- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Pool Corp. (POOL): Margin Decline Reinforces Cautious Outlook Despite Premium Valuation

Reviewed by Simply Wall St

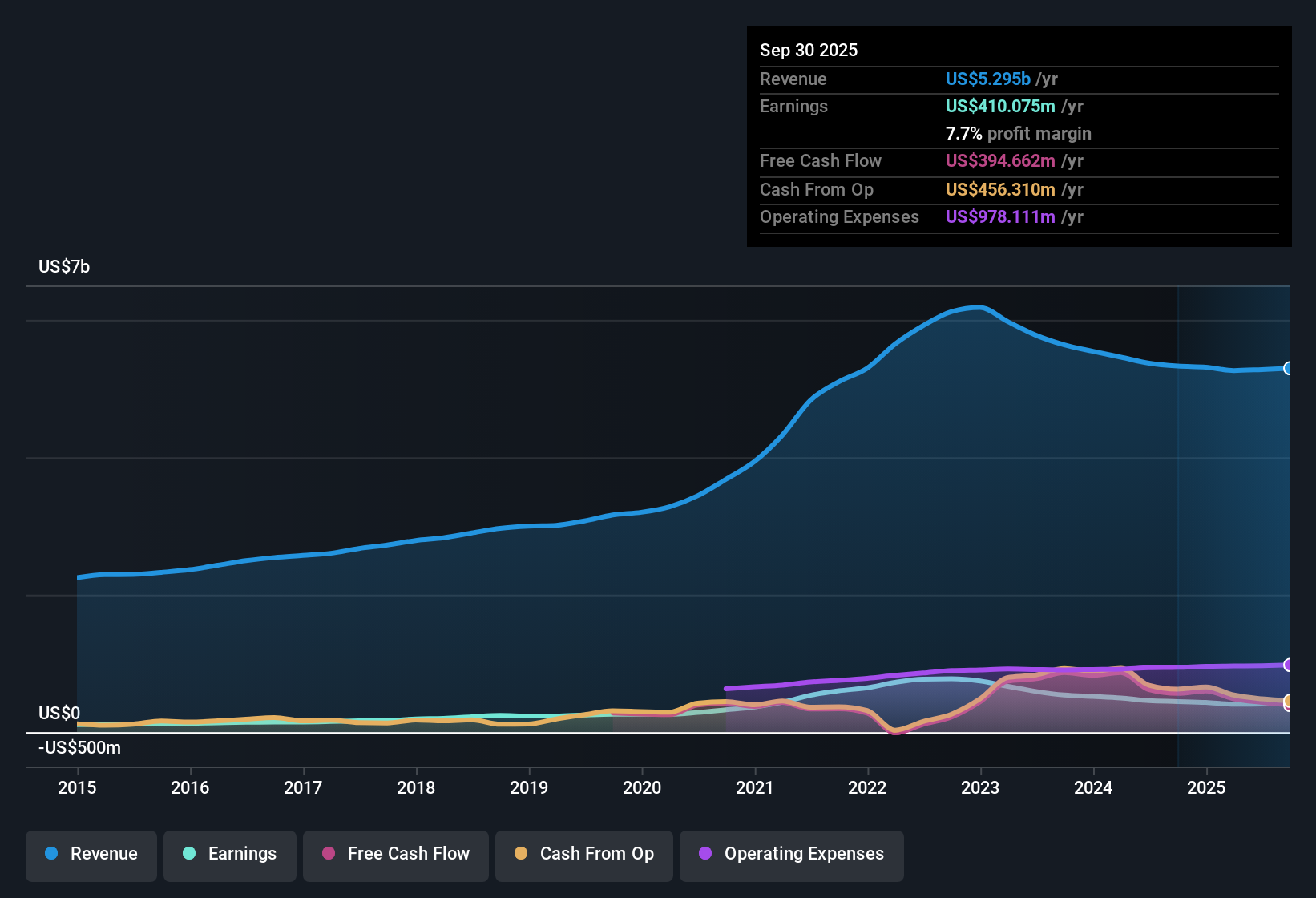

Pool (POOL) reported earnings that show profit growth of 6.5% annually and revenue growth of 4% per year. Both figures trail the broader US market averages of 15.5% and 10%, respectively. Net profit margin now stands at 7.7%, lower than last year’s 8.5%, with earnings having declined by 2.8% per year over the past five years. Despite the company’s good value in certain areas and an attractive dividend, investors may be cautious given the moderating margins, a price-to-earnings ratio of 27.4x that is well above both peer and industry averages, and a financial position that could pose risks.

See our full analysis for Pool.The next step is to see how these results compare with the prevailing narratives. Investors will want to determine whether the numbers reinforce current beliefs or challenge some established views.

See what the community is saying about Pool

Profit Margin Persists Despite Inflation Pressures

- Net profit margin is sitting at 7.7%, a decrease from last year’s 8.5%, underscoring how costs and industry headwinds are squeezing profitability.

- According to the analysts' consensus view, Pool’s investments in private label products and digital platforms like POOL360 are expected to drive operational efficiencies and help support margins over the next three years.

- Consensus narrative highlights that growing consumer emphasis on home-based leisure plus recurring maintenance revenues are providing a buffer, partially insulating Pool from cyclical downturns in new construction.

- This margin stability is seen as a differentiator, even with inflation and supply chain challenges presenting continuing risks to sustained profit levels.

Growth Outlook Trails Broader Market

- Pool’s earnings are forecast to grow at 6.5% per year, while revenue is expected to rise at 4% per year. Both of these rates are well below the US market averages of 15.5% and 10% annual growth, respectively, emphasizing a slower path forward.

- The consensus narrative points out that although Pool is expanding branches in high-growth Sun Belt regions and focusing on maintenance revenues, reliance on mature North American markets and persistent housing headwinds limit upside potential.

- Consensus narrative also notes that demographic shifts and affordability constraints are changing customer mix, favoring high-end pools and cash buyers, while entry-level demand remains pressured.

- This evolving demand profile may shrink the company’s long-term addressable market, making sustained outperformance versus the sector a challenge.

Premium Valuation Versus Peers

- Pool’s price-to-earnings ratio is 27.4x, considerably higher than both its peer average (20.2x) and the broader industry average (18.1x). This indicates a premium valuation despite only moderate projected growth.

- Analysts' consensus view stresses that the 3.4% difference between the current share price of $300.31 and the consensus analyst price target of $326.30 implies the stock is seen as fairly valued, with little margin for upside unless growth or margins outperform expectations.

- The DCF fair value stands at $306.47, almost on par with the current share price, which further suggests a limited disconnect between market optimism and fundamental forecasts.

- Consensus narrative flags that to justify a higher price relative to peers, Pool would need to beat both its earnings growth and margin targets over the next several years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pool on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the numbers tell you a different story? Put your viewpoint in motion and create your own take in just a few minutes with Do it your way.

A great starting point for your Pool research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Pool faces weaker growth prospects and a premium valuation, which makes its upside limited compared to market peers with faster earnings expansion.

If you want exposure to established leaders forecasted for stronger growth, take a look at high growth potential stocks screener (54 results) to find companies set to deliver bigger results in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives