- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Does Advance's Operational Progress and Tariff Strategy Mark a Turning Point for AAP's Long-Term Viability?

Reviewed by Sasha Jovanovic

- Advance Auto Parts recently reported operational improvements and a better in-store experience, alongside successful price increases to offset tariffs, while continuing to face headwinds from cautious consumer spending and a softer DIY segment.

- Investor skepticism remains high, as reflected in the substantial rise in short interest, highlighting ongoing concerns about the sustainability of recent gains despite progress in the company’s turnaround efforts.

- We'll explore how progress in store operations and cost control might reshape the outlook for Advance Auto Parts going forward.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Advance Auto Parts Investment Narrative Recap

To own Advance Auto Parts stock today, you have to believe the company's ongoing operational improvements and pricing actions can meaningfully offset both macro pressures and internal restructuring costs. While management is reporting better in-store experience and some margin gains, the recent surge in short interest and the persistence of negative free cash flow suggest that issues around consumer demand and cash generation remain the most critical challenges near term, this update has not materially altered these core risks or the key turnaround catalyst.

Among recent updates, Advance Auto Parts’ October decision to maintain its regular dividend stands out, as it signals a commitment to shareholder returns even as headwinds linger. Paired with the current focus on supply chain efficiencies and cost controls, this move aligns with the company's broader strategy to regain profitability, despite market uncertainty and tepid sales growth.

However, investors should be cautious as short interest in AAP is now significantly higher than its peers, which could signal...

Read the full narrative on Advance Auto Parts (it's free!)

Advance Auto Parts' outlook anticipates $9.0 billion in revenue and $295.3 million in earnings by 2028. This is based on a -0.9% annual revenue decline and a $891.3 million improvement in earnings from the current -$596.0 million.

Uncover how Advance Auto Parts' forecasts yield a $53.20 fair value, a 3% upside to its current price.

Exploring Other Perspectives

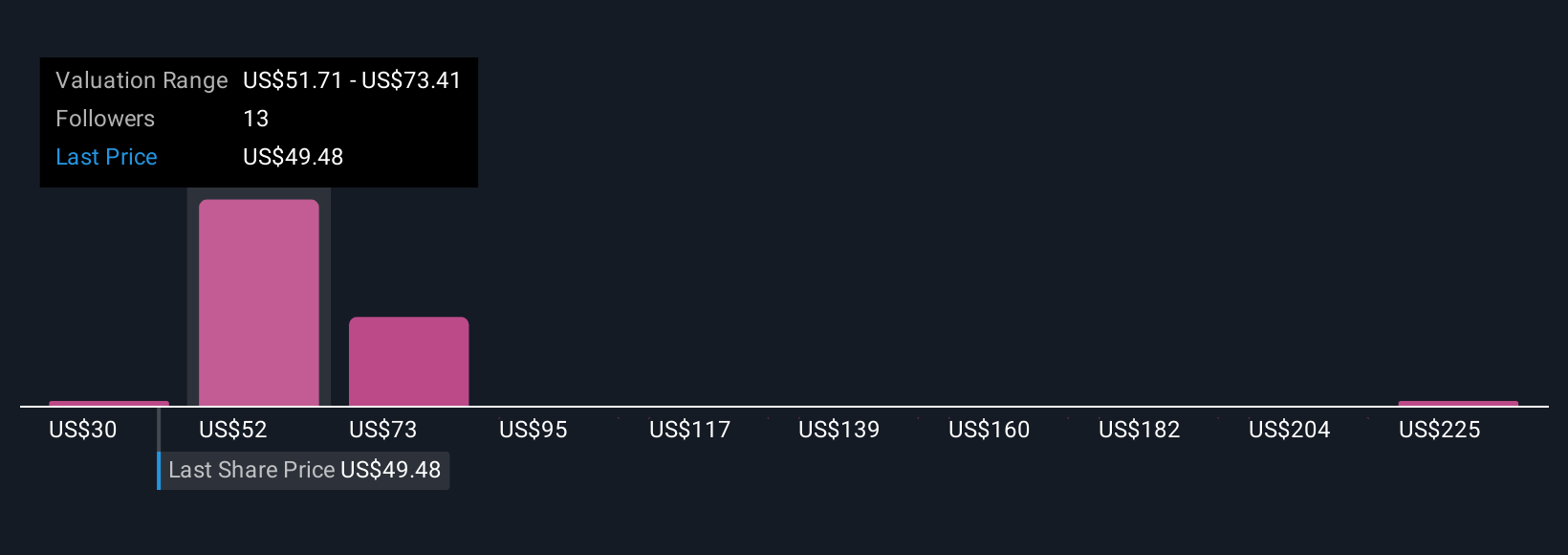

Five individual fair value estimates from the Simply Wall St Community range from US$6.94 to US$247.07, reflecting sharply diverging outlooks. With recent short interest well above peers, it is clear opinions about Advance Auto Parts' future vary widely, review multiple viewpoints to inform your approach.

Explore 5 other fair value estimates on Advance Auto Parts - why the stock might be worth less than half the current price!

Build Your Own Advance Auto Parts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advance Auto Parts research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Advance Auto Parts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advance Auto Parts' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives