- United States

- /

- Specialty Stores

- /

- NasdaqGS:REAL

Is RealReal’s 204.5% Stock Surge Justified After Recent E-Commerce Expansion News?

Reviewed by Bailey Pemberton

- Thinking about RealReal? If you are wondering whether the recent buzz means it is finally a good value play, you are in exactly the right place.

- The stock has put up an eye-popping 204.5% gain over the past year, despite some volatile swings, including a recent 6.6% dip in the last week and a 12.7% surge over the past month.

- Big news has kept RealReal in the spotlight lately, especially as the company continues to expand its e-commerce luxury platform and rethinks operational strategies to drive profitability. These headlines have played a big part in shaping both excitement and caution among investors.

- But let’s get to the heart of the matter: when we run RealReal through six major valuation checks, it passes as undervalued in none of them (0/6). Coming up, we will break down what that actually means, how valuing a stock goes far beyond just scoring systems, and why there might be a smarter way to find real value.

RealReal scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

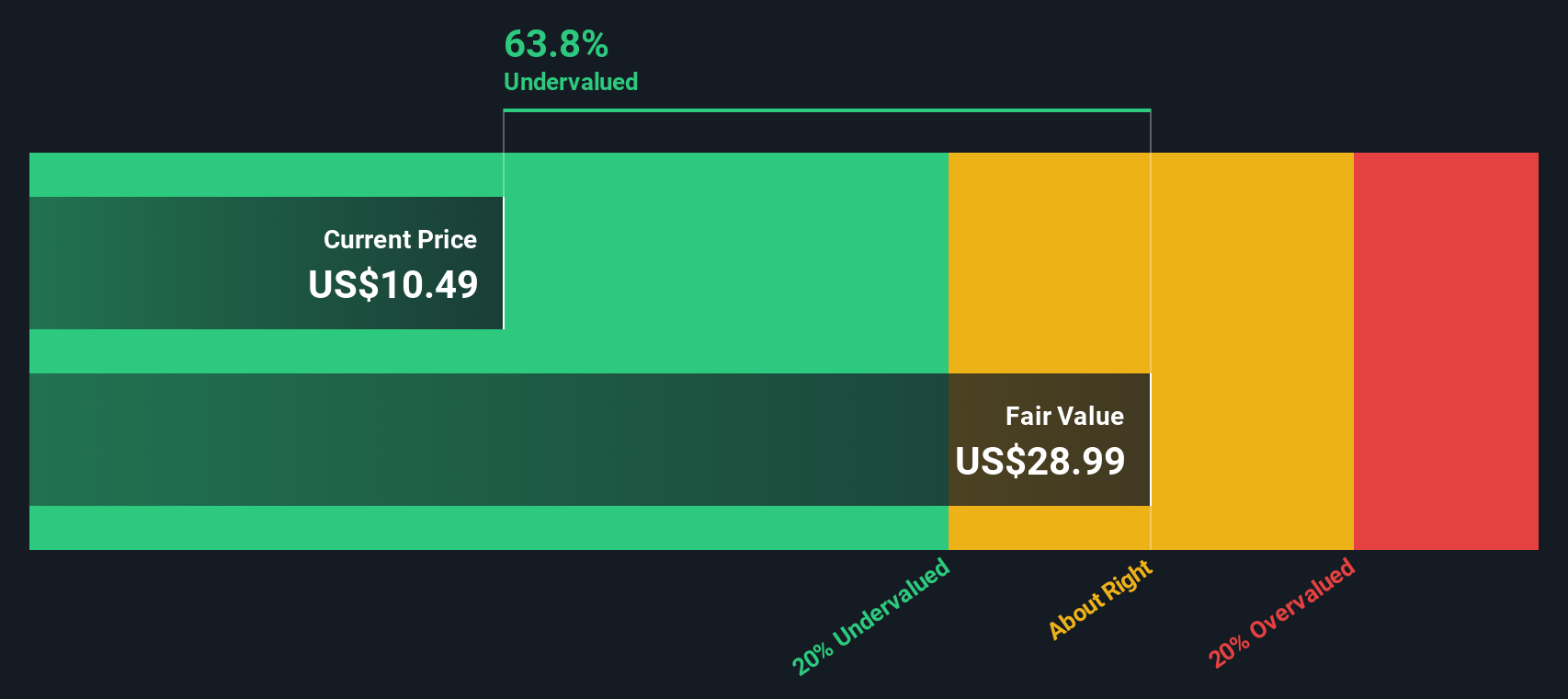

Approach 1: RealReal Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by forecasting its expected future cash flows and then discounting them back to today's dollars. This approach focuses on the fundamental ability of a business to generate cash over time.

For RealReal, the latest reported Free Cash Flow (FCF) stands at -$33.43 million. Analysts expect FCF to turn positive and grow significantly, projecting approximately $29.2 million by 2027. Beyond the five-year analyst window, further increases are extrapolated, with 2035 estimates reaching $40.86 million. These future projections are based on systematic growth assumptions and discounting.

Despite this growth outlook, the DCF model currently calculates RealReal's fair value at $4.51 per share. This is a sharp contrast to the recent share price, indicating the stock is trading at a 154.4% premium over its intrinsic value.

Based on this analysis, RealReal appears considerably overvalued using the DCF method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests RealReal may be overvalued by 154.4%. Discover 836 undervalued stocks or create your own screener to find better value opportunities.

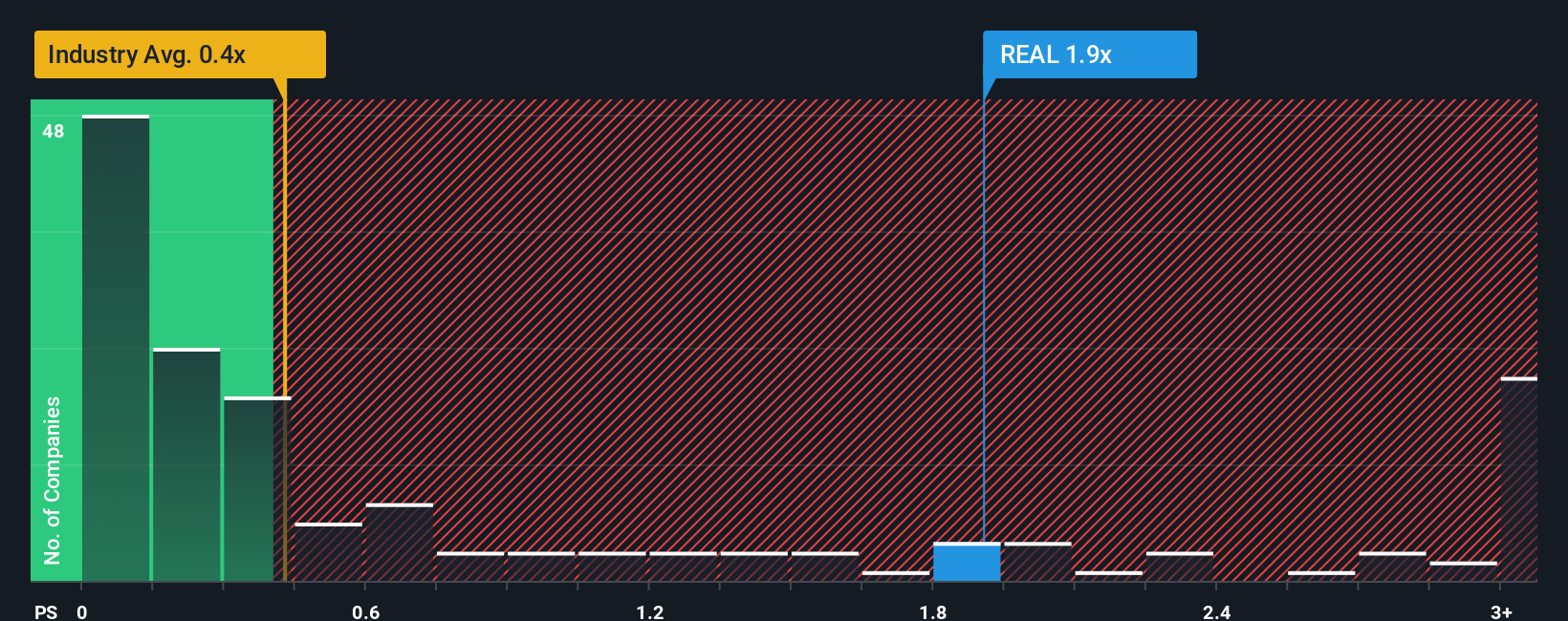

Approach 2: RealReal Price vs Sales (P/S) Multiple

The Price-to-Sales (P/S) ratio is often the go-to valuation multiple for companies like RealReal that are not yet consistently profitable but generate significant revenues. This ratio allows investors to assess the value the market places on every dollar of sales and is especially relevant when earnings are negative or volatile.

When considering the P/S ratio, it is important to recognize that expectations for revenue growth, business risk, and profit margin drive what an appropriate or "fair" multiple should be. High-growth or lower-risk companies tend to justify a higher multiple, while riskier or slower-growth firms typically trade at lower ratios.

Currently, RealReal trades at a P/S ratio of 2.08x. For context, the Specialty Retail industry average is only 0.43x, and the average among RealReal’s peers is roughly 1.46x. However, Simply Wall St’s proprietary “Fair Ratio” for RealReal is 1.48x. The “Fair Ratio” goes beyond simple peer and industry comparisons by integrating factors like the company’s projected earnings growth, profitability outlook, market cap, and industry-specific risks.

Comparing RealReal’s current P/S ratio of 2.08x with its Fair Ratio of 1.48x, the stock appears overvalued via this method, as it is trading at a notable premium to what would be justified by fundamentals and risk profile.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your RealReal Narrative

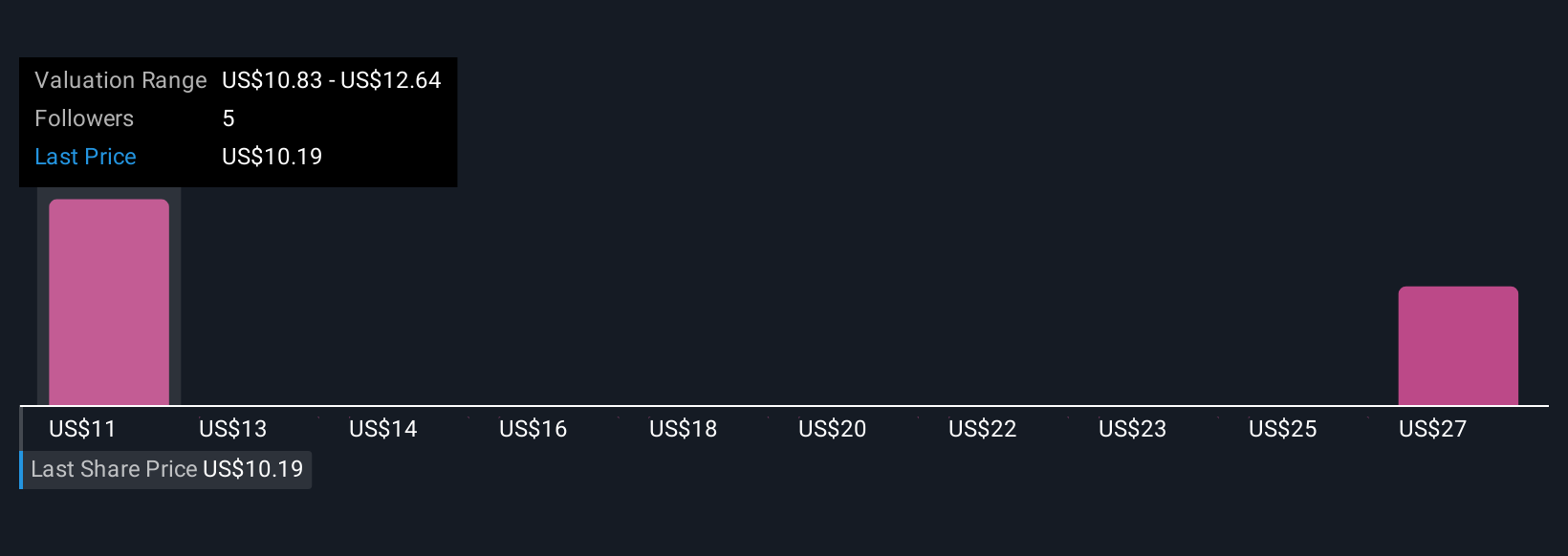

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are an intuitive way for investors to express the story behind the numbers, your perspective on a company’s future, including assumptions about fair value, revenue growth, and profit margins, not just what the models dictate.

With Narratives, you link RealReal’s business story and your outlook directly to a financial forecast and ultimately a fair value. This enables you to go beyond one-size-fits-all analysis. Narratives give you full context for your investing decisions by showing how the company’s potential and risks shape what you believe it is worth, allowing you to compare your convictions to others in the market.

On Simply Wall St’s Community page, millions of investors share and refine Narratives every day, all easily accessible and constantly updated as fresh news and earnings emerge. Narratives help you decide when to buy or sell by making it clear at a glance whether current prices reflect underlying stories or have detached from reality.

For example, some RealReal investors see robust AI-driven growth ahead and set fair values as high as $15.00, while others, wary of margin risks and supply constraints, value the shares closer to $8.00. Narratives show you both sides so you can invest with clarity and conviction.

Do you think there's more to the story for RealReal? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REAL

RealReal

Operates an online marketplace for resale luxury goods worldwide.

Slight risk with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives