- United States

- /

- Retail Distributors

- /

- NasdaqCM:RCT

Could RedCloud Holdings' (RCT) NVIDIA Partnership Reveal Its Next Move in Global Supply Chain Innovation?

Reviewed by Sasha Jovanovic

- On September 24, 2025, RedCloud Holdings plc announced it has joined the NVIDIA Connect program, enabling its development teams to access NVIDIA's advanced AI frameworks and resources to accelerate innovation in global trade solutions.

- This initiative reinforces RedCloud’s commitment to leveraging cutting-edge technology to tackle the $2 trillion global inventory gap impacting the $14.6 trillion global FMCG industry.

- We'll explore how RedCloud’s adoption of NVIDIA’s AI capabilities could influence its investment narrative in global supply chain technology.

Find companies with promising cash flow potential yet trading below their fair value.

What Is RedCloud Holdings' Investment Narrative?

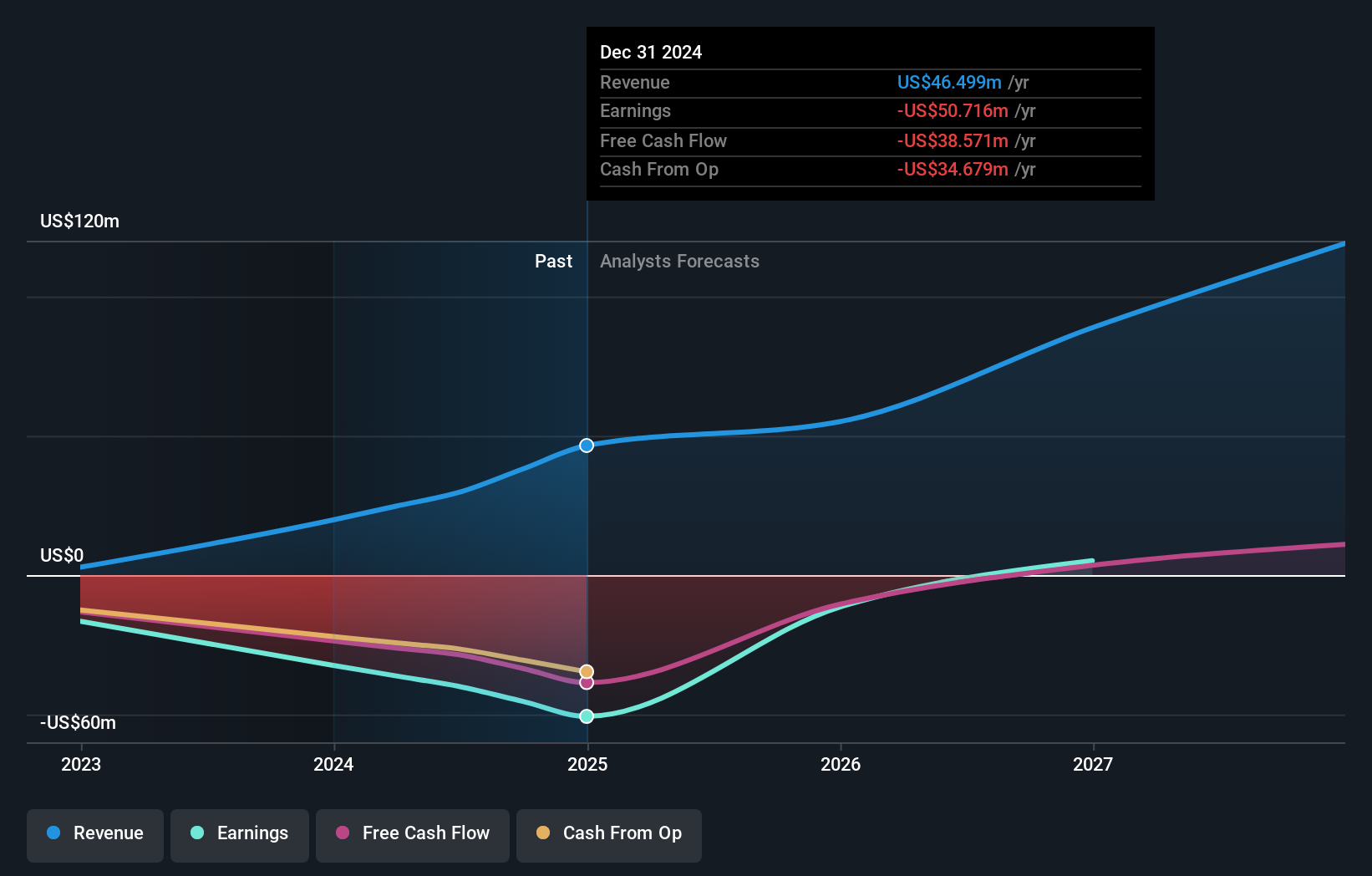

For investors considering RedCloud Holdings, the big picture rests on a belief that technology-driven innovation can meaningfully address critical supply chain inefficiencies for the multi-trillion dollar FMCG industry. The recent integration with NVIDIA Connect has the potential to sharpen RedCloud’s technological edge, empowering its AI-driven product suite and potentially accelerating customer adoption. In the short term, this could help reinvigorate positive sentiment after a period of share price volatility and operational growing pains. However, RedCloud’s challenges haven’t disappeared with this announcement, the company is still loss-making, faces going concern warnings, and operates with an inexperienced board and management team. While the NVIDIA partnership aligns with RedCloud’s core story, investors should closely assess whether this development can translate into tangible commercial results soon enough to address immediate cash burn and financial risks, especially given the company's history of delayed filings and share price swings.

By contrast, recent financial and governance setbacks remain key risks investors need to watch carefully.

Exploring Other Perspectives

Explore another fair value estimate on RedCloud Holdings - why the stock might be worth just $7.30!

Build Your Own RedCloud Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RedCloud Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RedCloud Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RedCloud Holdings' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RCT

RedCloud Holdings

Operates a cloud based business-to-business open commerce platform primarily in Argentina, the United Kingdom, Brazil, Nigeria, South Africa, and internationally.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success