- United States

- /

- Specialty Stores

- /

- NasdaqGS:TDUP

ThredUp (TDUP): Exploring Valuation After Volatile Share Price Swings in 2024

Reviewed by Kshitija Bhandaru

ThredUp (TDUP) shares have seen mixed movement lately, catching investor attention after a stretch of market volatility. With its year-to-date returns solidly in positive territory, many are weighing what comes next for this online resale platform.

See our latest analysis for ThredUp.

ThredUp’s share price has seen quite a journey in 2024, with momentum shifting rapidly from a bullish 532.62% share price return year-to-date to a sharper pullback in recent weeks. Despite a 24.76% share price gain over the past 90 days, a tougher past month has reminded investors of the volatility inherent in fast-growing online retailers. Even so, the 1-year total shareholder return of 1,036.16% still stands out, hinting at both the upside and risk perception that continues to shape sentiment around the stock.

If you’re curious about other standout performers in today’s market, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With ThredUp shares trading below analyst targets and double-digit annual growth rates fueling debate, the key question emerges: is this a genuine buying opportunity, or is the market already betting on continued outsized gains?

Most Popular Narrative: 31% Undervalued

With ThredUp’s narrative fair value sitting well above the last close, the platform’s long-term potential is coming under intense market scrutiny. Fresh drivers and catalysts for the business are emerging as the market recalibrates what is possible in the online resale space.

The closure of the de minimis loophole and the introduction of new tariffs are making fast fashion and new apparel imports more expensive. This increases the relative value proposition and attractiveness of secondhand platforms like ThredUp, which should support further customer acquisition and drive strong revenue growth.

Want a glimpse at the logic fueling this bold price target? Analysts underpin their valuation with projections of transformational margin growth and rapid revenue scaling, betting on a competitive edge strengthened by regulatory and consumer trends. Dive in to discover which headline financial levers make the numbers work.

Result: Fair Value of $13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising acquisition costs and shifting consumer interest could slow ThredUp’s growth. These factors pose real challenges to the platform’s long-term bullish narrative.

Find out about the key risks to this ThredUp narrative.

Another View: Room for Doubt?

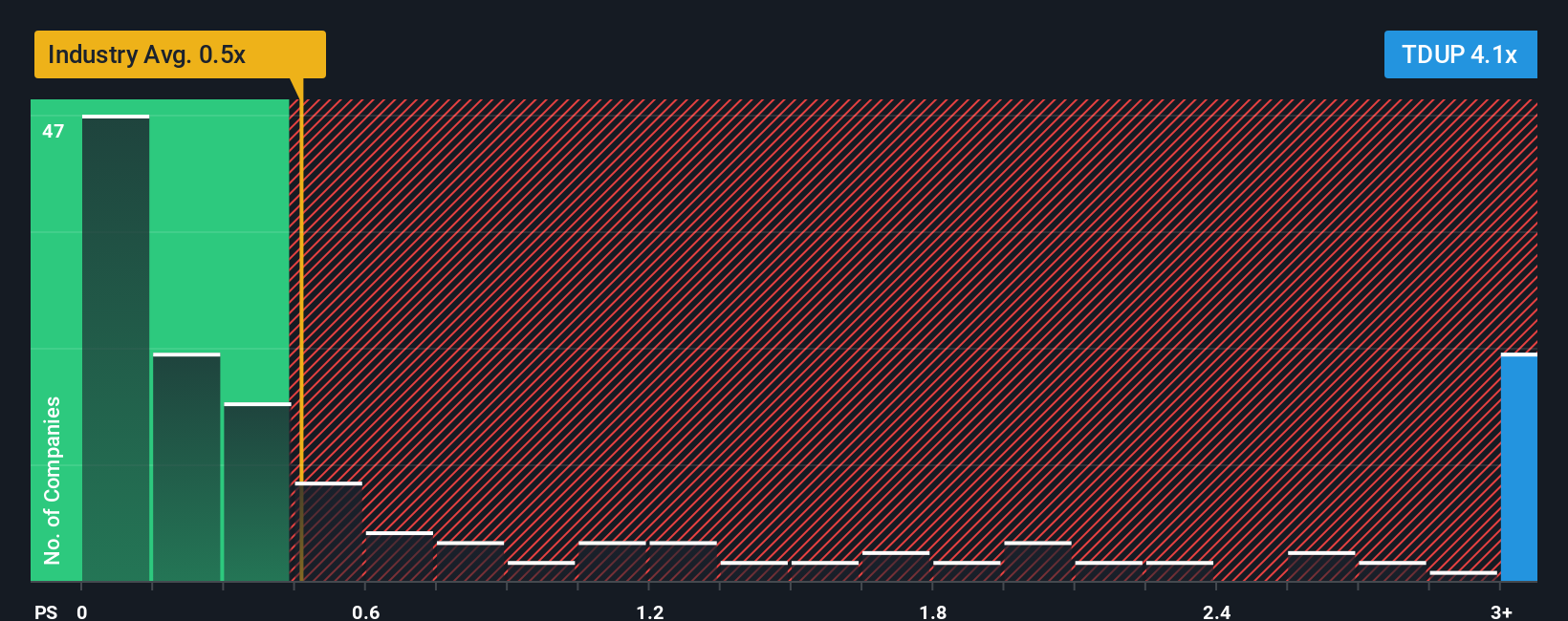

Looking at valuation through the market’s price-to-sales lens, ThredUp stands out as expensive. It trades at 4x sales compared to the US Specialty Retail industry average of just 0.4x and a peer average of 1x. The market could eventually pull ThredUp’s ratio closer to a fair ratio of 1.6x. Does this signal that investors are too optimistic, or does ThredUp truly warrant this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ThredUp Narrative

If you think the story looks different after digging into the numbers yourself, there's nothing stopping you from testing your own thesis in just minutes. Do it your way

A great starting point for your ThredUp research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay one step ahead, now’s your chance to seize unique opportunities beyond ThredUp. The market’s next standout performer could be just a click away.

- Unlock smart cash flow bargains and see which companies could be undervalued right now by using these 893 undervalued stocks based on cash flows.

- Catch the unstoppable rise of artificial intelligence and propel your portfolio by checking out these 25 AI penny stocks with exciting AI potential.

- Target long-term growth and reliable income by scanning these 18 dividend stocks with yields > 3% delivering high yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if ThredUp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TDUP

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion