- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

Should Ulta Beauty's (ULTA) Premium Launches and AI Upgrades Signal a Shift in Competitive Positioning?

Reviewed by Sasha Jovanovic

- Revlon announced the exclusive launch of its premium Super Lustrous Ultra Lipstick at Ulta Beauty, while e.l.f. Beauty expanded its e.l.f.iverse, debuting in all Ulta stores and online in Mexico, with Medicube also reporting substantial sales growth through the retailer's channels earlier this month.

- Recent weeks have also seen Ulta Beauty integrate AI-powered personalization and marketplace innovations, reinforcing its position as a destination for both digital and in-store beauty experiences.

- We'll explore how Ulta Beauty's technology-driven retail experience and brand partnerships may influence its investment narrative and outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Ulta Beauty Investment Narrative Recap

To own shares of Ulta Beauty, investors typically need to believe in the retailer’s ability to sustain customer growth and margin performance through new brand partnerships, exclusive launches, and digital transformation. While recent launches, like Revlon’s Super Lustrous Ultra Lipstick exclusive and e.l.f. Beauty’s Mexico debut, may drive in-store traffic and online engagement, they do not meaningfully shift the balance of Ulta’s short-term catalysts or its most significant risk: the challenge of maintaining store profitability as digital sales expand and operating costs rise.

Among this month’s updates, Ulta Beauty’s integration of AI and marketplace innovations stands out as the most relevant to its outlook. Enhanced personalization and faster brand onboarding directly support the company’s catalyst of winning Gen Z and Millennial shoppers, but the effectiveness of omnichannel investments remains a critical component of Ulta’s narrative as competition intensifies.

Yet, in contrast to top-line momentum, investors should stay focused on the risk around store cost inflation and what happens as customers increasingly...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty's outlook anticipates $13.8 billion in revenue and $1.3 billion in earnings by 2028. This reflects a 5.9% annual revenue growth rate and a $0.1 billion increase in earnings from the current $1.2 billion level.

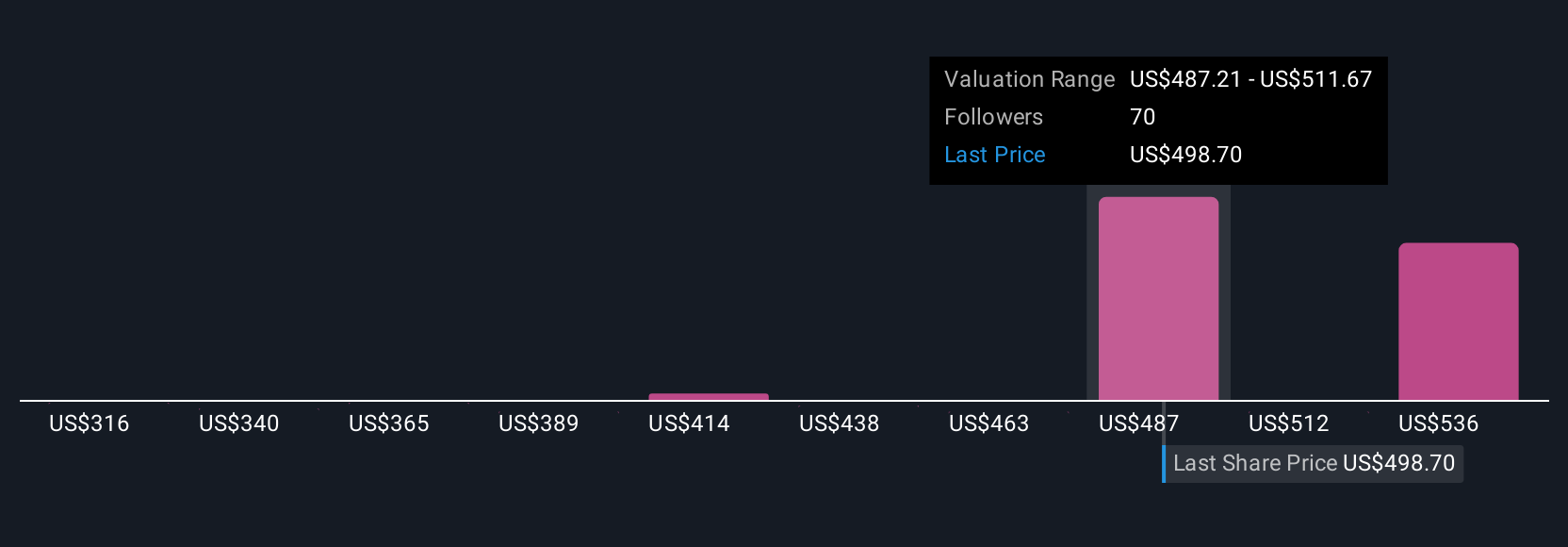

Uncover how Ulta Beauty's forecasts yield a $574.57 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span US$361.84 to US$574.57, showing wide disagreements among retail investors. Many are watching how Ulta’s rising SG&A and store expenses might affect margins and long-term profit delivery, offering plenty of viewpoints for you to consider.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth as much as 11% more than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States, Mexico, and Kuwait.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives