- United States

- /

- Specialty Stores

- /

- NYSE:AEO

Why American Eagle Outfitters (AEO) Is Up 11.1% After Viral Campaigns Drove Record Customer Gains

Reviewed by Sasha Jovanovic

- In recent news, American Eagle Outfitters saw strong 2025 brand momentum led by viral marketing collaborations across its American Eagle, Aerie, and OFFLINE brands, resulting in record engagement and higher-than-expected customer acquisitions and traffic gains.

- This surge in engagement highlights how successful marketing efforts and innovative campaigns can quickly broaden reach and attract new customers even amidst broader retail challenges.

- We'll explore how American Eagle Outfitters' viral campaigns and record engagement may influence its long-term investment narrative and growth assumptions.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

American Eagle Outfitters Investment Narrative Recap

To be a shareholder in American Eagle Outfitters, you need to believe that its brand momentum, fueled by viral collaborations and strong customer engagement, can ultimately outweigh sector headwinds like soft consumer demand and tariff pressures. The latest surge in engagement could support short-term gains, but the most important catalyst remains the company’s ability to translate this buzz into sustained sales growth. The biggest risk, ongoing consumer uncertainty and global trade impacts, has not materially shifted in light of the news.

Among recent announcements, the September 3 Q2 earnings report stands out given the timing of viral campaigns and marketing collaborations, which contributed to higher-than-expected results and a share price lift. Linking this to the catalyst of expanding brand engagement, investors will watch if new campaigns like the AE x Tru Kolors collaboration can maintain momentum and offset operational risks or margin pressures.

However, against these positives, investors should also factor in...

Read the full narrative on American Eagle Outfitters (it's free!)

American Eagle Outfitters is projected to achieve $5.6 billion in revenue and $340.2 million in earnings by 2028. This outlook assumes annual revenue growth of 2.2% and reflects a $143.1 million increase in earnings from the current figure of $197.1 million.

Uncover how American Eagle Outfitters' forecasts yield a $15.94 fair value, a 4% downside to its current price.

Exploring Other Perspectives

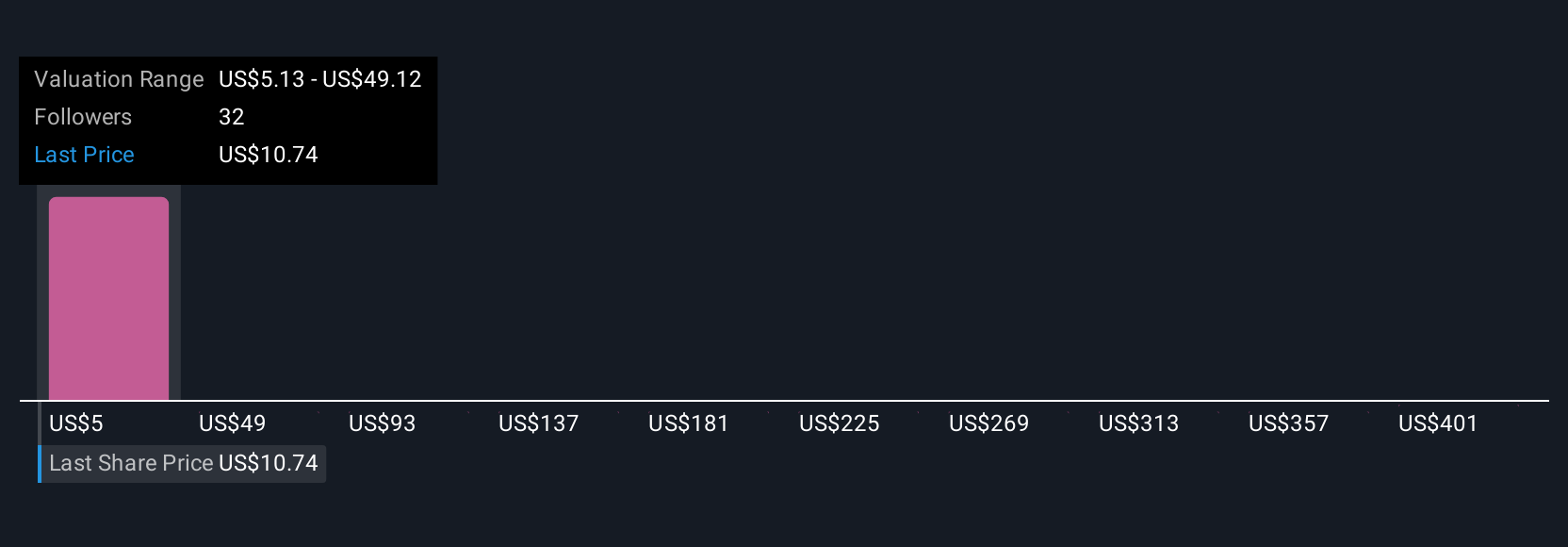

The Simply Wall St Community offers 10 fair value estimates for American Eagle Outfitters, ranging from US$9.13 to US$445.03 per share. While marketing momentum is promising, ongoing consumer and tariff risks highlight why market participants arrive at such different conclusions, encouraging you to consider several viewpoints.

Explore 10 other fair value estimates on American Eagle Outfitters - why the stock might be worth 45% less than the current price!

Build Your Own American Eagle Outfitters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free American Eagle Outfitters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Eagle Outfitters' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives