- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (NYSE:AAP investor three-year losses grow to 82% as the stock sheds US$92m this past week

As every investor would know, not every swing hits the sweet spot. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of Advance Auto Parts, Inc. (NYSE:AAP), who have seen the share price tank a massive 83% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 30%, so we doubt many shareholders are delighted. Furthermore, it's down 41% in about a quarter. That's not much fun for holders. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 4.0% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Advance Auto Parts

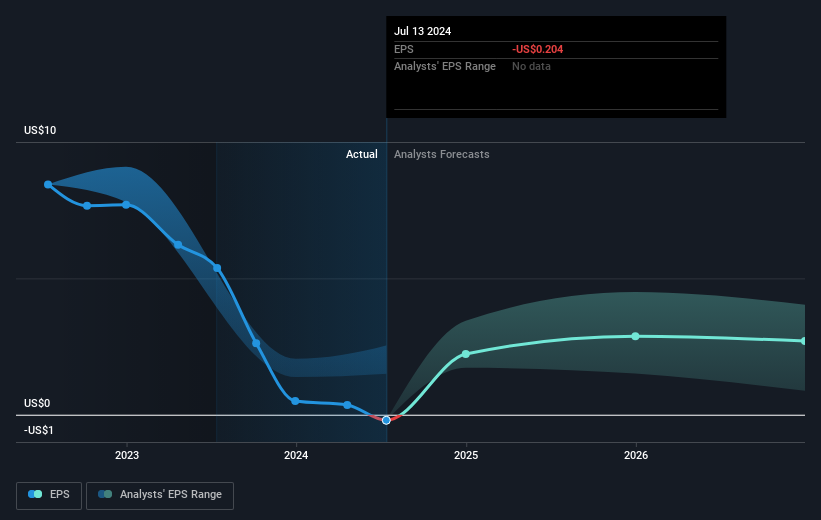

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Advance Auto Parts saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Advance Auto Parts' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 35% in the last year, Advance Auto Parts shareholders lost 29% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Advance Auto Parts better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Advance Auto Parts (including 1 which is a bit concerning) .

Advance Auto Parts is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AAP

Advance Auto Parts

Provides automotive replacement parts, accessories, batteries, and maintenance items for domestic and imported cars, vans, sport utility vehicles, and light and heavy duty trucks.

Fair value with moderate growth potential.