- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Tractor Supply (TSCO): Assessing Value After Recent Share Price Weakness

Reviewed by Simply Wall St

Tractor Supply (TSCO) has seen movement in its stock lately, capturing attention as investors track performance in a retail landscape shaped by changing consumer spending patterns and economic uncertainty. The stock’s recent price action invites a closer look at its value today.

See our latest analysis for Tractor Supply.

After a stretch of downward momentum, Tractor Supply’s share price slipped 6.3% over the past week and is down nearly 14.6% in the past three months. The moves reflect shifting sentiment as investors weigh growth potential against current risks. While price returns have been under pressure lately, it is worth noting the long-term story remains positive, with a five-year total shareholder return of 112.4% underscoring the company’s resilience.

If you’re curious what else the market has to offer in the retail and consumer landscape, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading about 20% below analyst price targets and showing steady long-term growth, the big question is whether Tractor Supply is undervalued in this climate or if the market has already priced in its future prospects.

Most Popular Narrative: 17% Undervalued

With the narrative fair value at $63.52 and Tractor Supply’s last close at $52.64, the price sits well below what consensus expectations suggest the shares are worth. This valuation gap sets the stage for a deep dive into the growth drivers highlighted by the most popular narrative.

Tractor Supply's strategy to reduce reliance on Chinese imports and diversify its supply chain, from over 90% to closer to 50% by year-end, could mitigate tariff impacts and potentially improve net margins and earnings. Strong transaction growth, unit growth in consumable, usable, and edible categories, and record customer retention indicate sustained demand, likely bolstering future revenue.

Want to know what’s fueling these high expectations? The secret is a bold mix of margin expansion, revenue trajectory, and profit assumptions that push boundaries for this sector. Curious which upgrades and strategic changes get the most weight in the math? Uncover what’s behind these numbers and why analysts are staking their bets on this upside.

Result: Fair Value of $63.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in consumer demand or a dip in comparable store sales could quickly undermine these optimistic forecasts and shift the outlook for Tractor Supply.

Find out about the key risks to this Tractor Supply narrative.

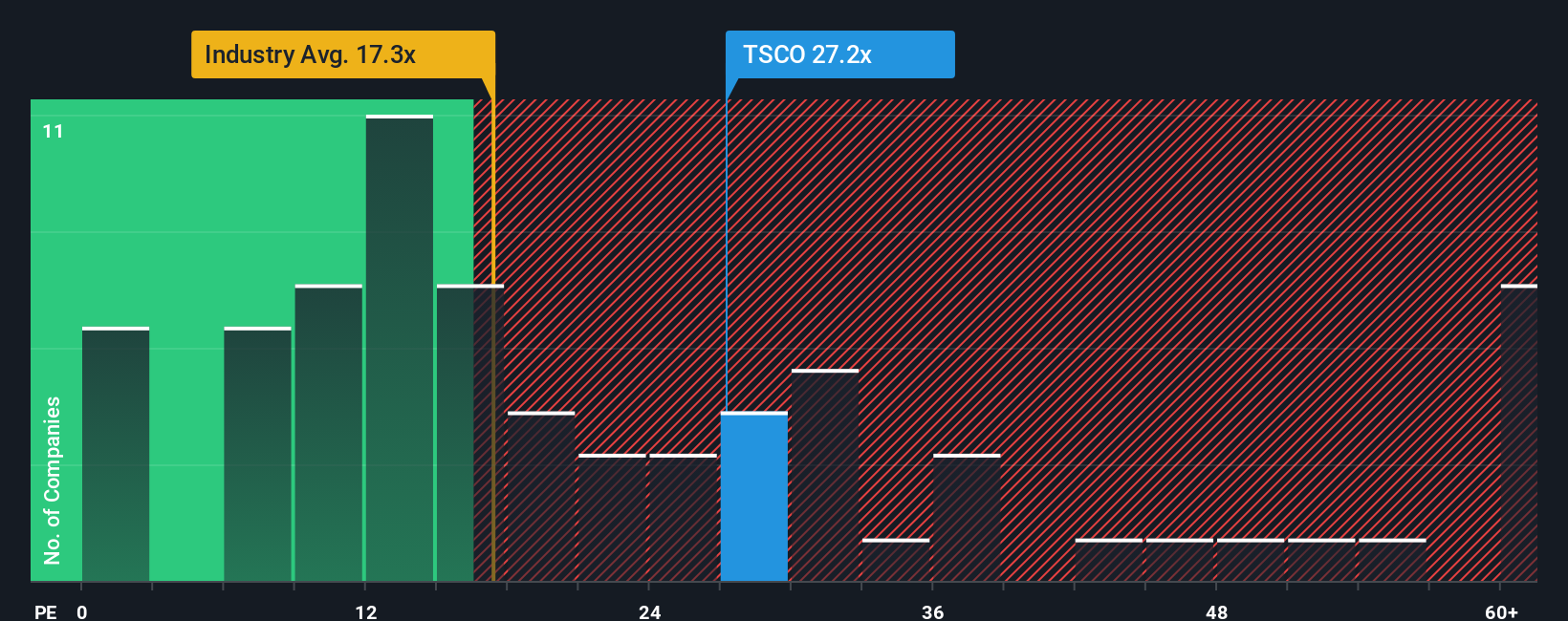

Another View: Gauging Value by Market Multiples

Looking through another lens, Tractor Supply’s market value appears stretched compared to industry benchmarks. The company’s P/E ratio of 25.2 times earnings stands well above the US Specialty Retail average of 16.6 times. It is also higher than the fair ratio of 18.2 times that the market could ultimately target. This premium suggests the market expects substantial future growth, but it also heightens the risk if those expectations are not met. Is the stock’s valuation running too far ahead of reality, or are investors right to look past today’s numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tractor Supply Narrative

If this view does not match your own outlook or if hands-on analysis drives your decisions, you can build and personalize a unique narrative for Tractor Supply in just a few minutes. Do it your way

A great starting point for your Tractor Supply research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to a single stock when smarter opportunities could be just a click away? Top investors are always searching for their next big win. Use these targeted screens to get ahead of the crowd and find stocks that could reshape your portfolio before they hit the headlines.

- Target a long-term income stream by checking out these 16 dividend stocks with yields > 3%, featuring strong yields and reliable payouts.

- Get in early on digital innovation and see which companies are shaping tomorrow’s markets with these 81 cryptocurrency and blockchain stocks.

- Spot breakthrough opportunities in healthcare tech by searching these 30 healthcare AI stocks, highlighting companies already making an impact with investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives