- United States

- /

- Specialty Stores

- /

- NYSE:ABG

Does Asbury Automotive Group’s (ABG) Strong Earnings and Buyback Signal a Shift in Capital Strategy?

Reviewed by Sasha Jovanovic

- Asbury Automotive Group reported past third quarter earnings with revenue rising to US$4.80 billion and net income reaching US$147.1 million, both higher than the previous year, while completing a share repurchase of 220,500 shares for US$50 million within the quarter.

- This combination of solid earnings growth and buyback activity highlights Asbury's operational momentum and renewed efforts to return capital to shareholders.

- We'll explore how Asbury's robust earnings and share buyback activity could reshape its long-term investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Asbury Automotive Group Investment Narrative Recap

To be optimistic about Asbury Automotive Group as a shareholder, you'd need to believe the company can keep growing earnings while integrating acquisitions, managing leverage, and adapting to changing retail models. The recent strong Q3 results and resumed share buybacks help support near-term confidence, but they have not meaningfully shifted the biggest short-term catalyst, execution on profitability gains from new digital and operational investments, or diminished the ongoing risk from elevated leverage and integration challenges. Among recent developments, the pace of Q3 share repurchases stands out, especially after two consecutive quarters without buybacks. This activity could reinforce investor focus on capital returns, but it also draws attention to balance sheet flexibility at a time when the company's acquisition strategy and real estate financing have increased debt loads. Yet while recent earnings show progress, investors should not lose sight of how leverage and acquisition integration present tangible...

Read the full narrative on Asbury Automotive Group (it's free!)

Asbury Automotive Group's outlook projects $21.6 billion in revenue and $676.4 million in earnings by 2028. This is based on a 7.7% annual revenue growth rate and an increase in earnings of $136.4 million from current earnings of $540.0 million.

Uncover how Asbury Automotive Group's forecasts yield a $261.75 fair value, a 16% upside to its current price.

Exploring Other Perspectives

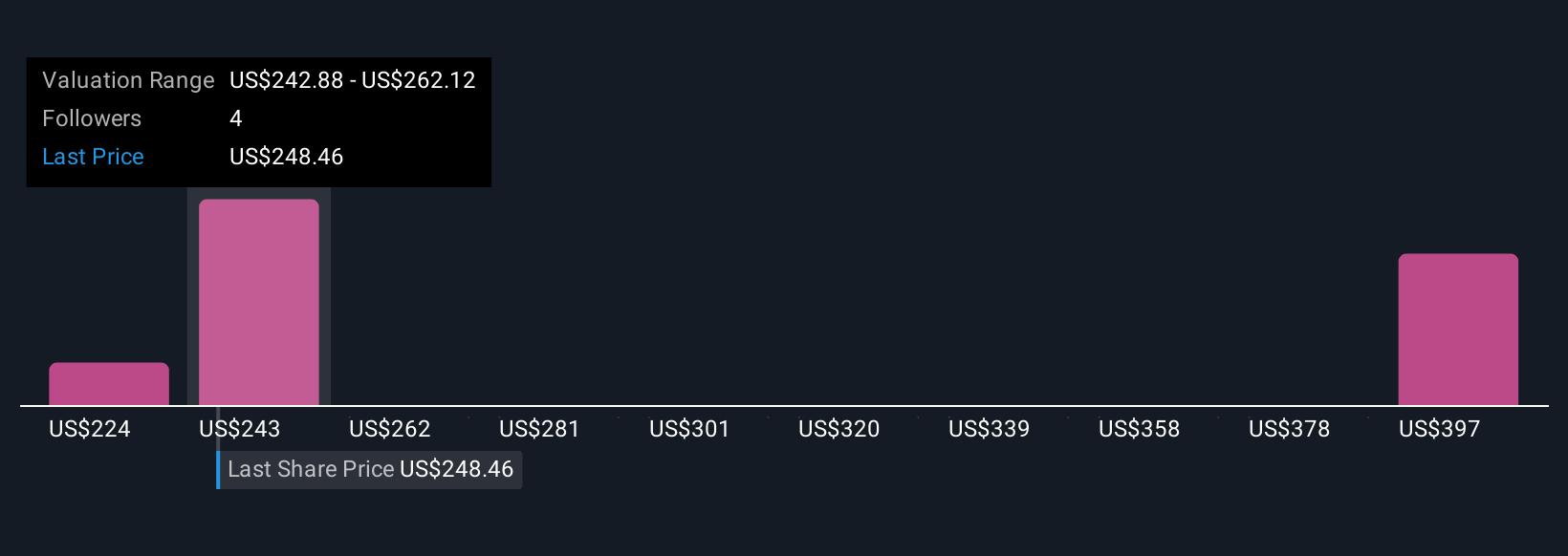

Three valuation estimates from the Simply Wall St Community span a wide range, from US$223.65 to US$381.83 per share. Despite this spread, ongoing acquisition-related debt and integration risks continue to raise questions about future earnings stability and return potential.

Explore 3 other fair value estimates on Asbury Automotive Group - why the stock might be worth as much as 68% more than the current price!

Build Your Own Asbury Automotive Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asbury Automotive Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Asbury Automotive Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asbury Automotive Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABG

Asbury Automotive Group

Operates as an automotive retailer in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives