- United States

- /

- Specialty Stores

- /

- NasdaqGS:ULTA

How Does Ulta Beauty’s New Market Push Impact Its 35% Stock Surge?

Reviewed by Bailey Pemberton

- Wondering if Ulta Beauty’s stock is a hidden gem or already priced for perfection? You’re not alone. A closer look at its valuation could spark some surprises.

- The share price has jumped 20.6% so far this year and is up 34.8% over the last twelve months, even after a recent 7.0% dip in the past month.

- Ulta Beauty has caught Wall Street’s attention recently after expanding its partnership with major retailers and unveiling plans to enter new markets. These moves have fueled both excitement and speculation around its growth trajectory.

- For all that buzz, the company only scores 1 out of 6 on our valuation check. Before you get swept up in the hype, let’s break down what goes into that score and explore a smarter way to look at value by the end of this article.

Ulta Beauty scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ulta Beauty Discounted Cash Flow (DCF) Analysis

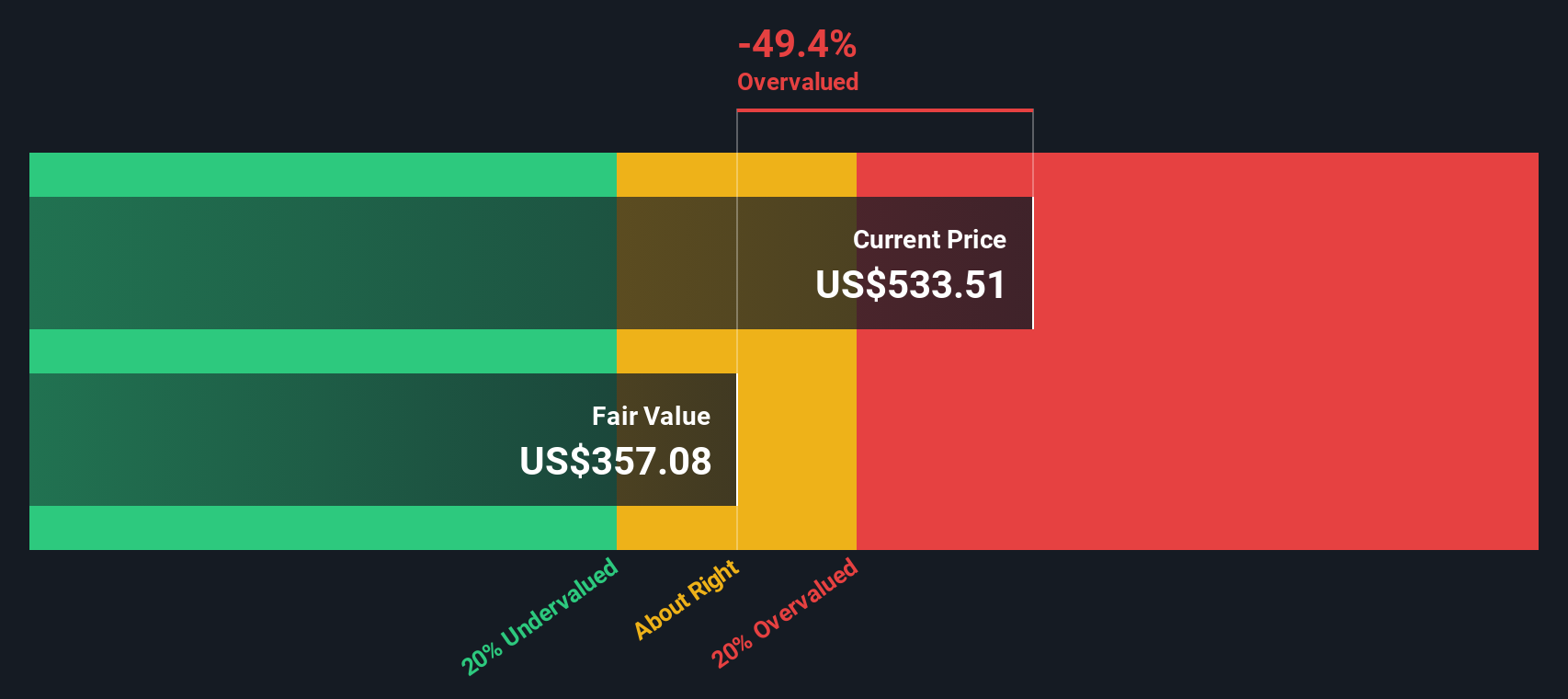

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to today's dollars. This allows investors to assess what the underlying business might truly be worth, aside from current market sentiment.

For Ulta Beauty, the current Free Cash Flow (FCF) stands at about $895.8 million. Analysts forecast modest growth over the next few years, with estimates reaching approximately $958.3 million by 2027. After that, cash flow projections are extrapolated further out for a total of ten years, gradually increasing toward just over $1 billion by 2035.

Applying the DCF approach, these cash flow estimates are translated into a fair value per share of $362.30. Comparing this intrinsic value to the current share price, DCF analysis indicates that Ulta Beauty stock is trading at a premium of 42.8 percent over its calculated worth. In other words, today's price reflects significant optimism about future growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ulta Beauty may be overvalued by 42.8%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ulta Beauty Price vs Earnings

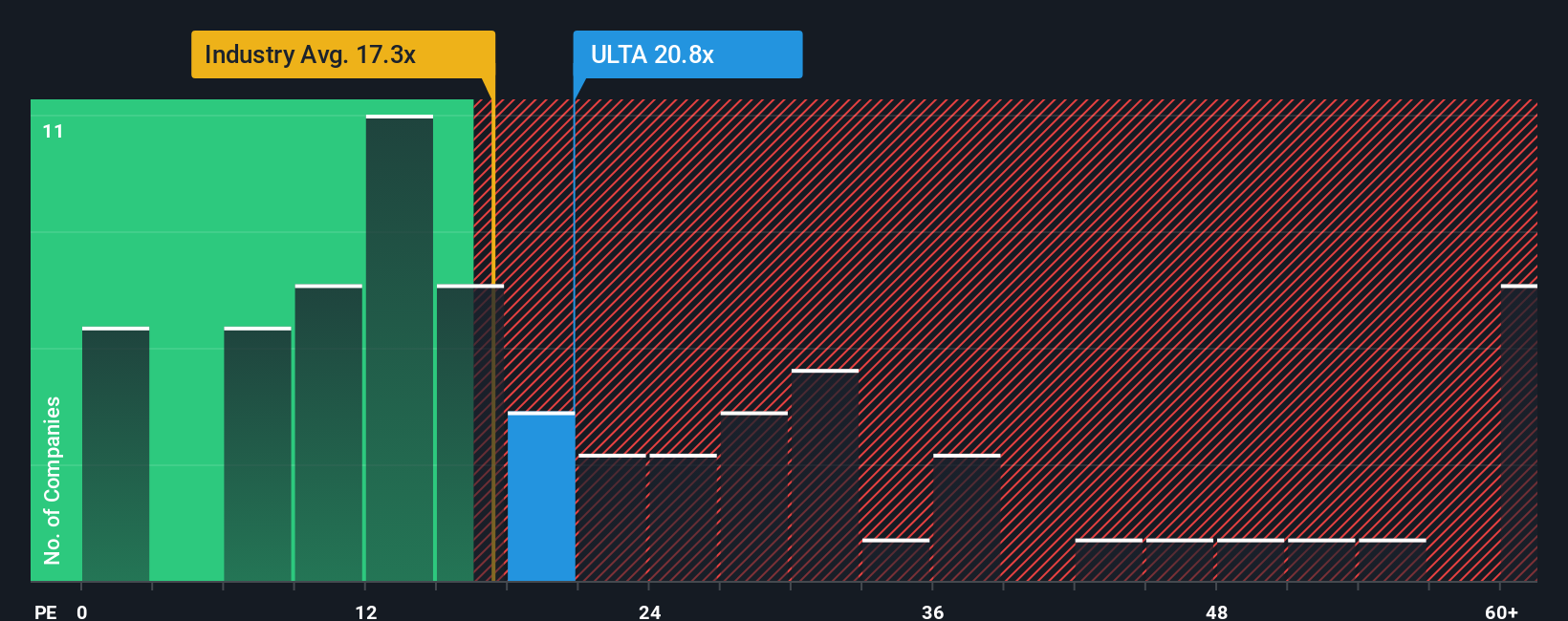

The Price-to-Earnings (PE) ratio is one of the best-known metrics for gauging the value of profitable companies like Ulta Beauty. It compares a company’s share price with its per-share earnings, providing a snapshot of how much investors are willing to pay for each dollar of profit. Generally, higher growth prospects or lower perceived risk can justify a higher PE, while lower growth or more risk results in a lower “fair” ratio.

Ulta Beauty currently trades at a PE of 19.3x. This sits a bit above the Specialty Retail industry average of 16.6x, and well below the average of key peers at 40.6x. However, just relying on industry or peer comparisons can be misleading, as each company’s specific growth outlook and risks deserve their own spotlight.

That is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio represents what Ulta Beauty’s PE should be, given its unique blend of earnings growth, profit margins, risk profile, industry, and scale. For Ulta Beauty, the Fair Ratio is calculated at 17.1x, slightly lower than its current PE. Because this difference is small, it suggests the stock’s price is largely in line with where fundamentals and expectations say it should be, even if optimism is not running wild.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ulta Beauty Narrative

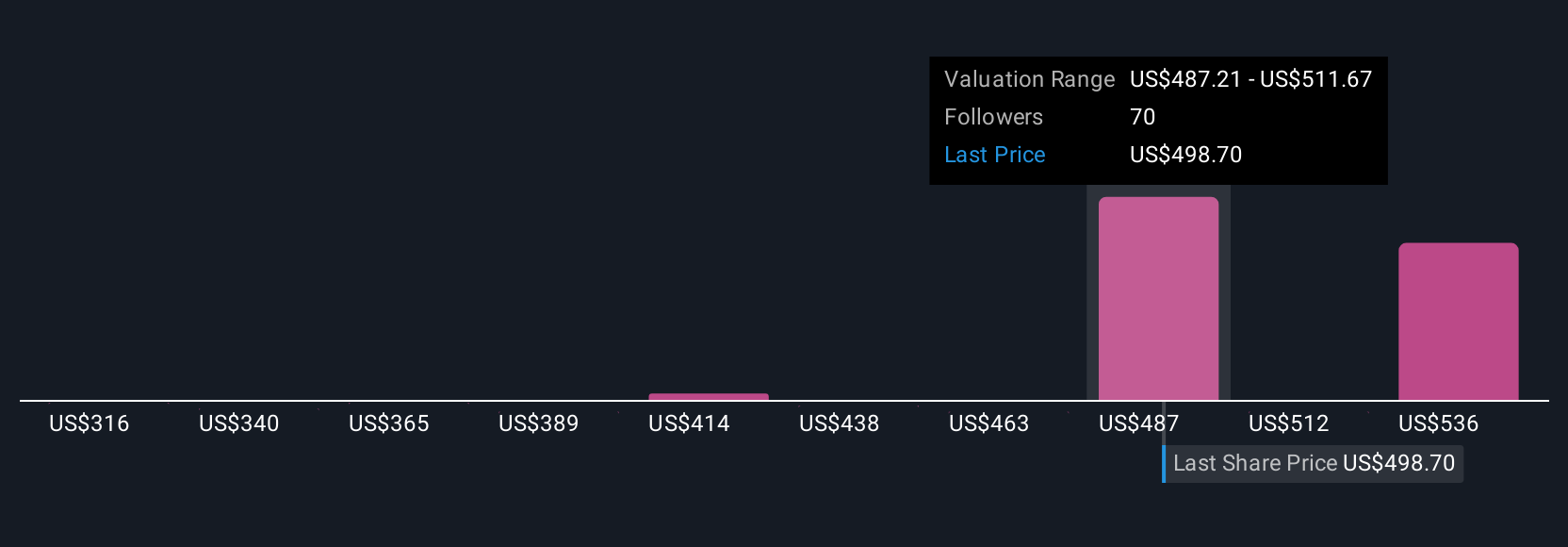

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are your opportunity to give the real story behind Ulta Beauty’s numbers, connecting your expectations for revenue, earnings, and margins with your own fair value and outlook. Instead of just crunching numbers, Narratives help you translate what you know or believe about Ulta Beauty into an actionable investment thesis. What should the price be, based on the company’s unique journey and its tomorrow?

On Simply Wall St’s Community page, millions of investors build and share Narratives by tying Ulta Beauty’s story, such as wellness expansion, new markets, or partnership risks, directly to their forecasts. You can compare your own forecast and fair value with the current price to decide if it’s a buy, hold, or sell, and see how your view stacks up to others. Narratives also update automatically with each new piece of news or earnings, ensuring your perspective stays current.

For example, some investors see long-term upside in digital and international growth, setting their Narrative fair value as high as $680, while others cite margin pressure and competition, with fair values nearer $405. This shows how Narratives make every investment decision personal and dynamic.

Do you think there's more to the story for Ulta Beauty? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ULTA

Ulta Beauty

Operates as a specialty beauty retailer in the United States and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives