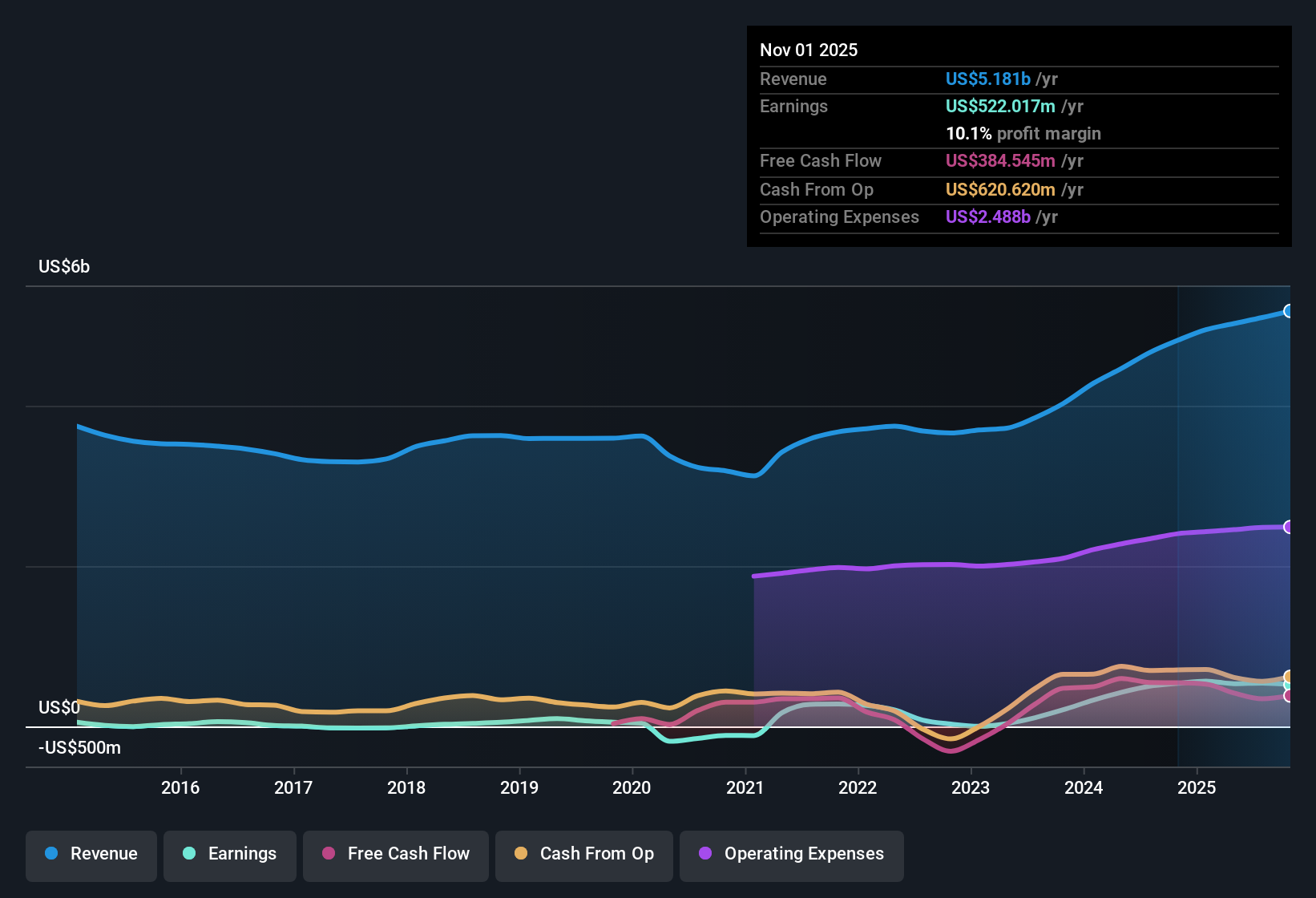

Abercrombie & Fitch (ANF) just posted its Q3 2026 results, reporting revenue of $1.3 billion and basic EPS of $2.41. The company has seen revenue climb from $1.1 billion in Q1 2026 to $1.3 billion in the most recent quarter, while EPS moved from $1.63 to $2.41 over the same period. Margins held firm, with same store sales growth holding steady at 3% each quarter. This development is prompting discussion about the future of the company’s profitability.

See our full analysis for Abercrombie & Fitch.Let's see how these headline results stack up against the market's most popular narratives. Some themes will get reinforced, while others could see new perspectives emerge.

See what the community is saying about Abercrombie & Fitch

Margin Compression Eats Into Profits

- Net profit margin over the past year landed at 10.1%, down from 11.2% previously. This reflects a significant squeeze compared to last year's stronger profitability.

- Consensus narrative notes that supply chain management and disciplined inventory control have helped sustain profitability. However, margin declines are putting pressure on long-term earnings durability.

- Despite these margin pressures, net income is still $522.0 million over the last twelve months, showing the business turnaround remains intact for now.

- Ongoing cost headwinds risk undermining the consensus view that strong inventory discipline alone will insulate profits, especially if fixed costs continue to rise and tariff impacts worsen into next year.

What if shrinking margins threaten the turnaround story? See why consensus still favors long-term renewal in the full narrative. 📊 Read the full Abercrombie & Fitch Consensus Narrative.

Valuation Supports a Value Angle

- Abercrombie & Fitch is trading at a price-to-earnings ratio of just 8.6x, well below the specialty retail industry average (18x) and its peers (20.3x), plus 7% under its DCF fair value of $102.31 per share.

- Analysts' consensus view holds that undervaluation here may be justified despite declining earnings forecasts, as the stock’s low multiple and steady buybacks ($250 million repurchased this year, aiming for $400 million) support the investment case.

- Profit durability is now the big swing factor. Analysts expect revenue to inch up only 3.9% annually, far behind the broader US market’s 10.5% growth.

- The analyst price target of 107.33 is 13% above the current $95.14 share price, implying room for upside if even slow growth is achieved.

Profit Growth Stalls After Strong Run

- Trailing twelve-month net income totaled $522.0 million, but earnings are projected to decline by 4.3% per year for the next three years according to consensus estimates, marking a sharp reversal from the prior five-year average growth rate of 41.1% annually.

- Consensus narrative raises doubts about whether recent investments in global expansion and digital engagement can offset sector headwinds and drive sustainable profit growth moving forward.

- Brand revitalization and product innovation have boosted youth engagement, but recent declines in Abercrombie’s comparable sales (down 11% year-over-year in Q2) flag difficulties in holding share amid changing trends.

- Ongoing expansion increases store occupancy and fixed costs, which could further pressure margins if digital gains do not accelerate enough to absorb these new obligations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Abercrombie & Fitch on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take on these results? Put your perspective into practice and shape your own story in just a few minutes with Do it your way.

A great starting point for your Abercrombie & Fitch research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Abercrombie & Fitch faces stalled profit growth and falling margins, raising serious questions about whether recent momentum can be sustained in the long term.

If you want more consistent earnings and reliable expansion, focus your search on companies showing steady performance across cycles by using stable growth stocks screener (2075 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ANF

Abercrombie & Fitch

Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success