- United States

- /

- Specialty Stores

- /

- NasdaqGS:ROST

Ross Stores (ROST): Evaluating Valuation After Q3 Earnings Beat and Raised Full-Year Guidance

Reviewed by Simply Wall St

Ross Stores (ROST) just announced higher sales and earnings for the third quarter, and management has since raised full-year guidance. These updates indicate steady operational strength that has caught investor attention.

See our latest analysis for Ross Stores.

Ross Stores’ solid third quarter is the latest in a streak of upbeat developments, including board succession plans, a fresh round of buybacks, and a newly affirmed dividend. The company’s positive outlook and regular shareholder returns have supported a 90-day share price return of 17.8%, with the total shareholder return reaching 16.8% over the past year and a notable 65% over five years. Short-term momentum is building as investors reward consistent execution and rising earnings expectations.

If these strong moves have you thinking more broadly, it could be the perfect time to discover fast growing stocks with high insider ownership.

With shares already up sharply and Ross Stores' stock now trading within 1% of the average analyst price target, investors are left to wonder whether the recent momentum leaves room for further gains, or if expectations for future growth are already fully reflected in the current price.

Most Popular Narrative: Fairly Valued

With Ross Stores closing at $177.50 and the narrative’s fair value at $178.24, the current price is just about in line with popular forecasts. The margin between trading price and consensus target is very slim, setting the stage for a deeper exploration into the assumptions driving this outlook.

Enhanced merchandising strategy, including a higher mix of closeout inventory and refined vendor negotiations, is mitigating tariff impacts and supporting gross margin stability. Over time, expected price equilibrium across the sector will enable improvement in merchandise margin and earnings.

Curious what’s supporting this no-room-for-error fair value? The narrative leans on bold assumptions for stable margins and future profitability that challenge the typical retail growth playbook. Discover the projections behind this razor-thin valuation gap. Find out the headline forecast that keeps this price target just a whisper above today’s close.

Result: Fair Value of $178.24 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and the lack of a strong digital presence could undermine long-term growth expectations for Ross Stores.

Find out about the key risks to this Ross Stores narrative.

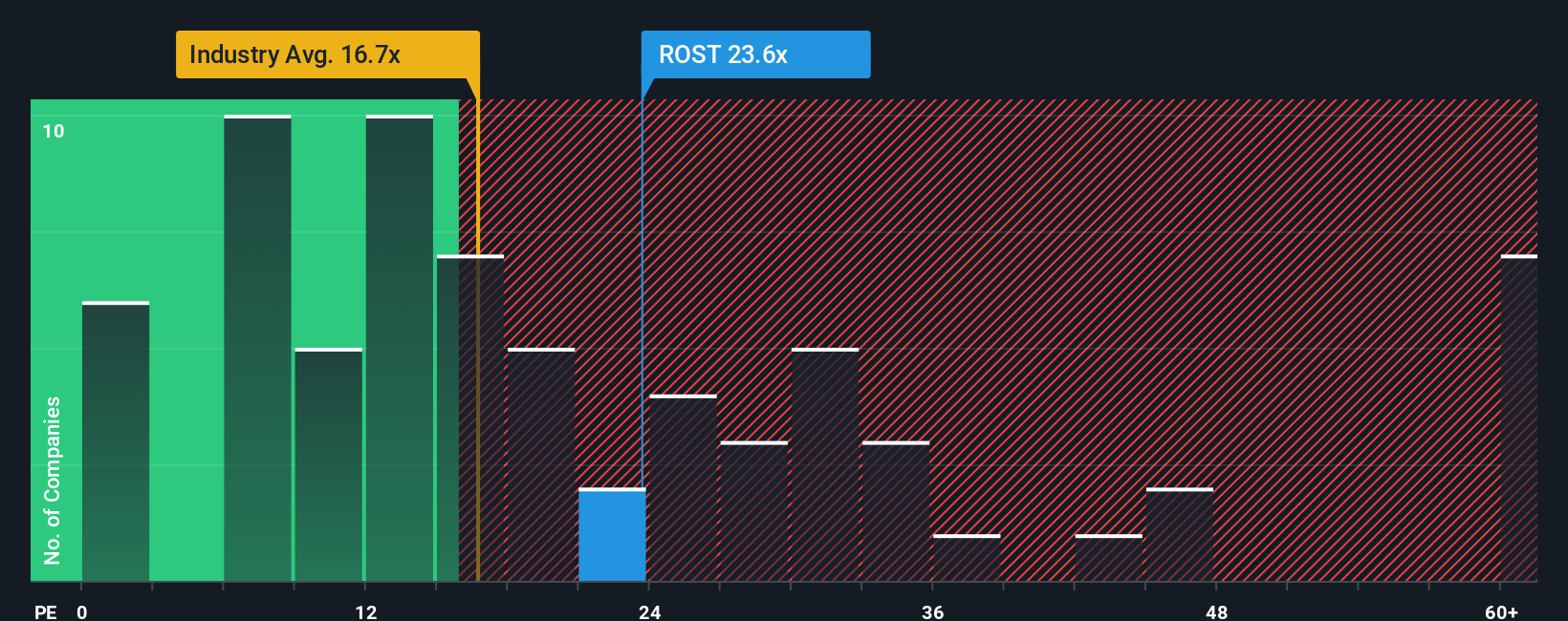

Another View: The Big Picture on Valuation

Looking from another angle, Ross Stores is trading at a price-to-earnings ratio of 27.7x. That is notably higher than both the peer average of 21.5x and the broader US Specialty Retail industry at 18.1x, and even above the fair ratio of 19.2x where the market could potentially settle. This gap signals investors are baking in a lot of optimism. If growth disappoints, the premium could quickly evaporate. Does paying up make sense, or is it a red flag for future returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ross Stores Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own Ross Stores narrative in just a few minutes. Do it your way.

A great starting point for your Ross Stores research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines while others make bold moves. Expand your watchlist with strategies tailored for fast growth, future tech, and reliable income.

- Uncover income opportunities by tapping into these 14 dividend stocks with yields > 3% with yields greater than 3% from dependable companies supporting your portfolio’s stability.

- Get ahead of the trend by targeting innovators with these 25 AI penny stocks that are accelerating business transformations through artificial intelligence breakthroughs.

- Ride the digital revolution and seize your chance with these 81 cryptocurrency and blockchain stocks, which fuels advancements in blockchain, secure transactions, and next-generation finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROST

Ross Stores

Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brands in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026