- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Ross Stores (ROST): Evaluating Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Ross Stores.

Ross Stores has been building a steady head of steam for much of the past year, with its 1-year total shareholder return reaching 15.26% and a 30-day share price return of 6.3% hinting at renewed optimism around the stock’s outlook. That kind of consistent momentum, especially paired with the company’s longer-term outperformance—an impressive 82% total return over three years—keeps Ross Stores firmly on the radar for investors watching the retail space.

If you’re curious where else positive momentum or insider confidence could translate to big wins, it’s a great moment to broaden your search and check out fast growing stocks with high insider ownership.

With shares riding this persistent wave, the big question is whether Ross Stores is still trading below its true value or if investors have already factored future gains into today’s price, leaving little room for upside.

Most Popular Narrative: 1.4% Undervalued

The current most-followed narrative sees Ross Stores as a touch undervalued, pricing fair value just above the last close. This outlook hinges on operational growth and efficient cost management. What truly stands out is how the company positions itself for future gains as economic uncertainty persists.

Resilient demand for value-oriented retail is evidenced by continued broad-based improvement in traffic and basket size, alongside strong early back-to-school sales and a robust pipeline of new store openings. This positions Ross to capture incremental revenue as persistent economic uncertainty drives consumers toward off-price channels.

Eager to see what’s powering this valuation? The narrative’s numbers rest on bold new store expansion, steady margins, and a forward earnings multiple that raises eyebrows for the retail sector. Unlock the surprising forecasts and scenario that analysts used to arrive at this price target. One figure in particular is sure to make you question the potential upside.

Result: Fair Value of $164.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from tariffs and the ongoing lack of a digital strategy could still challenge this positive outlook.

Find out about the key risks to this Ross Stores narrative.

Another View: High Multiple Signals Caution

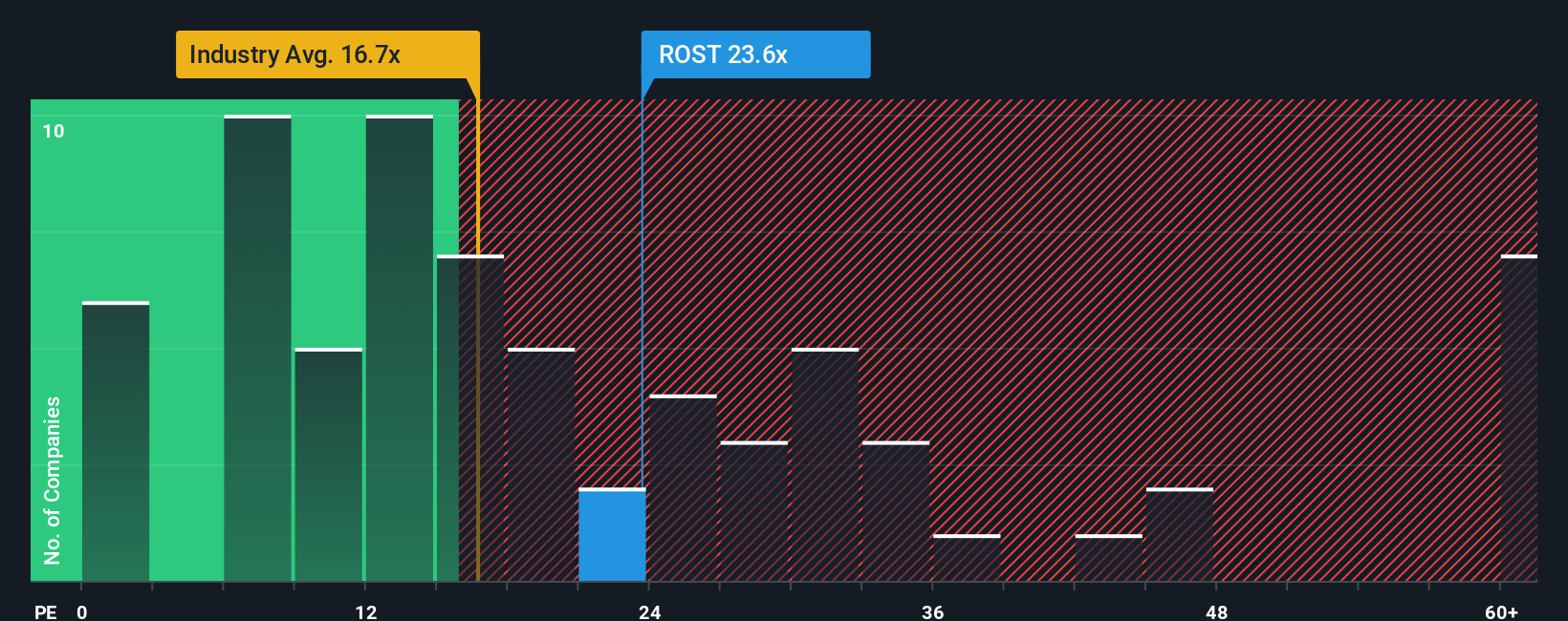

Looking at Ross Stores through the lens of its price-to-earnings ratio, a different story emerges. The company trades at 25.6x earnings, noticeably higher than the US Specialty Retail industry average of 16.6x, its peer average of 21x, and even above the market's fair ratio of 18.3x. This premium suggests investors are banking on continued outperformance, but it also raises valuation risk if future growth falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ross Stores Narrative

If you see an opportunity or want to dig deeper, you can dive into the data and shape your own story in just a few minutes. Do it your way.

A great starting point for your Ross Stores research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t wait on the sidelines while the market moves. Get ahead by targeting untapped trends and high-potential sectors using the Simply Wall Street Screener. Act now and give yourself the best shot at the next breakout winner.

- Tap into reliable cash flow with solid yields by reviewing these 20 dividend stocks with yields > 3% to boost your portfolio’s consistent earning power.

- Step into tomorrow’s breakthroughs by spotting early movers through these 26 AI penny stocks for an edge in rapidly innovating industries.

- Pounce on overlooked bargains and value plays with these 840 undervalued stocks based on cash flows before the wider market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives