- United States

- /

- Specialty Stores

- /

- NYSE:AN

A Fresh Look at AutoNation (AN) Valuation After Expanding Its $11.5 Billion Buyback Plan

Reviewed by Simply Wall St

AutoNation (AN) just expanded its equity buyback plan by $1,000 million, bringing the total repurchase authorization to $11,500 million. This signals ongoing confidence from management in the company’s long-term outlook.

See our latest analysis for AutoNation.

AutoNation’s expanded buyback comes after a solid run, with a year-to-date share price return of 16.1% and a robust 1-year total shareholder return of 17.9%. While the past month saw softer momentum, the stock’s longer-term total returns, including an impressive 218% over five years, highlight strong value creation and investor optimism connected to strategic moves like this.

If AutoNation’s large-scale buyback has you rethinking what’s next for the auto sector, consider exploring the wider landscape with our auto manufacturers screener: See the full list for free.

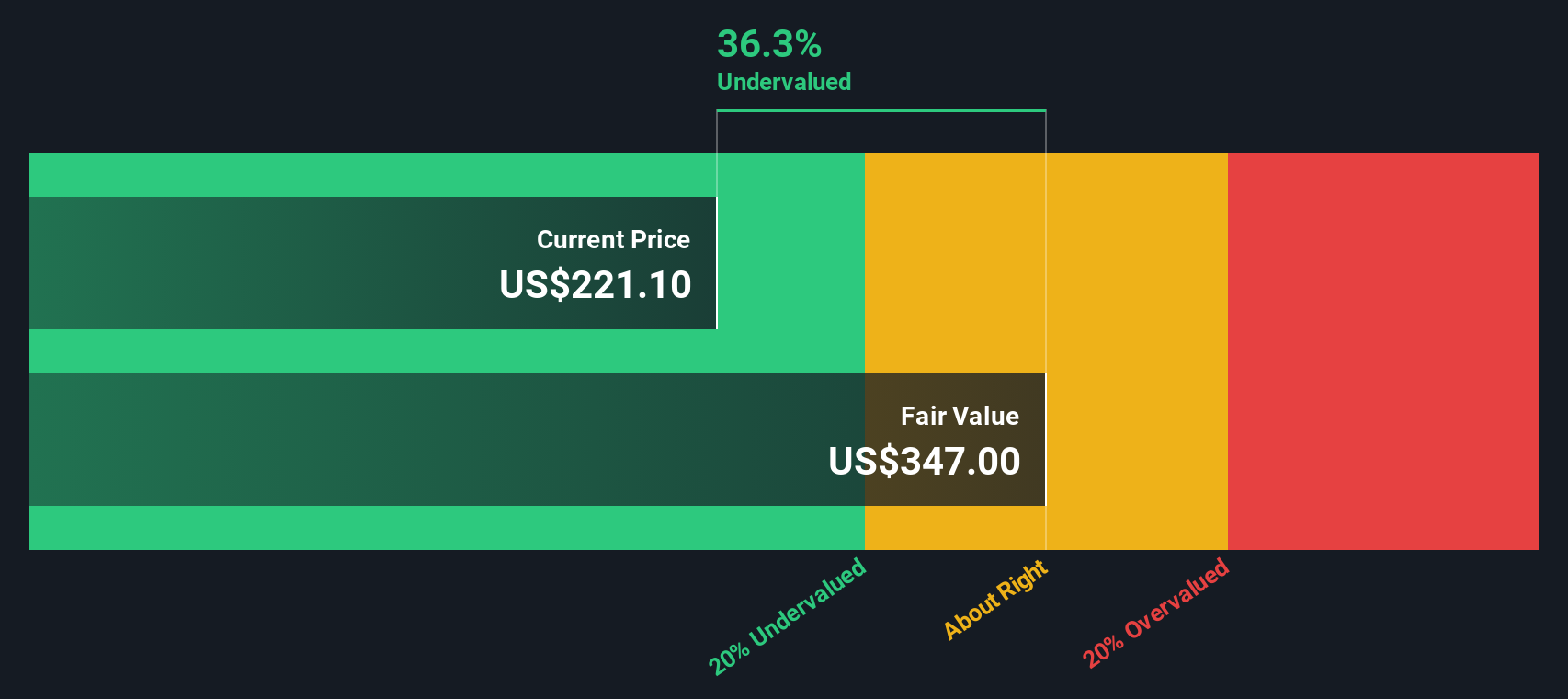

But with shares still trading about 19% below analyst targets and nearly 40% beneath some intrinsic value estimates, the key question is whether the market is overlooking a bargain or fully factoring in future growth potential.

Most Popular Narrative: 15.1% Undervalued

AutoNation's most followed narrative pegs fair value at $228.30, notably above the last close of $193.86. The gap grabs attention for those scoping potential value dislocations or looking for clear quantitative reasoning behind market optimism.

Significant investment and operational emphasis on digital transformation, including enhanced data analytics, omnichannel sales, and improving inventory/pricing management, leverages accelerating consumer preference for online research and purchasing, broadening customer reach and driving higher topline and operating margin efficiency.

Curious what big assumptions drive this bold fair value? Digital strategy shifts meet ambitious margin targets, and future earnings multiples matter. Want to reveal the precise numbers that made this narrative so bullish? Dive in to see the full picture.

Result: Fair Value of $228.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, competition from direct-to-consumer models and the rapid rise of electric vehicles could squeeze margins and challenge AutoNation’s current growth trajectory.

Find out about the key risks to this AutoNation narrative.

Another View: Numbers Behind the Narrative

Taking a look at our DCF model offers a stark contrast. It places AutoNation’s fair value at $322.39, which is far above both recent prices and analyst consensus. This suggests a potentially substantial disconnect, but it also raises questions: Is the market missing key growth drivers, or is the DCF approach too optimistic given today’s risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AutoNation Narrative

If you see the story differently or want to test your own ideas, you can dig into the numbers and shape a custom narrative in just a few minutes. Do it your way

A great starting point for your AutoNation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize your next opportunity with confidence. The right screen could mean the difference between catching the next winner and just watching from the sidelines. Put yourself in the best position by acting today.

- Uncover stocks with resilient cash flows and attractive value by starting your research in these 870 undervalued stocks based on cash flows, targeting companies overlooked by the broader market.

- Target upcoming trends in healthcare innovation and find advancements powered by artificial intelligence through these 32 healthcare AI stocks, where science meets investment potential.

- Jump into the fast-moving world of digital assets by screening these 82 cryptocurrency and blockchain stocks, focused on businesses driving blockchain and cryptocurrency progress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AN

AutoNation

Through its subsidiaries, operates as an automotive retailer in the United States.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives