- United States

- /

- Specialty Stores

- /

- NasdaqGS:TSCO

Evaluating Tractor Supply (TSCO): Is the Recent Share Price Dip an Opportunity for Value Investors?

Reviewed by Simply Wall St

See our latest analysis for Tractor Supply.

This latest slide comes on the heels of some mixed retail industry headlines. What really stands out for Tractor Supply is the way its momentum has faded in recent months. While the share price is holding steady for the year so far, recent pressure leaves its one-year total shareholder return slightly negative. Its three- and five-year total returns are up by a solid 32% and 119% respectively, showing that long-term investors have still fared well.

If the shifting tides in retail have your attention, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and recent performance lagging, the key question for investors is whether this weakness reflects an undervalued stock or if the market has already factored in future growth potential.

Most Popular Narrative: 17.1% Undervalued

Tractor Supply’s last close of $52.49 stands notably below the narrative’s fair value estimate of $63.30. This sets the stage for a lively debate on whether consensus forecasts are too low or if the market is simply too cautious.

Tractor Supply's strategy to reduce reliance on Chinese imports and diversify its supply chain, from over 90% to closer to 50% by year-end, could mitigate tariff impacts and potentially improve net margins and earnings. Strong transaction growth, unit growth in consumable, usable, and edible categories, and record customer retention indicate sustained demand, likely bolstering future revenue.

Want the full story behind this double-digit upside? The secret sauce is a carefully engineered blend of margin recovery, ambitious growth levers, and an industry-beating profit target. Curious about the financial assumptions and bold strategies that support a price target beyond today’s market? Discover the forecasts that analysts are betting on.

Result: Fair Value of $63.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in store sales and ongoing economic uncertainty could challenge Tractor Supply’s growth story and limit its potential upside.

Find out about the key risks to this Tractor Supply narrative.

Another View: Market Multiples Tell a Different Story

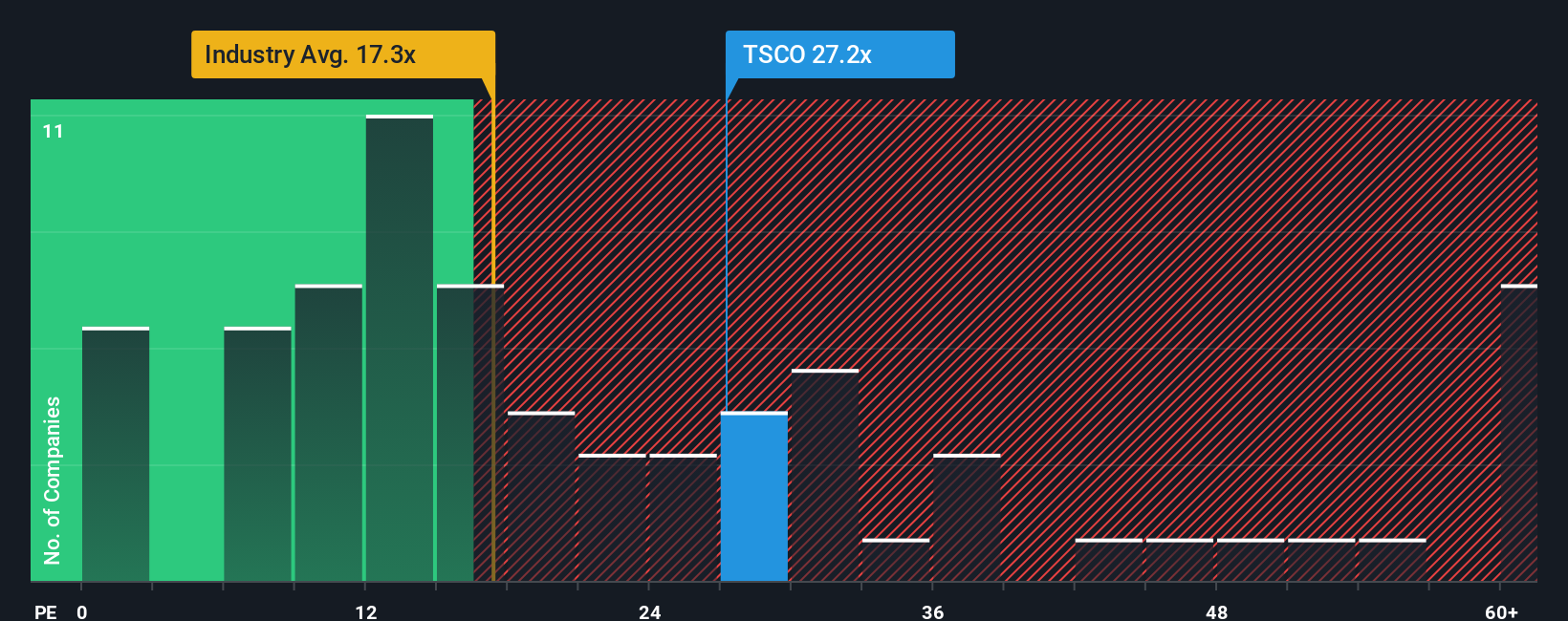

While analyst forecasts suggest Tractor Supply is undervalued by fair value estimates, a look at current price-to-earnings ratios raises a caution flag. Shares trade at 25.2 times earnings, well above the industry average of 16.7 and the fair ratio of 18.3. This premium could mean higher expectations, and higher risks, unless profits accelerate. Is the market too optimistic, or is something special being priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tractor Supply Narrative

If this perspective does not quite align with your own outlook or you prefer to build your own case from the ground up, you can delve into the details and craft a personalized thesis in just a few minutes. Do it your way

A great starting point for your Tractor Supply research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Don’t miss your chance to uncover exceptional opportunities. Simply Wall Street’s powerful screener puts unique investment themes and breakout potential right at your fingertips.

- Tap into potential with these 839 undervalued stocks based on cash flows to spot companies trading below their true worth before the crowd catches on.

- Ride the income wave by using these 18 dividend stocks with yields > 3% to pick out stocks delivering strong yields above 3% and robust fundamentals.

- Capitalize on the explosive future of health and tech with these 33 healthcare AI stocks, which finds companies transforming patient care through artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tractor Supply might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSCO

Tractor Supply

Operates as a rural lifestyle retailer in the United States.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives