- United States

- /

- Retail Distributors

- /

- NasdaqGS:POOL

Berkshire Hathaway’s Stake Boost and Expansion Could Be a Game Changer for Pool (POOL)

Reviewed by Sasha Jovanovic

- Earlier this month, Pool Corporation presented at the Baird 55th Annual Global Industrial Conference in Chicago, highlighting its Q3 revenue of US$1.45 billion, an increase of 1.3% year-on-year, and ongoing expansion efforts including four new locations.

- Despite missing analyst revenue estimates in the previous three quarters and a decline in stock price this year, heightened investor interest has emerged as Berkshire Hathaway significantly increased its stake in Pool Corp through the first half of 2025.

- Next, we'll explore how Berkshire Hathaway’s increased holdings and Pool Corp’s business expansion shape its current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Pool Investment Narrative Recap

To be a shareholder in Pool Corporation today, you need to believe in the long-term value of recurring pool maintenance and renovation, alongside the company's ability to profit from demographic shifts to Sun Belt regions. Recent news around Berkshire Hathaway's increased stake and Pool's modest revenue growth does little to shift the most important catalyst, resilient, recurring demand for pool services, while persistent high interest rates and lackluster housing turnover remain the biggest risks, neither of which the recent developments materially alter.

Among the latest announcements, Pool Corp's Q3 earnings update stands out: revenue grew 1.3% year on year to US$1.45 billion, with stable profits and four new locations opened, reinforcing the company's ongoing efforts to maintain a broad service footprint and stable recurring revenue amid subdued new build activity.

However, investors should not overlook that unlike expanding high-growth markets, much of Pool's future is still tied to...

Read the full narrative on Pool (it's free!)

Pool's narrative projects $5.8 billion in revenue and $475.4 million in earnings by 2028. This requires 3.5% yearly revenue growth and a $66.6 million earnings increase from $408.8 million.

Uncover how Pool's forecasts yield a $333.27 fair value, a 38% upside to its current price.

Exploring Other Perspectives

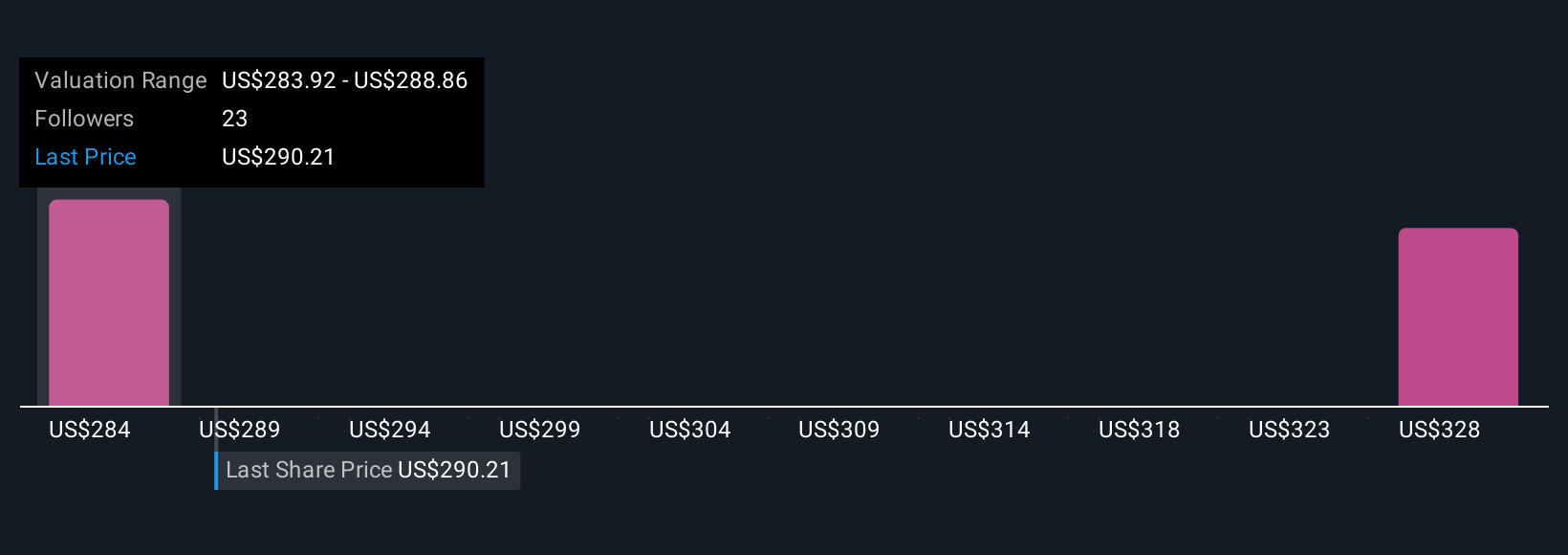

Retail investors in the Simply Wall St Community value Pool Corp between US$305.14 and US$333.27 across two independent estimates. With muted housing turnover posing a headwind to growth, these varied outlooks highlight why it’s worth examining several perspectives before making your own decisions.

Explore 2 other fair value estimates on Pool - why the stock might be worth just $305.14!

Build Your Own Pool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pool research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pool's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POOL

Pool

Distributes swimming pool supplies, equipment, related leisure, irrigation, and landscape maintenance products in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives