- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Is Advance Auto Parts a Bargain After Recent 12.6% Drop and Leadership Shakeup?

Reviewed by Bailey Pemberton

- Wondering if Advance Auto Parts is a hidden gem or a value trap? Let’s break down what current numbers and news are really saying about the stock’s worth.

- In the past year, Advance Auto Parts shares have climbed 27.9%. However, recent weeks saw a 12.6% drop over the last month, showing just how quickly risk perceptions can shift.

- Some of this volatility followed headlines about changes in the company’s leadership and renewed industry competition, prompting investors to take a closer look. Alongside sector-specific news, analyst commentary has zeroed in on the company’s efforts to improve its supply chain and regain lost market share.

- On our valuation scorecard, Advance Auto Parts scores 2 out of 6 for undervaluation. How does that stack up? We’ll dive into the standard approaches to valuation next, but stick around for a final perspective that can reveal even more about what makes a company truly undervalued.

Advance Auto Parts scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advance Auto Parts Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method helps investors judge whether a stock price reflects the true financial potential of a business.

For Advance Auto Parts, the DCF model starts with a last twelve months Free Cash Flow (FCF) of -$398.6 Million. Analysts forecast a recovery beginning in 2026, projecting FCF at about $58.6 Million. Over the next decade, estimates suggest modest growth, with FCF reaching approximately $45.1 Million in 2035. These projections combine direct analyst forecasts for the next five years, with further years extrapolated by Simply Wall St’s model.

Based on these future cash flows and using a 2 Stage Free Cash Flow to Equity approach, the model calculates an intrinsic value per share of $6.94. In comparison, the current stock price is significantly higher. According to this analysis, Advance Auto Parts appears 597.0% overvalued.

In summary, the DCF model indicates that Advance Auto Parts stock trades far above its projected cash flow-based value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advance Auto Parts may be overvalued by 597.0%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Advance Auto Parts Price vs Sales

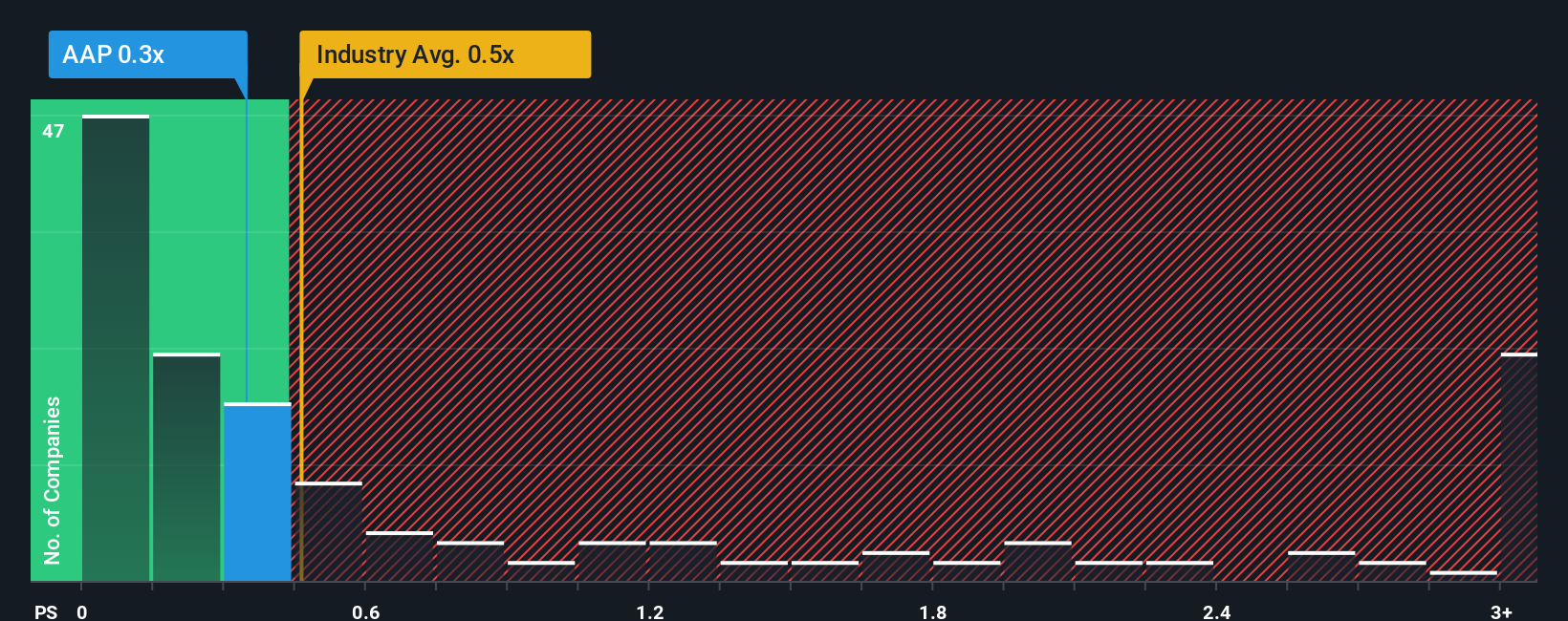

For companies like Advance Auto Parts, the Price-to-Sales (P/S) ratio is a practical valuation yardstick, especially when profitability is currently challenged or volatile. The P/S ratio compares a company’s market value to its revenue, helping investors gauge if shares are cheap or expensive relative to how much money the business brings in from sales.

Growth expectations and risk play a big role in what is considered a “normal” or “fair” P/S ratio for a stock. Higher-growth companies or those facing fewer risks typically command a higher multiple. Slower-growth or riskier firms might trade at a discount.

Advance Auto Parts currently trades at a P/S ratio of 0.34x. This is below both the Specialty Retail industry average of 0.42x and the peer average of 0.24x. These numbers suggest the market is cautious about Advance Auto Parts' near-term revenue prospects, perhaps due to recent volatility and competitive challenges.

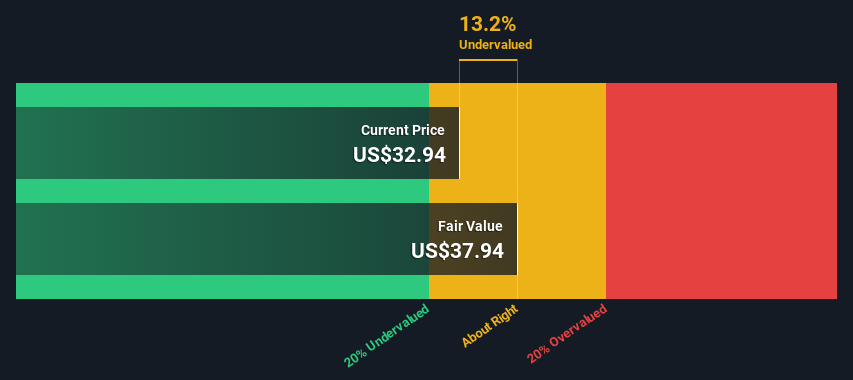

Simply Wall St’s proprietary “Fair Ratio” model takes this analysis a step further. The Fair Ratio is designed to reflect the multiple you would expect given Advance Auto Parts’ unique combination of growth forecasts, profit margins, industry realities, market cap, and company-specific risks. Unlike broad benchmarks, it aims to give a more tailored view of the company’s fair value.

Advance Auto Parts’ Fair Ratio is 0.52x. Since the actual P/S multiple (0.34x) is moderately below the Fair Ratio, the stock appears undervalued based on sales fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advance Auto Parts Narrative

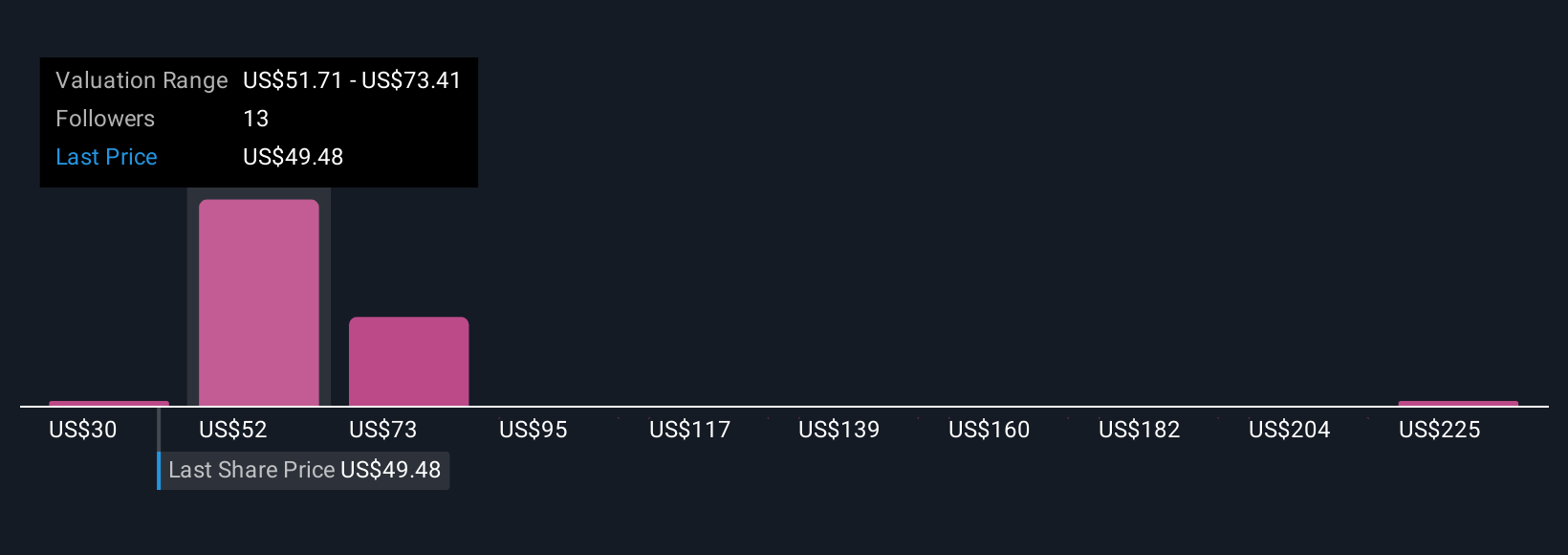

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your way of connecting the story you see for a company with actual financial forecasts, including your assumptions for fair value, future revenue, and profit margins. It goes beyond static ratios, letting you express why you believe Advance Auto Parts will perform a certain way and see it numerically play out.

Narratives link what’s happening in the business, your expectations, and real analysis in one place, leading directly to a fair value number you can compare against today’s share price. This approach is both powerful and easy. Simply Wall St makes it available to everyone through the Community page, which millions of investors use to share and update their own narratives.

With Narratives, you can quickly spot when your expectations differ from the market, or when fresh news and earnings shift the outlook. Updates are reflected in real time. For example, some investors believe Advance Auto Parts’ strategic initiatives will spark a turnaround and have estimated a fair value as high as $65 per share, while more cautious investors, worried about ongoing challenges, see fair value around $30. With Narratives, your investing strategy becomes as dynamic as the company itself.

Do you think there's more to the story for Advance Auto Parts? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives