- United States

- /

- Specialty Stores

- /

- NYSE:BYON

Overstock.com (NASDAQ:OSTK shareholders incur further losses as stock declines 9.7% this week, taking five-year losses to 46%

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Overstock.com, Inc. (NASDAQ:OSTK) shareholders for doubting their decision to hold, with the stock down 46% over a half decade. And some of the more recent buyers are probably worried, too, with the stock falling 34% in the last year. Furthermore, it's down 15% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

With the stock having lost 9.7% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Overstock.com

SWOT Analysis for Overstock.com

- Debt is well covered by earnings.

- Expensive based on P/S ratio compared to estimated Fair P/S ratio.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Debt is not well covered by operating cash flow.

- Not expected to become profitable over the next 3 years.

Overstock.com wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Overstock.com grew its revenue at 7.8% per year. That's a fairly respectable growth rate. We doubt many shareholders are ok with the fact the share price has fallen 8% each year for half a decade. Those who bought back then clearly believed in stronger growth - and maybe even profits. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

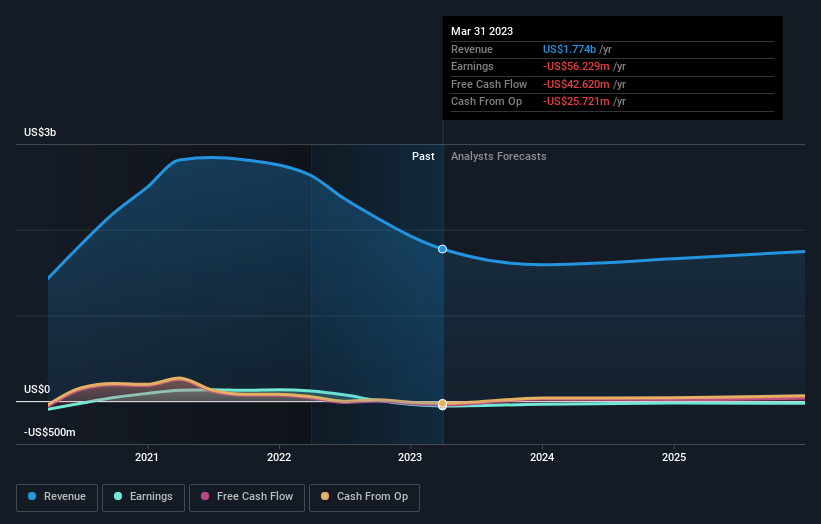

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 6.9% in the last year, Overstock.com shareholders lost 34%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Overstock.com better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Overstock.com , and understanding them should be part of your investment process.

Overstock.com is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Beyond might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BYON

Beyond

Operates as an e-commerce affinity marketing company in the United States and Canada.

Good value slight.

Similar Companies

Market Insights

Community Narratives