- United States

- /

- Specialty Stores

- /

- NasdaqCM:RDNW

RideNow Group (RDNW): Losses Deepen at 34.3% Pace, Margin Stagnation Pressures Market Narrative

Reviewed by Simply Wall St

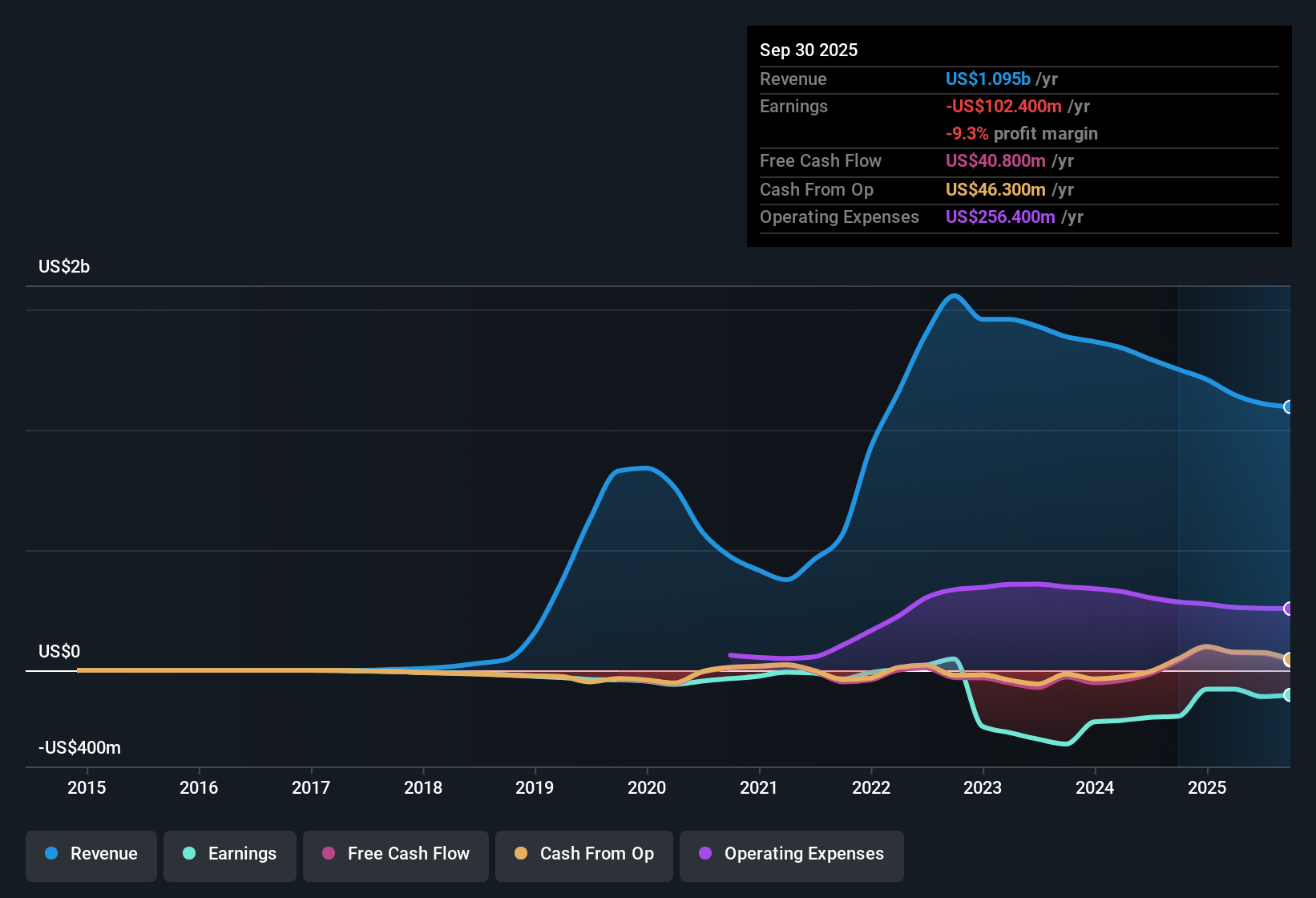

RideNow Group (RDNW) posted another challenging set of numbers, with losses deepening at a rapid 34.3% annual rate over the past five years. While revenue is projected to grow at just 4.4% per year, slower than the US market's 10.5% pace, the company's net profit margin has shown no improvement over the last year and there is no indication of high-quality past earnings. Despite the stock trading at a Price-To-Sales ratio of 0.1x, which is well below industry and peer averages, the persistence of significant losses and slower growth has cooled investor enthusiasm. The share price of $4.14 sits far beneath an estimated fair value of $20.46.

See our full analysis for RideNow Group.Next, we will see how these headline numbers compare with the consensus narratives about RideNow Group, highlighting where they support or contradict the broader market story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Shows No Progress

- RideNow Group’s net profit margin failed to show any improvement over the last year, signaling that cost controls or efficiency initiatives have not gained traction despite ongoing losses.

- What is surprising is that, even as revenue is projected to grow at 4.4% per year, there has been no evidence of high-quality past earnings to suggest future margin gains.

- This challenges any optimism that expanding revenue alone might improve bottom-line results.

- With profitability stalled, questions persist about the company’s ability to shift toward sustainable earnings.

Share Price Discounted Deeply Versus DCF Value

- The current share price of $4.14 stands far below RideNow Group's DCF fair value of $20.46, reflecting heavy skepticism about prospects and significant discounts versus fundamental estimates.

- Bulls may point to the company’s Price-To-Sales ratio of just 0.1x, which is already more than half below peer (0.2x) and industry (0.4x) averages. Yet this deep discount raises debate about whether market pessimism has gone too far.

- Such a low valuation heavily supports the narrative that RideNow Group is categorized as ‘good value’ in both absolute and relative terms.

- However, the persistent losses highlight why many investors remain on the sidelines despite the apparent bargain.

Negative Equity and Financial Risks Add Pressure

- The company does not have positive equity, a major red flag that often signals ongoing financial vulnerability and potential challenges securing funding or weathering future setbacks.

- Bears argue this structural weakness overshadows any perceived value, as the lack of profit margin improvement and below-market revenue growth rates make a turnaround unlikely without substantial operational change.

- The volatility in RideNow’s share price over the past three months further amplifies near-term risk exposure.

- Slower growth than the broader US market (4.4% vs. 10.5%) supports worries that RideNow Group may continue to struggle to attract new capital or investor confidence.

See what the community is saying about RideNow Group

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on RideNow Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

RideNow Group faces persistent profitability issues, slow growth, and negative equity. These factors raise concerns about its ability to deliver financial stability or inspire investor confidence.

If dependable finances are what you seek, take a closer look at solid balance sheet and fundamentals stocks screener (1979 results) to find companies with stronger balance sheets and resilience through tough times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RDNW

RideNow Group

Provides powersports dealership and vehicle transportation services in the United States.

Undervalued with low risk.

Market Insights

Community Narratives