- United States

- /

- Specialty Stores

- /

- NYSE:AEO

A Look at American Eagle Outfitters’s Valuation Following Buzz From Star-Studded Campaigns and Analyst Upgrades

Reviewed by Simply Wall St

American Eagle Outfitters (AEO) saw a sharp swing in its stock after highly visible ad campaigns with Sydney Sweeney and Travis Kelce drew 700,000 new customers and triggered a product sellout. Positive analyst actions and upbeat views on valuation have fueled the excitement, even as questions linger about long-term business fundamentals.

See our latest analysis for American Eagle Outfitters.

After a blockbuster ad campaign put American Eagle Outfitters in the spotlight, the company’s share price has staged a remarkable rally, climbing 17.5% over the past month and 36.6% in the last 90 days. While momentum is clearly building in the short term, the longer view is more mixed, with a 1-year total shareholder return of -0.9%. However, there has been a solid 48% total return over three years, reflecting both hype-fueled bursts and underlying volatility.

If you want to broaden your radar beyond headline-grabbing retailers, now’s a perfect time to discover fast growing stocks with high insider ownership

With valuation metrics suggesting a bargain and upbeat analyst sentiment fueling buzz, the key question is whether American Eagle Outfitters is truly undervalued or if recent gains already reflect all the good news. This would leave little room for upside.

Most Popular Narrative: 7.1% Overvalued

American Eagle Outfitters’ most-followed narrative pegs its fair value at $16.39, below the last close of $17.56. The stage is set for a close look at the ambitious strategies that underpin this view.

American Eagle Outfitters is expanding brand awareness and strengthening customer engagement with targeted strategies, particularly for Aerie and OFFLINE. By increasing brand visibility and expanding collections, they aim to drive strong revenue growth. The company is optimizing operations by investing strategically in their store fleet and digital platforms to support multi-channel growth, enhance speed, and agility in their supply chain. These efforts are expected to improve net margins through efficiency gains.

What’s the engine behind this bold outlook? The narrative hinges on management’s sweeping bets to boost margin expansion and revenue via a consistent push into trending categories. The wild card is whether the company’s evolving product mix and digital pivot will truly pay off. Want the full story behind the headline numbers? It's all revealed in the rest of the narrative.

Result: Fair Value of $16.39 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent tariff pressures and ongoing consumer uncertainty could challenge American Eagle's optimistic outlook. These factors may potentially curb margin gains ahead.

Find out about the key risks to this American Eagle Outfitters narrative.

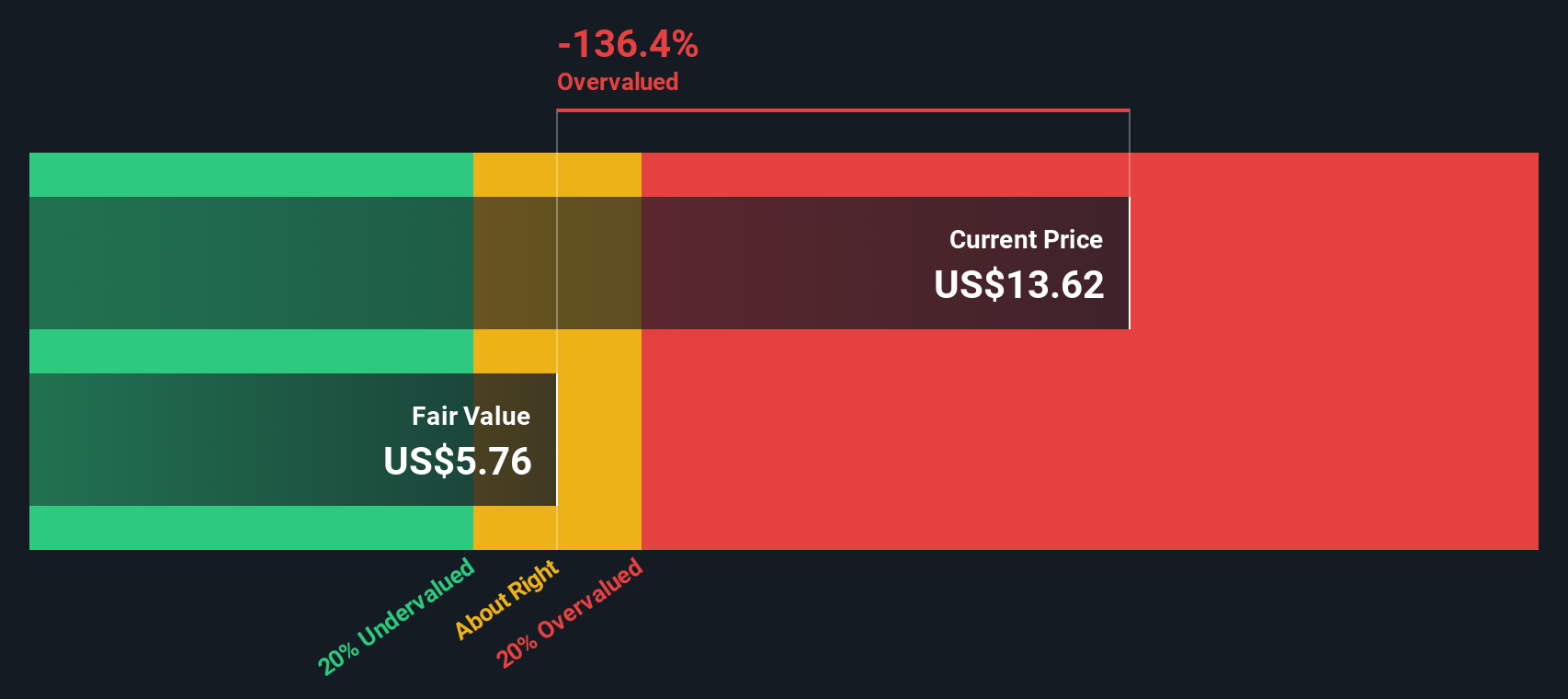

Another View: SWS DCF Model Challenges the Multiples

While American Eagle Outfitters looks attractively priced based on earnings ratios, our DCF model paints a different picture. It suggests the shares are actually trading above their estimated fair value, raising the possibility that the market’s optimism has already been priced in. Could further upside truly materialize, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Eagle Outfitters Narrative

If you want to dive deeper or arrive at your own conclusions, you can quickly build a personalized narrative from the data in just a few minutes. Do it your way

A great starting point for your American Eagle Outfitters research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to a single story? Stay ahead of the curve by tapping into carefully selected opportunities across different themes and sectors below. Smart investors never settle.

- Earn powerful income potential when you tap into reliable payout leaders with these 16 dividend stocks with yields > 3% offering yields greater than 3%.

- Ride the AI wave and position yourself among tomorrow’s market movers by checking out these 25 AI penny stocks leading technological innovation.

- Take advantage of untapped value by seizing opportunities among these 886 undervalued stocks based on cash flows driven by strong cash flows and favorable metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEO

American Eagle Outfitters

Operates as a multi-brand specialty retailer in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives