- United States

- /

- General Merchandise and Department Stores

- /

- NasdaqGS:PTRN

Pattern Group (NasdaqGS:PTRN): Assessing Valuation After Recent Growth Pullback

Pattern Group (NasdaqGS:PTRN) stock has been drawing attention lately, especially as investors consider its recent double-digit revenue and net income growth. Since there is no single event driving movement, the company’s recent performance data is in the spotlight.

See our latest analysis for Pattern Group.

Pattern Group’s share price has pulled back about 10% so far this year as investors digest its rapid growth phase and recalibrate expectations around valuation. Short-term momentum has faded for now; however, steady fundamentals continue to underpin long-term prospects.

If you’re interested in finding what else stands out in today’s market, consider broadening your search and discover fast growing stocks with high insider ownership.

The question now is whether Pattern Group’s recent pullback has created an appealing entry point for investors, or if strong growth is already reflected in the current share price. Could this be a buying opportunity, or is future upside already priced in?

Price-to-Earnings of 47.4x: Is it justified?

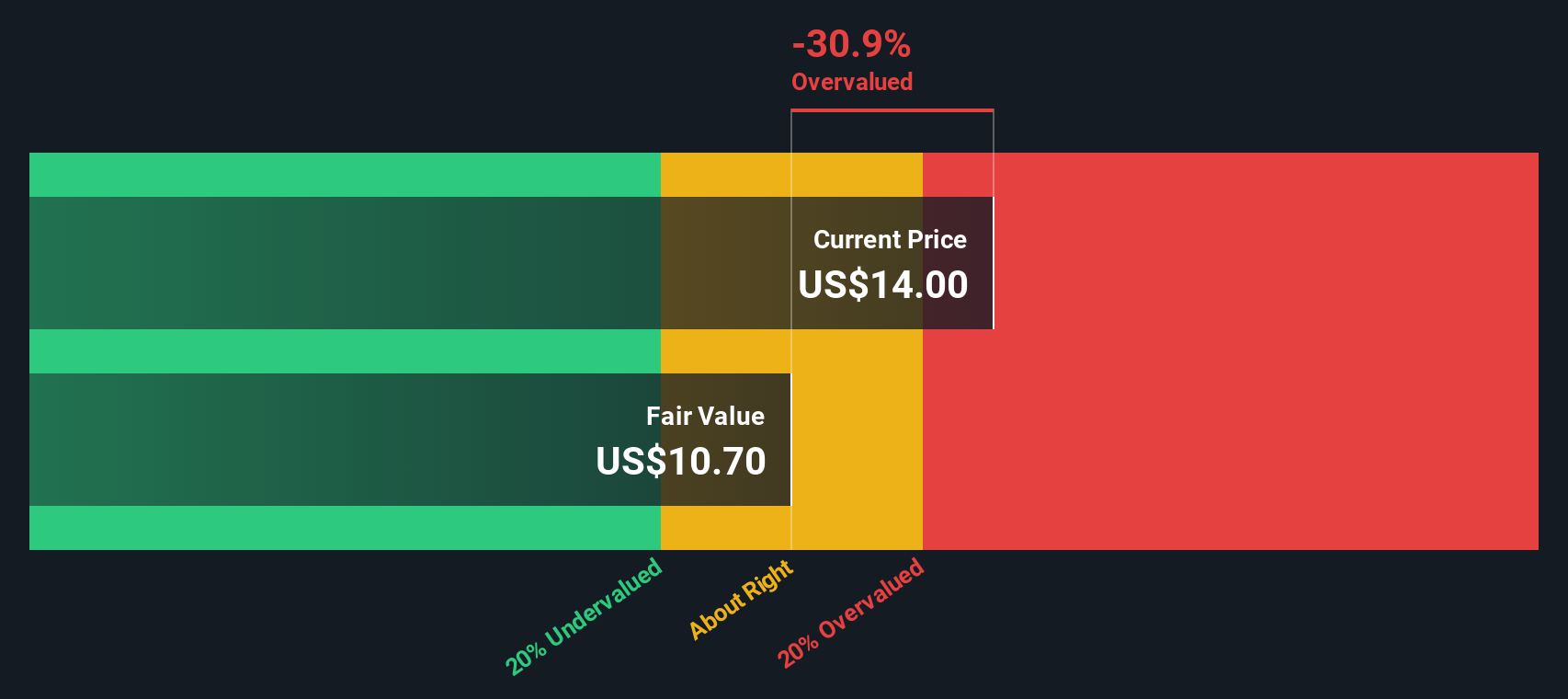

Pattern Group’s price-to-earnings ratio of 47.4x stands in stark contrast to both its global industry average and those of its peers. This makes the current $14 share price appear expensive by this measure.

The price-to-earnings (P/E) ratio represents how much investors are willing to pay for each dollar of earnings. In retail, it is a key signal for whether a stock is priced for aggressive future growth or not.

At 47.4x, Pattern Group’s P/E is well above the Global Multiline Retail industry average of 20.9x and also higher than the peer average of 24.8x. This suggests the market is pricing in an acceleration in future earnings well beyond what is typical for the sector. However, this elevated valuation is difficult to justify unless the company consistently outperforms retail peers in both growth and profitability for several years.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 47.4x (OVERVALUED)

However, risks remain if revenue growth slows unexpectedly or if Pattern Group struggles to maintain its high profitability levels in a more competitive market.

Find out about the key risks to this Pattern Group narrative.

Another View: Discounted Cash Flow Perspective

Looking from another angle, the SWS DCF model estimates Pattern Group’s fair value at $6.73 per share, which is less than half of its current trading price of $14. This model suggests the stock is significantly overvalued right now. Does the market see something that our model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pattern Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pattern Group Narrative

If you think there’s more to Pattern Group’s story, or prefer hands-on research, you can explore the numbers and build a narrative in just a few minutes. Do it your way.

A great starting point for your Pattern Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their edge by scanning new opportunities across fast-moving sectors. Make your next move count by browsing these unique stock ideas before the crowd catches on.

- Uncover unstoppable companies making waves in artificial intelligence with these 24 AI penny stocks. These stand out for their forward-looking innovation and strong earnings potential.

- Take charge of your income strategy and spot reliable yield opportunities by checking out these 18 dividend stocks with yields > 3%, which is designed to highlight high-yield stocks with solid fundamentals.

- Stay ahead of the curve in quantum computing by analyzing these 26 quantum computing stocks to see which future-ready businesses are set to transform technology as we know it.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTRN

Pattern Group

Pattern Group Inc. accelerates various brands on ecommerce marketplaces using proprietary technology and AI.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.