- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (AAP): Valuation Insight Following Raised Sales Outlook and Narrowed Q3 Loss

Reviewed by Simply Wall St

Advance Auto Parts (AAP) reported its third quarter and nine-month earnings, narrowing its quarterly loss and raising its full-year sales forecast. Investors quickly took note of the company’s improved outlook and revised guidance.

See our latest analysis for Advance Auto Parts.

Advance Auto Parts’ updated guidance and narrowed loss come amid a year of volatile share price action. While the 1-day share price return stands at 1.43%, the stock has faced meaningful pressure recently, with a 30-day share price return of -21.60%. Still, looking further back, patient shareholders have enjoyed a 1-year total shareholder return of 28.89%, which helps to balance out the challenges of the past few years. Momentum appears to be rebuilding after a tough stretch, which may suggest renewed investor confidence as management recalibrates its outlook.

If recent gains at Advance Auto Parts have you rethinking your portfolio, now might be the perfect moment to broaden your search and discover See the full list for free.

After a difficult stretch, shares in Advance Auto Parts are bouncing back and some valuation metrics hint at a possible discount. However, with modest revenue growth, is this a real buying opportunity or are markets already pricing in future gains?

Most Popular Narrative: 9.6% Undervalued

Advance Auto Parts is trading near $48.09, while the most widely followed narrative puts fair value at $53.20. This gap suggests market participants may be underestimating near-term business improvements. Here’s what’s driving the optimism.

The consolidation of distribution centers (DCs) from 38 to 12 by 2026 aims to enhance supply chain efficiency. This reorganization, along with new market hub stores, is projected to reduce supply chain costs and improve gross margins, impacting earnings positively.

There’s a bold turnaround story hiding in plain sight. Analysts are betting on transformative margin expansion powered by a sweeping reorganization. The blueprint behind this forecast? Dive in and uncover the unconventional financial bets and operational ambitions fueling these expectations.

Result: Fair Value of $53.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant costs associated with large-scale store closures and weaker-than-expected sales trends could challenge the company’s path to margin recovery.

Find out about the key risks to this Advance Auto Parts narrative.

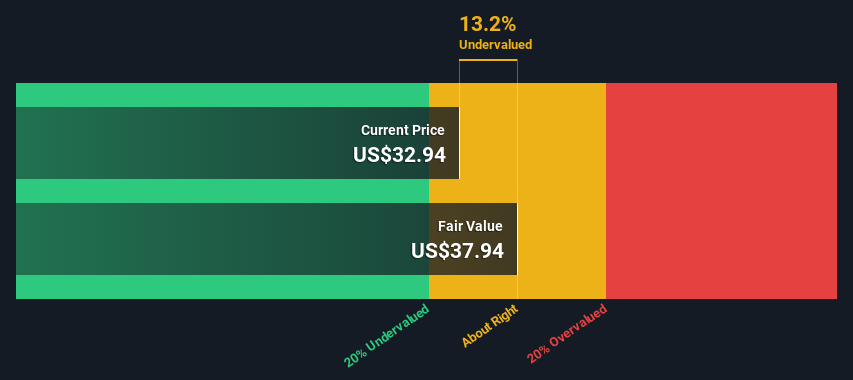

Another View: The SWS DCF Model Offers a Sharper Contrast

While some valuation methods suggest Advance Auto Parts is trading below its fair value, our SWS DCF model tells a much more cautious story. According to this approach, the current share price of $48.09 is well above its estimated fair value of just $6.96. Could the market be overstating the company's turnaround potential, or is it underestimating future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advance Auto Parts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advance Auto Parts Narrative

If the story so far doesn’t match your perspective, or you’ve got your own angle in mind, it’s quick and simple to craft your own narrative. Just a few minutes and you’re set. Do it your way

A great starting point for your Advance Auto Parts research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to unlock more opportunities? The best investors always look beyond the obvious. Don’t let market-changing stocks slip under your radar. Target the next big winners now.

- Earn steady income streams with companies offering impressive yields, all carefully selected through these 20 dividend stocks with yields > 3%.

- Catch early-stage innovators by tapping into these 28 quantum computing stocks, where tomorrow’s technology leaders are making breakthroughs today.

- Capitalize on shifting market momentum by sifting through these 839 undervalued stocks based on cash flows, home to stocks currently trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives