- United States

- /

- Specialty Stores

- /

- NYSE:AAP

Advance Auto Parts (AAP) Profitability Path Challenges Market Growth Narratives

Reviewed by Simply Wall St

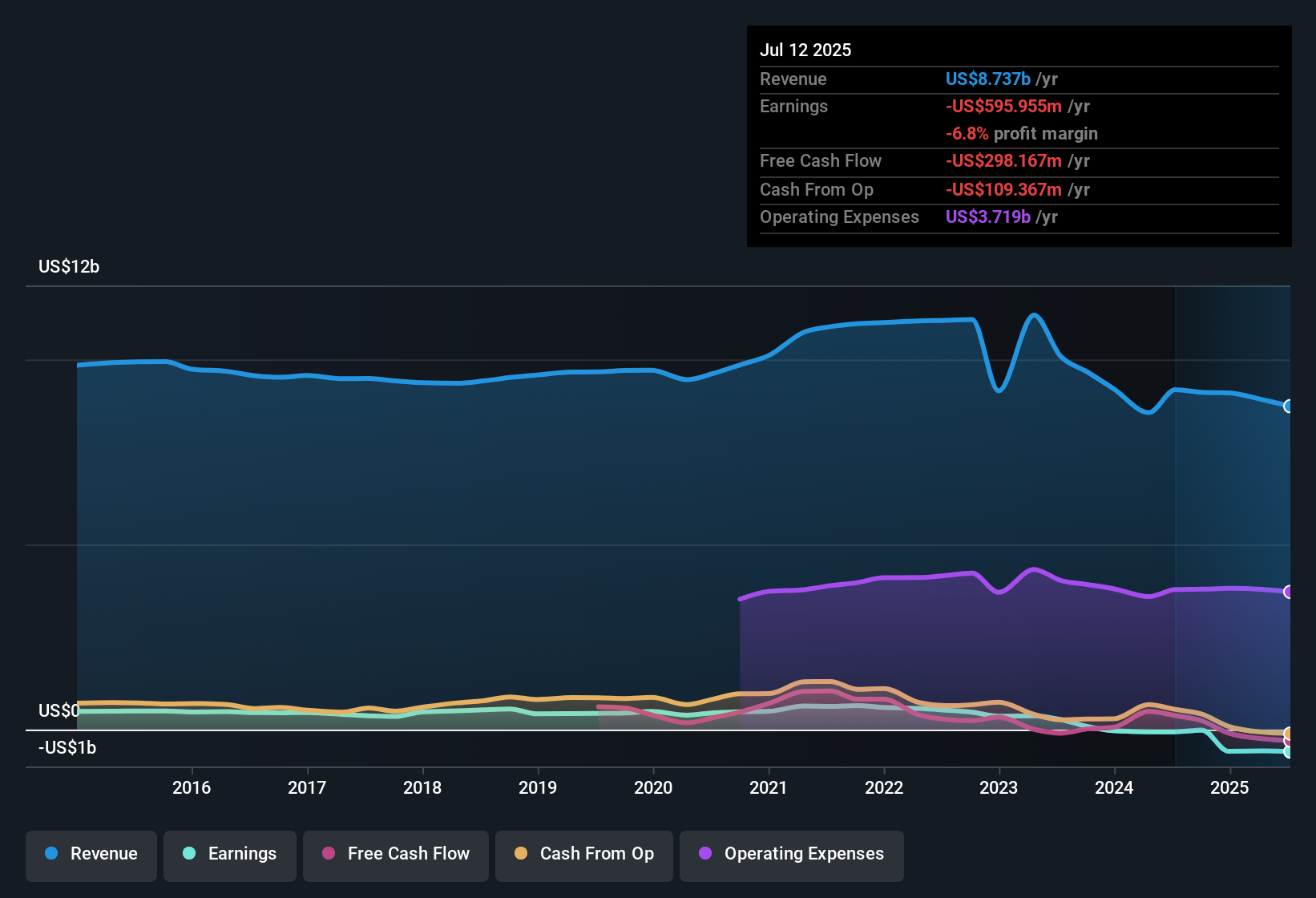

Advance Auto Parts (AAP) remains in the red, with losses deepening at an average rate of 64.1% per year over the past five years. Looking ahead, analysts project earnings growth of 20.37% annually, positioning AAP to shift into profitability within the next three years, which is a faster pace than the broader market's average. Revenue, on the other hand, is forecast to rise just 1.9% per year, lagging behind the US market’s 10.3% growth estimate. The balance for investors is a promising turnaround in earnings growth; however, slower top-line momentum and ongoing concerns about dividend sustainability create a mixed outlook.

See our full analysis for Advance Auto Parts.Now, let’s see how these results align with the prevailing market narratives, and where they might be turning them on their head.

See what the community is saying about Advance Auto Parts

Profit Margins Target 3.3% in Three Years

- Analysts expect profit margins to shift from -6.8% currently to 3.3% within three years, laying the groundwork for a swing to profitability by 2027.

- According to the analysts' consensus view, the margin improvement is backed by several strategic initiatives:

- Plans to consolidate distribution centers from 38 to 12 by 2026 are aimed at cutting supply chain costs and improving gross margins. This is expected to directly support higher net margins.

- Asset optimization and divestment of noncore operations are expected to deliver operating margins of around 7% by 2027, which could filter down to a stronger bottom line.

The consensus narrative says AAP's margin targets could hinge on executing these cost-saving moves without more store closure disruptions. 📈 Read the full Advance Auto Parts Consensus Narrative.

Analyst Price Target Lags Trading Price

- With AAP share price at $50.70 as of the latest update, the analyst consensus price target sits at $53.50, indicating just a 5.5% potential upside from current levels.

- The analysts' consensus view highlights that this small gap between the trading price and the price target shows analysts see AAP as roughly fairly valued right now:

- To buy into the analyst thesis, you would need to believe the company can reach $295.3 million in earnings and trade at a price-to-earnings ratio of 14.9x by 2028. This figure is lower than the current industry average of 19.2x.

- Despite forecasted margin improvement, current revenue growth forecasts trail the market at just 1.9% annually, leaving little room for valuation expansion unless execution beats expectations.

Store Closures Drive Near-Term Risks

- The closure of 500 corporate stores and 200 independent locations creates substantial one-off costs and complexities, which are already weighing on near-term profitability and net margins.

- Analysts' consensus view emphasizes that these disruptions, combined with weaker-than-expected sales to start 2025, challenge the company’s ability to quickly deliver on planned margin and earnings targets:

- Inventory liquidation and related adjustments are lowering gross margins, which risks delaying the expected turnaround in profitability.

- Continued volatility in consumer spending adds another layer of pressure, especially if cost-reduction efforts cannot offset the headwinds from softer top-line trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Advance Auto Parts on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your own perspective in just a few minutes and shape the story your way with Do it your way.

A great starting point for your Advance Auto Parts research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Advance Auto Parts faces persistent slow revenue growth, one-off restructuring costs, and ongoing challenges in achieving stable margins and dividend sustainability.

If you’re seeking companies with more reliable revenue and earnings, focus your research on stable growth stocks screener (2108 results) that consistently deliver steady results through economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAP

Advance Auto Parts

Engages in the provision of automotive aftermarket parts in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives