- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

Will RealReal's (REAL) Upbeat Guidance Reshape the Management Story After Q3 and Board Changes?

Reviewed by Sasha Jovanovic

- The RealReal, Inc. recently reported its third-quarter 2025 financial results, highlighting year-over-year revenue growth to US$173.57 million and raising its full-year earnings guidance.

- Amid these developments, co-founder and former board member Chip Baird resigned after GreyLion Partners exited its position, though Baird will remain as a consultant through mid-2026.

- We'll explore how RealReal's upgraded revenue outlook and strong Q3 performance may impact its investment narrative and future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

RealReal Investment Narrative Recap

To be a RealReal shareholder, an investor needs confidence in the company’s ability to drive sustained, profitable growth in the authenticated luxury resale market, fueled by expanding supply and technology-powered efficiency. The recent board changes, including co-founder Chip Baird’s departure, do not materially change the most important short-term catalyst: the ability to convert supply growth into higher GMV and revenue, although leadership continuity remains a general risk.

One of the most relevant recent announcements is the company’s upgraded full-year 2025 revenue guidance to US$687 million–US$690 million, following record Q3 revenue and gross merchandise value. This reinforces the near-term catalyst around growing supply and buyer activity, though also increases scrutiny on execution and margin improvement as losses remain elevated.

However, even as revenue guidance rises, investors should be aware of ongoing margin pressure as the platform’s take rate declines with higher ticket sales…

Read the full narrative on RealReal (it's free!)

RealReal's narrative projects $842.8 million in revenue and $40.0 million in earnings by 2028. This requires 9.8% yearly revenue growth and an increase of $75.4 million in earnings from the current earnings of -$35.4 million.

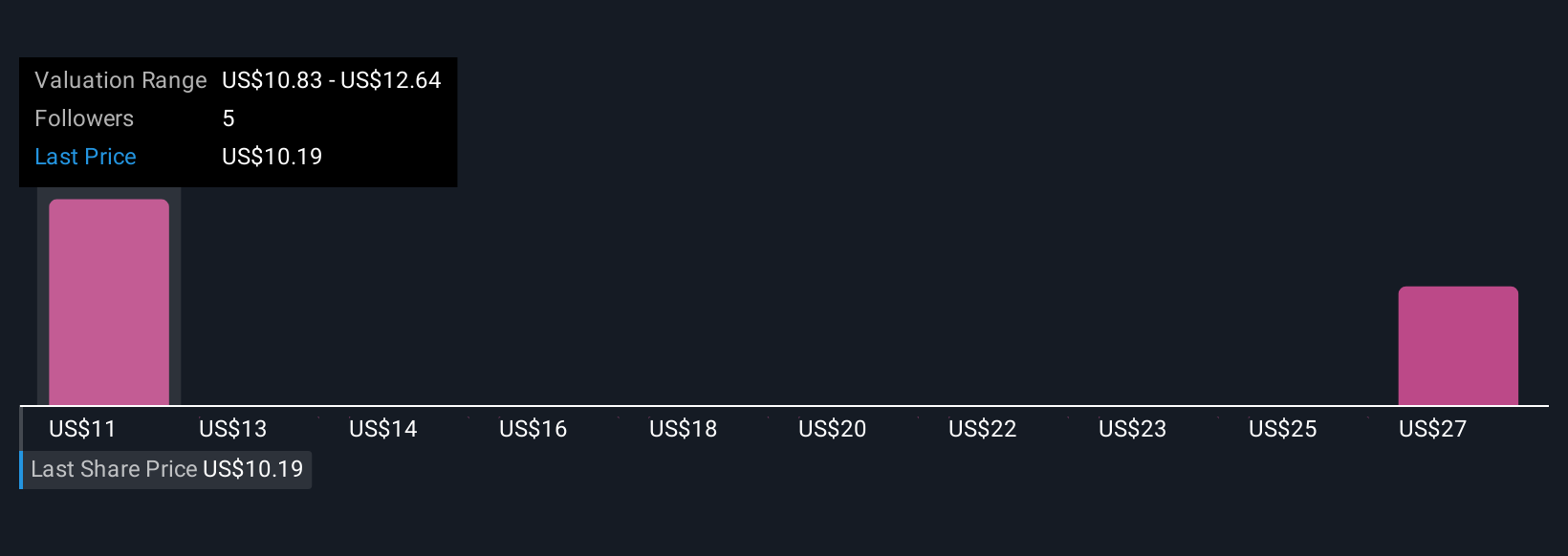

Uncover how RealReal's forecasts yield a $15.12 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for The RealReal, from US$4.69 to US$15.13 per share. While some expect substantial upside, others flag risks to long term growth if the supply flywheel slows, creating a broad spectrum for company performance outcomes.

Explore 2 other fair value estimates on RealReal - why the stock might be worth less than half the current price!

Build Your Own RealReal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RealReal research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RealReal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RealReal's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with concerning outlook.

Similar Companies

Market Insights

Community Narratives