- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (AAP): Unpacking Valuation After $1.5 Billion Worldpac Sale and Turnaround Progress

Reviewed by Simply Wall St

Advance Auto Parts (AAP) is shaking up its business with the sale of its Worldpac wholesale distribution arm to Carlyle for $1.5 billion in cash. This move reflects an aggressive push to streamline operations, reduce debt, and focus on the company’s core domestic business.

See our latest analysis for Advance Auto Parts.

Advance Auto Parts’ renewed focus on its core business arrives after a stretch of tough years for shareholders, with a 3-year total shareholder return of -63.35%. While the latest strategic moves and the $1.5 billion Worldpac sale have given the stock a boost so far this year, recent momentum is still mixed. The year-to-date share price return is up 6.96%, but the 30-day share price has slipped by 8.58%, despite double-digit total returns over twelve months. Turnaround hopes are building, but the market remains watchful for lasting improvement.

If you’re curious where else opportunity might be brewing among automakers, it’s a great time to explore the sector with our See the full list for free.

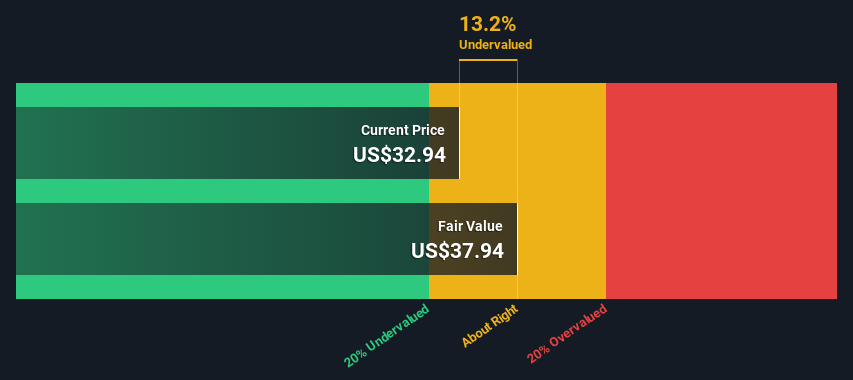

With shares still below analyst targets and early signs of operational progress, the question now is whether Advance Auto Parts is trading at a bargain or if the stock already reflects expectations for a turnaround.

Most Popular Narrative: 3.2% Undervalued

Advance Auto Parts’ most widely followed valuation narrative sets its fair value slightly above the latest close, suggesting just a modest undervaluation. Despite choppy performance and significant operational shifts, there are catalysts included in this fair value that give reason for optimism.

The company is rolling out a new assortment framework across the top 50 designated market areas (DMAs) over the next 12 to 18 months, improving store in-stock depth. This is expected to drive revenue growth through improved service levels and customer satisfaction.

Want to see the assumptions fueling this price target? The real story lies in a playbook of margin rebound, operational revamps, and ambitious future earnings forecasts. Surprised by what’s included behind this fair value? Pull back the curtain and discover the two key numbers that anchor this narrative.

Result: Fair Value of $53.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak sales trends and the complexities of large-scale store closures could quickly undermine any optimism building around a turnaround narrative.

Find out about the key risks to this Advance Auto Parts narrative.

Another View: The SWS DCF Model Tells a Different Story

While many investors see value based on current market multiples, our DCF model presents a sharper contrast. According to this approach, Advance Auto Parts is actually trading well above its estimated fair value. This implies the market could be overestimating the company's turnaround prospects. Could this discrepancy be a warning sign or simply a temporary mispricing to watch?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advance Auto Parts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advance Auto Parts Narrative

If you see things differently or want to dive into the numbers for yourself, you can craft your own view quickly and easily. Do it your way

A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let tomorrow’s market winners pass you by. Take charge and spot emerging growth, future-focused industry leaders, or untapped value with these powerful shortlists:

- Catalyze your returns by evaluating these 927 undervalued stocks based on cash flows, which focuses on strong cash flows and hidden value opportunities.

- Tap into the future by checking out these 25 AI penny stocks as these companies unlock breakthroughs in automation and artificial intelligence.

- Secure long-term income by targeting these 15 dividend stocks with yields > 3%, a selection consistently delivering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success