- United States

- /

- Specialty Stores

- /

- NasdaqGS:URBN

Is Urban Outfitters Still a Value Opportunity After Home and Lifestyle Expansion in 2025?

Reviewed by Bailey Pemberton

- Curious if Urban Outfitters is a hidden value gem or an overpriced hype story? You are in the right place for a straightforward look at whether this stock matches up to your valuation expectations.

- After an impressive 71.9% surge over the past year, Urban Outfitters shares have cooled off recently, down 8.4% in the last week and 14.9% over the past month, but are still up a strong 9.1% year-to-date.

- Recent headlines have centered on Urban Outfitters' strategic expansion in the home and lifestyle segment, along with new collaborations targeting Gen Z shoppers. Investors are watching closely as these moves signal both fresh opportunity and potential shifts in the company's growth outlook.

- With a perfect 6/6 valuation score, Urban Outfitters stands out as undervalued across every major metric we check. Next, we will break down the standard valuation approaches, and make sure to read on for a smarter perspective on what really drives long-term value.

Approach 1: Urban Outfitters Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps determine if the stock price reflects the true value of the company's expected future performance.

For Urban Outfitters, the most recent reported Free Cash Flow stands at $378.6 million. Analyst forecasts extend five years ahead, with projected Free Cash Flow reaching $452.93 million by 2029. Beyond these estimates, further annual projections are extrapolated, but all projections remain below $1 billion, so values are cited in millions.

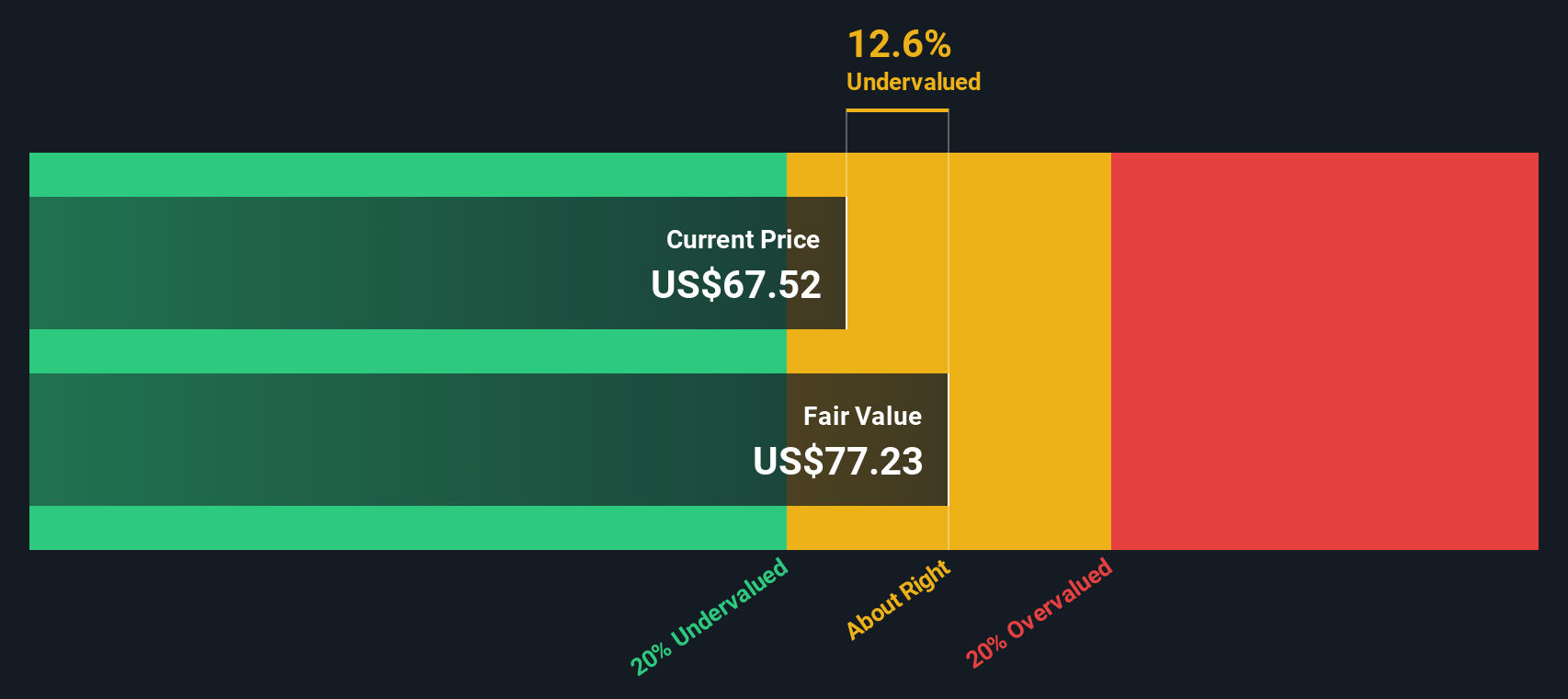

Simply Wall St's DCF model uses these analyst estimates and projections to calculate an intrinsic value of $77.63 per share. Compared with the current price, this suggests Urban Outfitters is trading at a 20.1% discount to its estimated fair value, indicating significant undervaluation based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Urban Outfitters is undervalued by 20.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Urban Outfitters Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly relates a company's share price to its per-share earnings, making it a straightforward measure of what investors are willing to pay for current profits. For companies like Urban Outfitters with consistent earnings, the PE ratio provides a clear snapshot of market sentiment and valuation relative to profit performance.

The "right" PE ratio for any stock depends on various factors, especially growth expectations and perceived risk. Higher growth prospects or lower risks usually justify a higher multiple, while the opposite draws valuations downward.

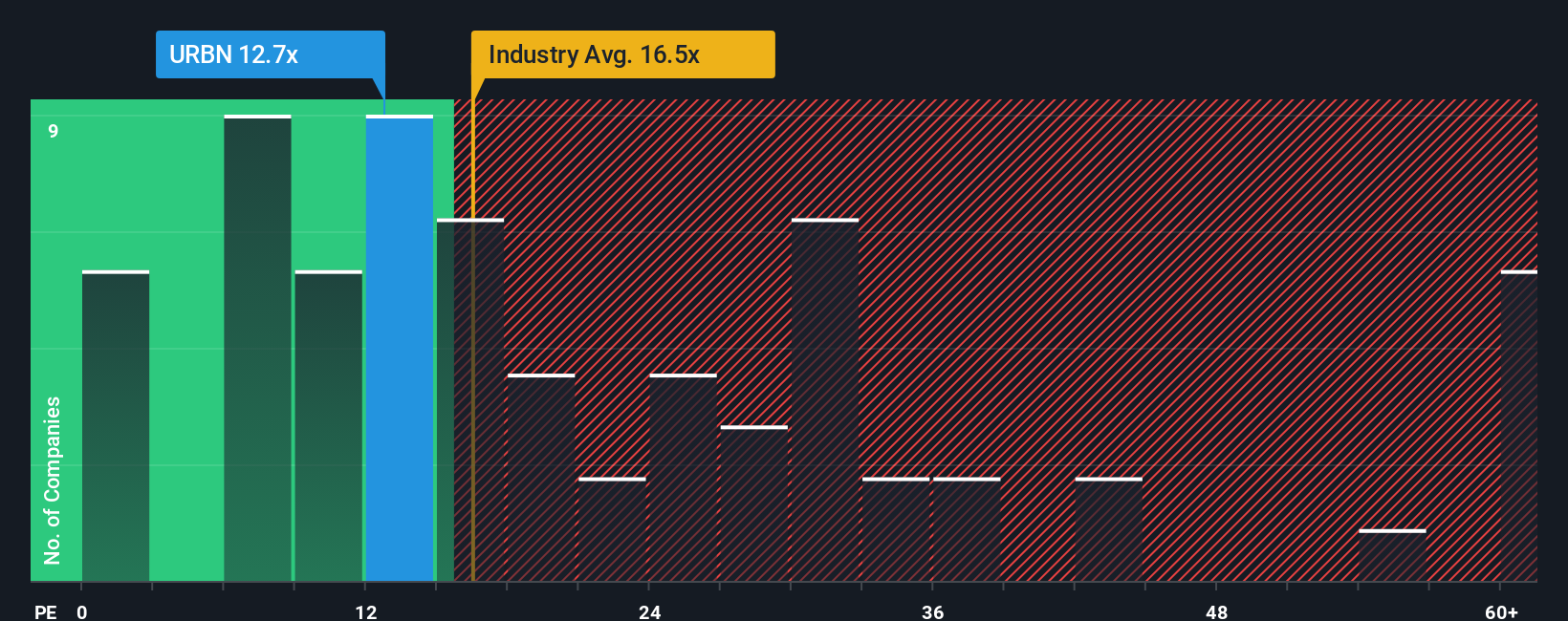

Urban Outfitters currently trades at an 11.7x PE ratio. For context, this is below the Specialty Retail industry average of 16.6x and the peer average of 14.5x. However, Simply Wall St’s proprietary “Fair Ratio” goes a step further, calculating a benchmark of 16.3x for Urban Outfitters. This Fair Ratio considers not just industry averages or what similar companies trade at, but also factors unique to Urban Outfitters, including its earnings growth potential, margins, risk profile, industry dynamics, and size. Because of this holistic approach, the Fair Ratio offers a much more tailored and meaningful benchmark for what the stock should be worth.

Comparing Urban Outfitters’ current PE of 11.7x with its Fair Ratio of 16.3x suggests that the stock is undervalued on this basis, indicating the market may be discounting the company more than its fundamentals justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Urban Outfitters Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives, a modern approach that combines your perspective on a company with the numbers to create a personal, adaptable investment story.

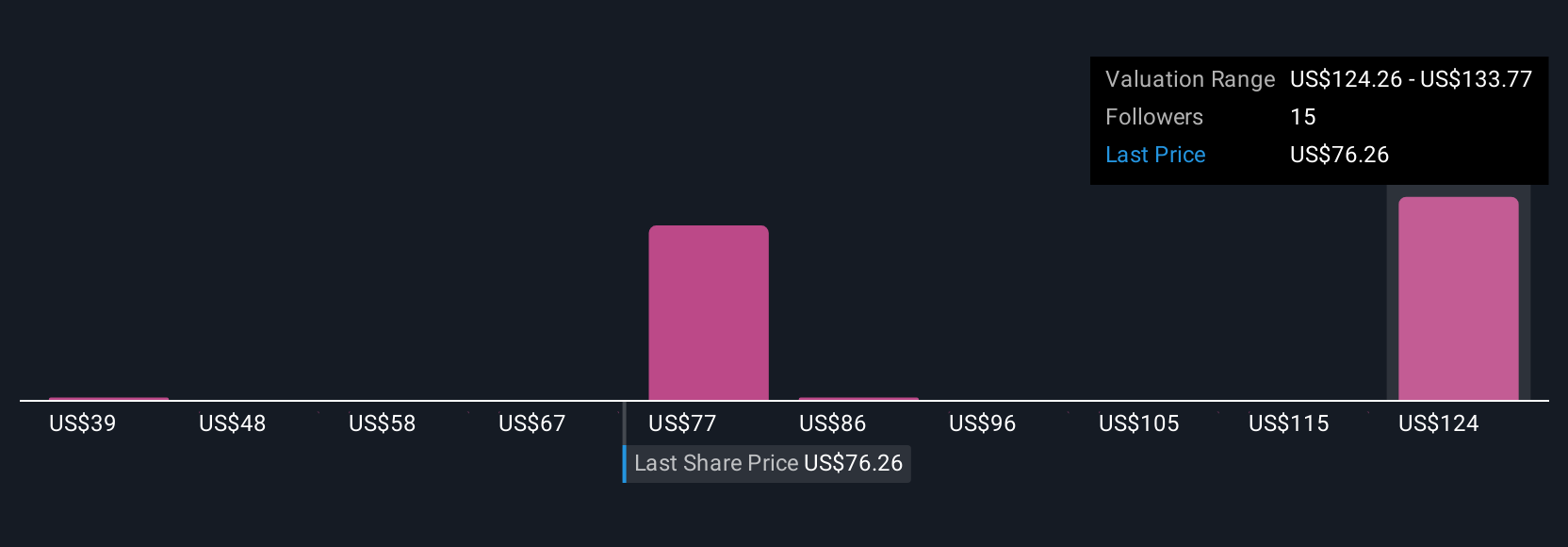

A Narrative is simply the story you believe about Urban Outfitters’ future, backed up by your own expectations for its sales, margins, and profit growth. These assumptions are then translated into a fair value so you can directly see how the current share price compares to your “story value.”

Narratives are designed to be effortless and are available for free on Simply Wall St’s Community page, used by millions of investors to turn complex forecasts into practical, real-world decisions.

This tool helps you decide when to buy or sell. If your Narrative suggests Urban Outfitters should be worth $93 and the price is $72, that may be a buying opportunity. If your story says $52, maybe it's time to consider selling. Narratives update automatically as new earnings, news, or data are released, so your view and your fair value stay current.

For example, some Urban Outfitters investors expect booming e-commerce and international expansion, setting their fair value near $93. Others, wary of industry risks and cost pressures, estimate just $52. This demonstrates how Narratives let you anchor decisions to your unique outlook.

Do you think there's more to the story for Urban Outfitters? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:URBN

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives